In our July 2019 blog we looked at the advantages of a comprehensive Loss Control Report in a hard market. Given the current market conditions for insurance placement, we thought it would be prudent to offer further considerations that may assist you in placing residential / condominium risk. As we see from the market reaction, losses incurred within this market segment have outpaced many other occupancies; accordingly, we endorse a proactive approach.

Like any other organization, the onus for managing the risk associated with these types of complexes falls on the applicable Boards / Councils and by extension, agents such as property managers and ultimately the unit owners. The steps outlined below should assist in mitigating and alleviating the type and severity of loss:

1. A clearly defined Policies and Procedures document should be drafted and held in place for all unit owners. The document should outline where the responsibilities lie for the Condo Board / Council and owners / tenants. This document is generally outside of the organization’s bylaws, allowing it to be easily amended as needed. The following are our suggested items for this document:

a. All work in any unit or within the building should ONLY be done by a licensed contractor (i.e. certified trades such as plumbers, electricians, carpenters, etc., with proof of insurance provided), as defined by the Board / Council.

b. Procedures should be in place to ensure all units are inspected on a regular basis when a tenant / unit owner will be away for an extended period of time.

c. Dishwashers and washing machines should only be run while the unit is occupied.

d. A clearly defined Emergency Response Plan should be developed and in place for each complex within the property. The Plan should have clear instruction / training provided for on-site residents / staff regarding what to do in the event of an emergency.

e. Insurance requirements with pre-determined coverage limits should be in place for all unit owners / tenants, that clearly define what coverage should be in place.

2. A regular maintenance and inspection program should be implemented and documented throughout all areas of the property. Items to consider are as follows:

a. All gutters should be cleaned on a semi-annual basis (or more frequently if the property is surrounded by trees), to ensure they are flowing as required.

b. All downspouts should have extensions of at least six feet to ensure that water does not pool around the foundation of the building.

c. All mechanical systems (boilers, furnaces, water heaters, make-up air units, air conditioning units, sprinkler systems, etc.) are inspected on an annual basis, with components replaced as required.

d. All walking surfaces should be in good condition and not subject to potential trips and falls. Snow removal, sanding and salting should be done within 24 hours in winter months.

e. Ensure all windows, doors and roofs are in good overall condition, with repairs to flashing, caulking around windows, doors, etc. completed as required and documented.

f. Areas subject to snow load should be cleared as required.

g. All shut-off valves should be exercised (fully closed and reopened) at least once per year, to ensure they function as required.

h. All drains should be inspected, cleaned out and tested on a regular basis, to ensure there are no obstructions and they are draining as required.

i. All rubber water hoses on washing machines / dishwashers should be replaced with a metal braided hose to prevent accidental rupture.

j. All drains from washing machines should be secured in place to the domestic drain to prevent accidental water discharge during the drain cycle.

k. Backflow prevention devices should be installed in all sewer drains.

l. Isolation valves should be provided on each floor for the main water system.

m. Water sensor alarms should be provided in all areas where water leaks could occur.

n. Water heaters should be replaced at a minimum every ten (10) years.

Having a comprehensive Risk Assessment Report on your facility is a huge advantage for brokers to successfully market their client’s business to the industry. A third party, arm’s length report provides an objective overview of the insured premises: the hazards associated in the operation and the controls in place to manage these hazards, so that the underwriter has a clear picture of the risk they are preparing to take on.

If you have any questions on the various Risk Management and Valuation services we can provide, please contact one of our offices and we would be happy to help.

As the Insurance Market Tightens, Professional Appraisal Standards Matter.

Like many other professions, the appraisal profession has developed minimal practice standards. These standards describe the minimal and mandatory scope of work and report content required to provide clients and the public with credible and competent valuation services.

In the US the predominate appraisal standards are known as the Uniform Standards of Professional Appraisal Practice (USPAP). USPAP is maintained by the Appraisal Standards Board which was established by the US Congress in 1989. USPAP is updated every two years, and sets mandatory standards for ethics, competency, appraisals of real property, personal property and business interests, and conducting technical reviews.

Canadian appraisers followed USPAP until 2001 when the Canadian Uniform Standards of Professional Appraisal Practice (CUSPAP) were introduced. CUSPAP is maintained by the Appraisal Institute of Canada and is also updated every two years. CUSPAP is similar to USPAP, however it also sets mandatory standards for reserve fund studies, and appraisals of machinery and equipment.

