Cost Appraisals vs Value Appraisals: What Are The Main Differences?

Imagine you decide to get into the picnic table business as a hobby. You figure you can make a basic picnic table in your garage in about an hour. Using white pine and some tinted exterior sealer would make it look nice. You figure the lumber and material costs from the store are about $50. And with your labor included your total cost is about $75 per table. So then you take your creation to the farmers market to sell. It is springtime, so lots of people are fixing up their yards and you have no problem selling your whole inventory of tables for $150 each. Nice! A couple of months go by and you decide to do it again to make some extra money. However, this time it is late fall and the farmer’s market is quiet. You are only able to sell a couple of tables for only $25 each. What happened? Well, in a way you just learned some of the differences between cost and value. Please read on to better understand what we mean..

“Price is what you pay. Value is what you get.” – Warren Buffet

In our example the cost of the picnic table was constant regardless of the season. However – it’s value fluctuated, mainly due to seasonal changes in demand levels. That is why there are both cost appraisals and there are also value appraisals. They are different. There are also different types of costs and different types of values too.

What kind of appraisal do I need?

To answer that question we need to know what you are using the appraisal for.

Cost Estimate Appraisals

Say you own a commercial building and you want to make sure you have enough building insurance coverage in place. If that building was destroyed somehow, you would hope that the insurance coverage was based on its cost and therefore you need a cost estimate appraisal. A cost estimate appraisal is one of the services that Suncorp specializes in. We do cost estimate appraisals for all building types including multi-family, commercial and industrial structures.

Market Value Appraisals

Say you decide to sell that commercial building, or maybe you are thinking of taking out a mortgage on it. Well in that case you need a value appraisal, specifically a market value appraisal. This is an estimate of what the property will sell for given current market conditions and you want to be sure that you sell it for at least it’s market value. For mortgage purposes, the bank will want to know market value to ensure that the loan-to-value ratio is appropriate. Suncorp has a team of highly qualified appraisers who specialize in this type of work. We do value appraisals for all building types, as well as machinery and equipment too.

Different Types of Cost

There are a variety of different types of cost. Here are 2 common examples;

– Reproduction Cost New (CRN)

An estimate of the cost to construct an exact duplicate of an existing building.

– Replacement Cost New (RCN)

An estimate of the cost to reconstruct a building using modern materials and standards.

Different Types of Value

There are a variety of different types of values too.

– Market Value

As mentioned, market value is an estimate of what a property/asset may sell for.

– Market Rent

An estimate of what a property may rent for.

– Forced Sale Value or Liquidation Value

An estimate of what a property may sell for under distressed conditions such as during a foreclosure or bankruptcy.

There are many factors that affect value that appraisers must consider including competing supply, effective demand levels or trends, exposure and marketing periods, etc. There are many other types of cost and value in addition to these examples. If you are unsure of the type of appraisal service you need, your first call must be to Suncorp Valuations. We have decades of experience with these matters and we are anxious to help you today.

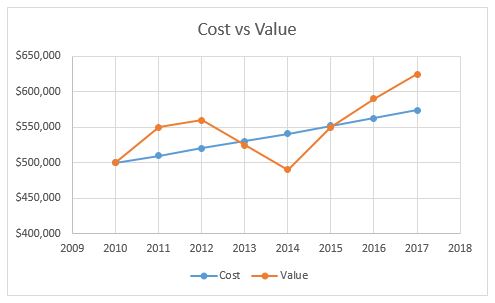

Cost vs. Value Chart

While there may be particular situations where the cost of a particular asset may be equal to its value, this is a rare occurrence. Generally speaking, costs increase steadily over time because of inflation and it is a function of basic material and labor costs. However, although value also tends to increase over time, it is much more volatile and subject to peaks and valleys. This is because value is a function of supply and demand, as well as economic cycles.

About Suncorp Valuations

Suncorp Valuations is a leading provider of independent valuation, appraisal and advisory services. Suncorp’s valuations and appraisals have been relied upon by leading insurance companies, public and private companies, property owners and managers, tax authorities, accounting bodies, courts, municipalities and financial institutions from all over the world.

Our valuation and appraisal staff consist of professionals that are highly accredited in the fields of engineering, real estate and equipment appraisal, business valuation, risk management and loss control. Our multi-disciplinary, multi-regional and multi-lingual staff take an interactive team approach and have been involved in some of the most complex valuation assignments across the globe.