The “RICS Valuation Global Standards,” which is published by the Royal Institution of Chartered Surveyors (RICS), is widely viewed as mandatory appraisal and consulting standards outside of North America.

USPAP, CUSPAP, and RICS are each recognized globally as premier top tier valuation standards. These standards are accepted and, in many cases, required by all levels of government, lenders, investors and the courts.

How do you know if your appraisal report complies with these standards? A starting point is to ensure that the signing appraiser holds one of the following professional appraisal designations:

ASA – American Society of Appraisers

AACI – Appraisal Institute of Canada

MRICS – Royal Institute of Chartered Surveyors

MAI – Appraisal Institute

In addition to ensuring quality and credibility, adherence to professional standards is also important for errors and omissions insurance coverage. If a party suffers a loss as a result of a faulty appraisal, and the E&O insurance carrier determines there is willful non-compliance then coverage may be denied. Willful non-compliance may occur if an appraisal does not meet professional standards, or if the signing appraiser does not have a professional appraisal designation (ASA, AACI, MRICS, or MAI).

It is recommended that when one engages an appraiser that the service contract stipulates that the services to be provided must be in full compliance with either USPAP, CUSPAP or RICS; and that the report must be signed by a fully qualified appraiser that holds a recognized appraisal designation.

At Suncorp, all appraisal services we provide are fully compliant with either USPAP, CUSPAP, or RICS, and in many cases exceed the minimal standards. All Suncorp Valuation Consultants have either earned or are working towards a professional appraisal qualification. Furthermore, all Suncorp appraisal reports go through a rigorous quality control procedure and are then signed by a Senior Valuation Consultant (ASA or AACI) prior to being published to our client.

Contact Suncorp today for all your valuations needs.

The One Asset Class that keeps growing in value…but real estate is still a great hold!

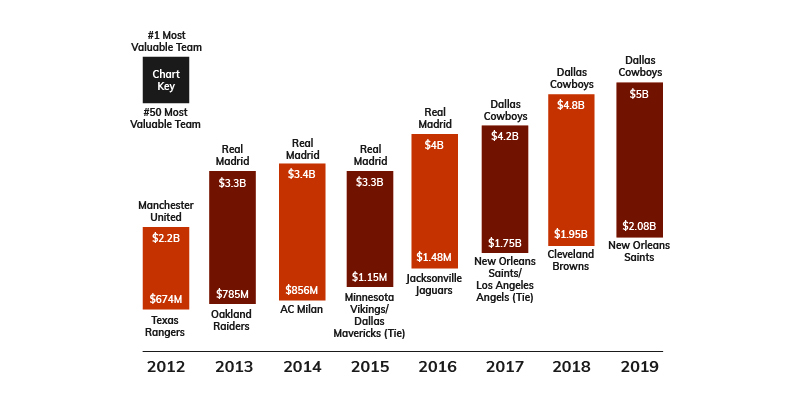

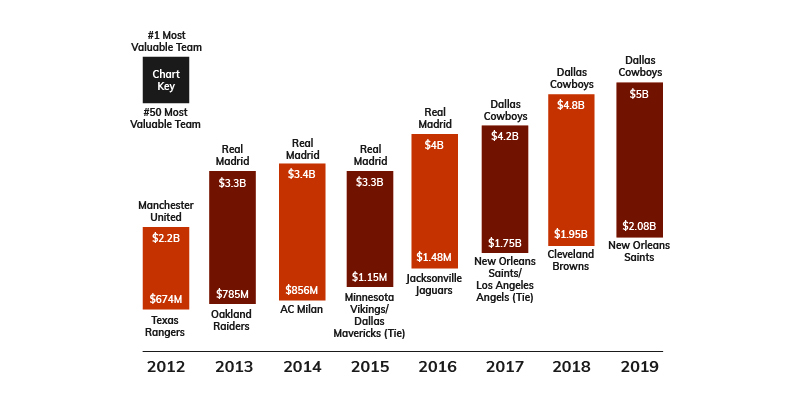

As a full service appraisal company completing engagements around the world, we often get involved in unique valuations. Recently, we have been involved with or proposed on the valuation of facilities for sports franchises. Taking out the political issues around funding of these facilities and whether or not the investment on the tangible asset side is worthwhile, we definitely see that the value of the franchises themselves appear to be have some immunity from economic cycles and downward pressure on values.

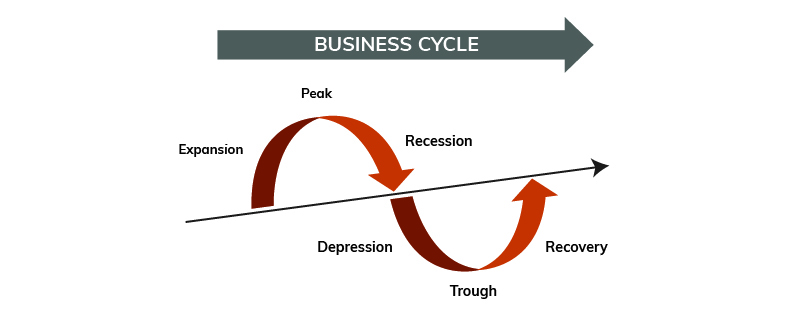

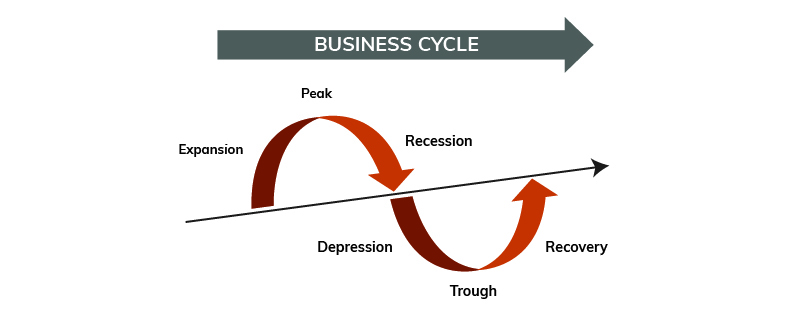

Traditionally, we see economic cycles having 5 distinct phases (1):

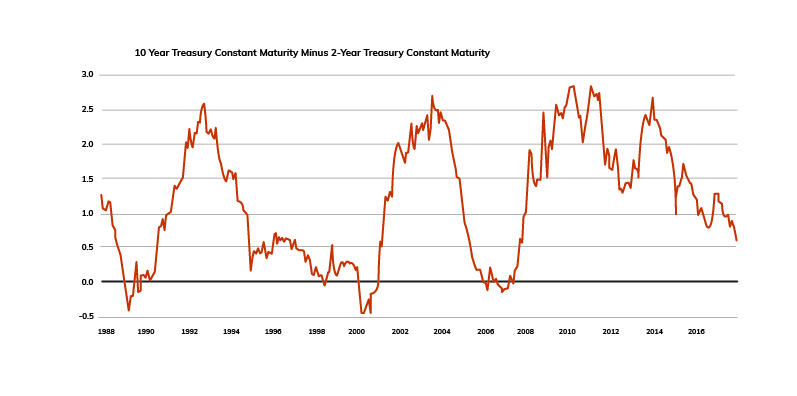

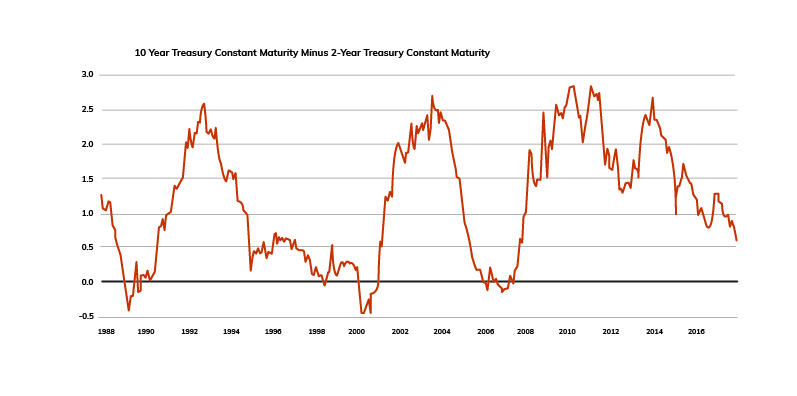

During these cycles we see fluctuations in market value and insurable values, often in recessions we see market values dive while insurable values can stay the same or increase due to pressures as we are experiencing right now with shrinking capacity in the insurance market(s).

Interestingly, sports franchises seem to have immunity from these cycle forces, even if the team(s) are not successful in the field of play. Underlying the immunity is the strength of earnings for these franchises, no matter the general economic circumstance these franchises have expanded their earnings which in turn drives up values.“The discount bin is empty when shopping for teams in the major sports leagues. Every NFL, NBA and MLB franchise is now worth at least $1 billion.”(2)

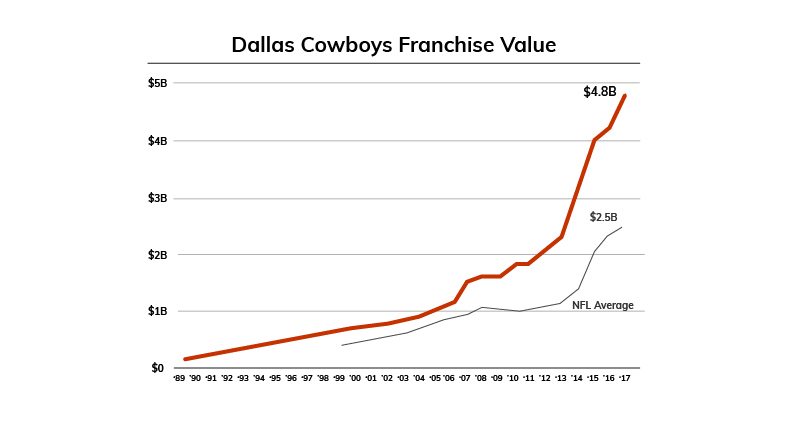

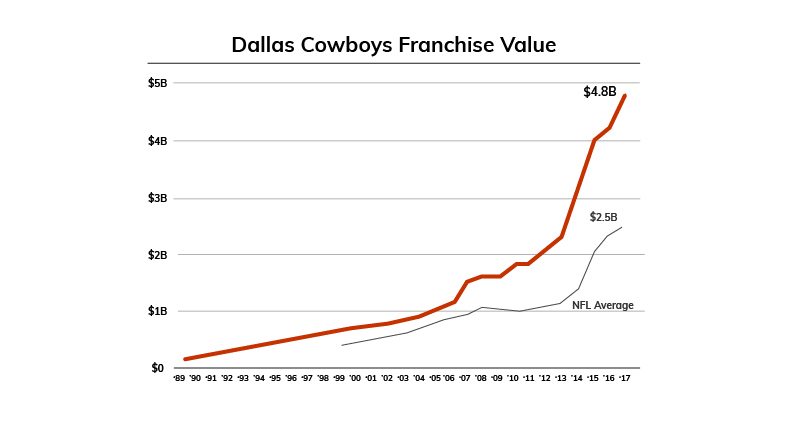

Consider that Jerry Jones (Owner of the Dallas Cowboys) paid $140 million USD for the franchise in 1989. That converts to around $300 million USD in today’s dollars, annual inflation was around 2.5% over that timeframe. “In the last decade the Dallas Cowboys franchise value has increased by 220% (see below graph), even the lesser known NFL franchises have grown significantly. “(3) As the graph illustrates the value trend has stayed upward trending.

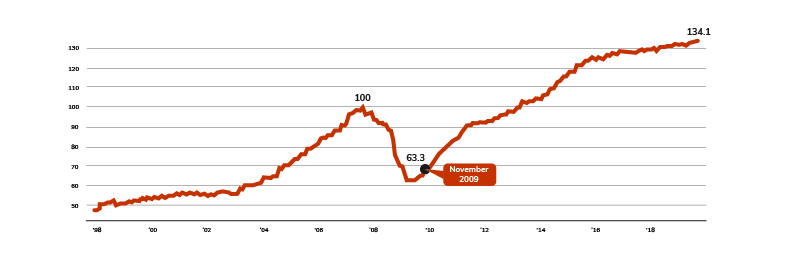

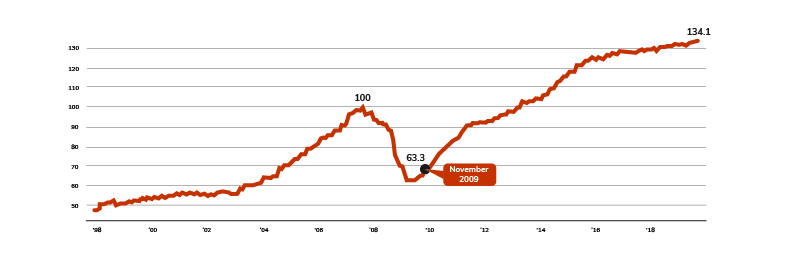

As comparative, let us look at an index of US Real Estate market values since 1998.

All Property CPPI weights: retail (20%), office (17.5%), apartment (15%), health care (15%), industrial (10%), lodging (7.5%), net lease (5%), self storage (5%), manufactured home park (2.5%), and student housing (2.5%). Retail is mall (50%) and strip retail (50%).

Core Sector CPPI weights: apartment (25%), industrial (25%), office (25%), and retail (25%). (4)

As you can see Commercial Real Estate in the US over time has increased but is subject to fluctuations based on economic cycles.

In looking at the volatility in general economic cycles, recessionary times can mean opportunities in real estate. Correlating the below graph on recessionary periods to the Green Street Commercial Property Price Index, we see a similar dip in real estate market values but values have had a general increasing trend. (5)

If you cannot own a sports franchise, commercial real estate is still a great hold!

REFERENCES:

5 Phases of Business Cycle

Kurt Badenhausen (July 22,2019). The World’s 50 Most Valuable Sports Teams 2019.

Cork Gaines (September 26, 2017). Jerry Jones paid a record $140 million for the Dallas Cowboys — the team is now worth $4.8 billion.

Commercial Property Index.

Jason Kirby (December 5, 2017). The 91 most important economic charts to watch in 2018.

Recent trends have shown that construction costs throughout the United States and Canada have escalated at an accelerated rate, particularly in specific metropolitan regions. This is due to a combination of factors, including price increases for building materials and rising labour costs due to a rebound in construction activity since the recession of 2009. Areas such as Seattle, Los Angeles, Vancouver and Toronto are emblematic of the rise in construction cost, as market values have rebounded.

Source: Pixabay

As a result of these cost increases, many commercial and residential properties are at risk of being under-insured. This is especially so for Condominiums that are situated in many of these city centres. It is therefore prudent to assess if the source and accuracy of your Condominium’s Insurable Value are reliable.

Common Pitfalls

It is not uncommon for Directors and Property Managers of Condominiums to be so heavily involved in other issues that they often forget the importance of having an accurate determination of the Replacement Cost of the standard unit and common elements of their Condominium. As a result, the Insurable Value they report may have come from a variety of less-than-reliable sources including:

1) Use of Developer’s Construction Costs

In many cases, the Insurable Value may have been based on the Developer’s construction cost. This amount may not include “soft costs” such as Architect Fees, Development Fees and General Contractor Fees. These are significant costs that should be included in the Insurable Value of the Condominium. In addition, a Developer who is building multiple condominiums can also achieve efficiencies in regards to material and labour costs. The reduction in these costs may result in a lower construction cost for the Condominium, which may not be achieved in the event of a loss and reconstruction of a single building. In most instances, the Developer’s construction cost can be approximately 20 to 40% less than the Replacement Cost of the Condominium.

2) Extended Indexing of Insurable Value

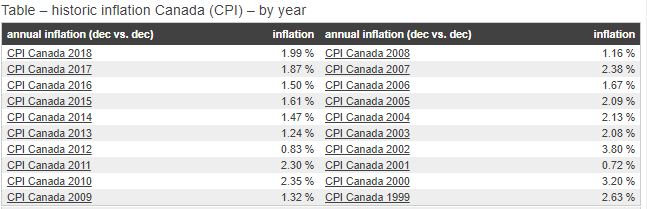

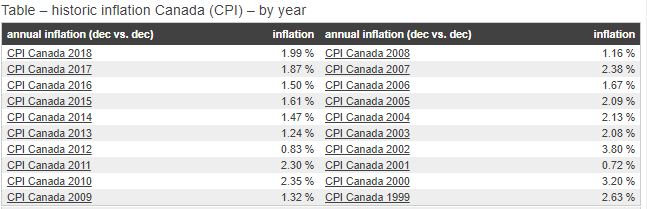

Once an Insurable Value exists, many Insurers/Insurance Brokers may use the annual Consumer Price Index (CPI) to update the Insurable Value of the condominium for an extended period of time. The annual CPI has been reported in the 1-2% range in recent years. In contrast, construction costs in some locales has been have been averaging double this amount. In addition, if the original construction cost that is being indexed is incorrect it can compound the error substantially over the years. Lastly, even with a correct original construction cost and accurate Inflation Index Factors, an Insurable Value should not be indexed up for more that three consecutive years.

3) Estimates from Unqualified Parties

In an attempt to save costs, some firms who lack architectural costing experience may develop a Replacement Cost estimate on a cost per square foot basis only. This methodology is not reliable since it may not consider location, construction quality and many of the important specialty features of the Condominium’s construction and services. Many of the construction details of a Condominium can only be verified by a physical inspection and comprehensive review of the architectural and site plans. In addition, the firm that completes the estimate should have specific architectural costing experience versus market value appraisal experience. Market value appraisals consider many other factors that are not relevant to the Insurable Value.

Insurance Appraisals By Qualified Professionals – The Most Accurate Source for Determining Insurable Values

An Insurance Appraisal is a formal estimate or opinion of value on a property as of a specified date. The premise of value developed should be the Replacement Cost New (RCN) of the standard unit and common elements of the Condominium. This value is based on a physical inspection, review of the building plans (architectural and site) and the development of current construction costs. Appraisal Firms use various construction costs from published sources including Marshall & Swift/Boeck, R.S. Means Construction Cost Data and Handscombe’s Yardstick for Costing. A reputable Appraisal Firm will also cross-reference this data with actual construction costs (including soft costs) reported by Contractors and Developers. Finally, construction costs of similar condominiums appraised should be used as a benchmark test to ensure the Insurable Value is correct. It is important that the Insurance Appraisal Firm you engage use as many of the above resources to develop an accurate Insurable Value.

Qualifications of Reputable Appraisal Firms

To select a reputable Appraisal Firm, it is recommended that they meet the following qualifications:

- The Firm carries Errors and Omissions Insurance;

- The Appraiser(s) have an educational background in Architectural Costing or Engineering;

- The Appraiser(s) are experienced at completing Insurance Appraisals for Condominiums;

- The Appraisal Service includes both Above Grade and Below Grade Assets;

- The Appraisal Service is performed in compliance with the Uniform Standards of Professional Appraisal Practice (USPAP); and

- The Appraiser(s) reviews Architectural Plans, Site Plans and Standard Unit-By Law (if applicable).

In conclusion, it is prudent for the Directors and Property Managers to engage a Professional Appraisal Firm to complete an Insurance Appraisal of their Condominium. Furthermore, many of the Declarations and By-Laws of Condominiums specify the frequency that Insurance Appraisals should be completed (e.g. every three years). Lastly, the Condominium Acts of many of the jurisdictions have sections requiring the Condominium be insured for its Replacement Cost. Compliance with these guidelines can be best achieved by having a reputable firm complete an independent Insurance Appraisal.

We are attending the next RIMS Canada Conference, the preeminent convention and trade show for risk insurance managers and Insurance Brokers from Canada.The conference is being held in Edmonton, AB from September 8-11th, 2019.

Event Location & Dates

Address: Shaw Conference Centre – 9797 Jasper Avenue, Edmonton, AB, Canada, T5J 1N9

Dates: Sunday September 8th to Wednesday September 11th, 2019

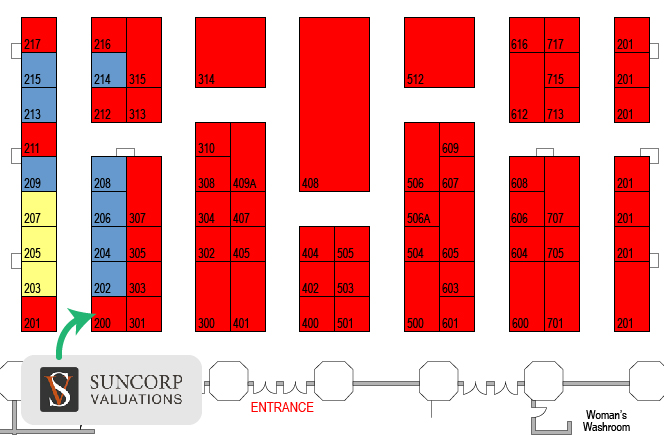

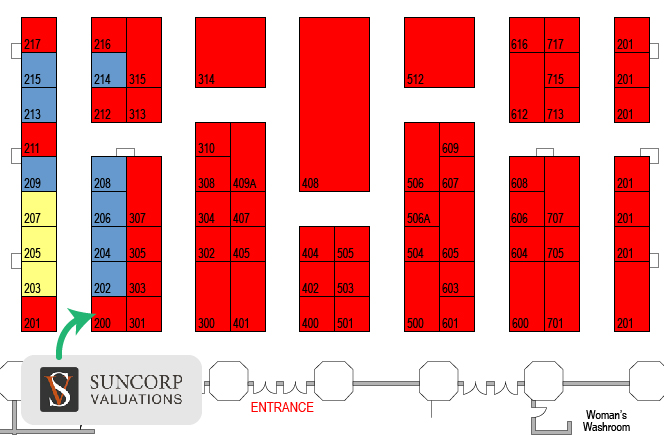

Visit Us At Booth #200

We have a stand booked for booth #200, so come on down to visit us and speak to one of our knowledgeable representatives! Booth #200 is close to the entrances. Just turn left when you walk into the booths area, and you should see our team! See the map below to get a better idea of where you’ll find us.

We Have Prizes!

We are going to do a Plinko style game with prizes! Come have some fun with our reps.

Share On Social

We encourage attendees to share their experience across social media channels! If you do so, feel free to use hashtags like #Appraisers, #ValuationServices, #ExpertTestimony, #FinancialServices, #RiskControl, #LossControl, and #SafetyServices etc. to further your reach to relevant viewers.

Event Organizers Video

Below is a fun video made by the event organizers to give you a better idea of what the conference is all about and why one should attend!

We Hope To See You There!

We hope to see you at the event in September. Remember, come visit us at Booth #200 to speak to any one of our awesome reps. Make sure you participate in our Plinko style game for your chance to win some nice prizes too! We are always here to answer any questions you may have, so feel free to contact us if you need to speak to one of our reps prior to the event.

Contact Suncorp Now

In our last blog post we talked about the importance of understanding your client’s exposure, values, risk management strategies and policy wording – especially when dealing with a hard market in the insurance industry like we are today.

READ: The Property Insurance Market Has Hardened

Challenges Facing Brokers and Clients Is Significant

With Insurance Companies tightening their underwriting requirements, increasing premiums and deductibles, and reducing limits, the challenges facing brokers and their clients is significant. Placing a client’s business – regardless of whether they have had a claim or not – can be a daunting task, and where you might have had 2 or 3 insurance companies on a risk before, today we are seeing upwards of a dozen companies now involved.

Advantages of Comprehensive Risk Assessment Reports

Having a comprehensive Risk Assessment report on your client’s operation is a huge advantage for brokers to successfully market their client’s business to the industry. This third party, arm’s length report provides an objective overview of your client’s operation – the hazards associated in the operation and the controls in place to manage these hazards – so that the underwriter has an excellent picture of the risk, they are preparing to take on.

Understanding Different Types of Clients

While many insurance companies today will categorize clients based on, the type of business they operate, this “broad brush” approach can affect many clients with limited or no loss experience. The residential/condominium market is a good example of an industry that has been hit hard given the high number of losses in this type of occupancy. However, in saying this, not all clients will fall under this category. Understanding what separates these clients from the rest is the message that needs to get across.

Solid Risk Management More Critical Than Ever

The insurance market is still well capitalized, however, insurance companies are becoming more selective to write only good quality risks. Solid risk management strategies are now more than ever a critical component for managing your client’s business. A comprehensive Risk Assessment report will provide you and your client with an invaluable tool to assist in mitigating losses, while at the same time providing you the leverage to differentiate your client’s business from the masses during insurance renewals or placement.

Our Risk Management & Valuation Services

If you have any questions on the various Risk Management and Valuation services we can provide, please contact one of our offices, we would be happy to help.

Contact Suncorp Now