In our February 2019 Industry Insight article, we looked at the insurance industry focusing on building resilience with those insured to be prepared for natural disasters. The underlying premise being that natural disasters will occur; it is no longer an “if”, it is about the when.

In that article, we pointed to the insurance markets hardening to face the pressure of mounting losses. We are now in the midst of a hard property market and the impact on renewals and premiums is certainly felt.

“Characteristics of Soft and Hard Markets.

A strong economic climate, a favorable legal environment and/or few catastrophic events can increase insurers’ capacity, creating a soft insurance market. When the market is soft many insurers are competing for business and premiums are generally low. Insurers relax their underwriting standards and coverage is widely available. Underwriters are generally flexible and willing to negotiate coverage terms. Broad coverage is available with some extensions available for free.

A series of catastrophic events, a litigious legal environment and/or a poor economy can reduce insurers’ capacity to write new policies. The result can be a hard insurance market. A hard insurance market is the opposite of a soft one. When the market hardens, insurers tighten their underwriting standards. Some coverages may be difficult to secure as fewer insurers are competing to write policies. Premiums are relatively high and insurers are disinclined to negotiate terms. Broad coverage may be costly or unavailable but some coverage extensions may be available for an additional premium.” (1)

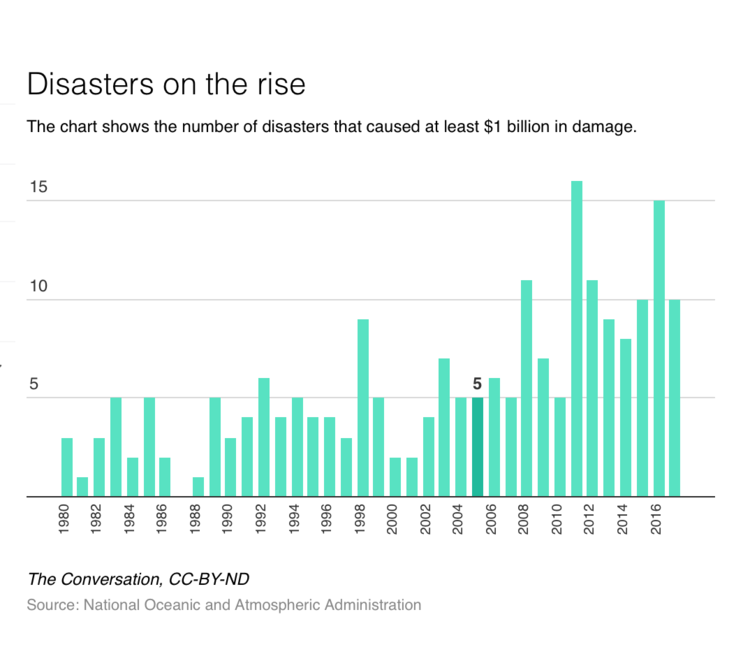

As the chart below depicts, we do have catastrophic events and their costs rising, which are having a direct impact on the insurance market hardening (2).

We are seeing the insurance market acknowledge the hardening of the property market and what that means for insureds, brokers, and property managers in property markets.

“At the end of 2018, the property market had begun to see some firming, and that continued into Q1 of 2019. As we move into Q2, this trend has not just continued; it has accelerated.”

“The message for retailers is that things are changing in property more quickly than expected, and the changes are deeper than anticipated,” says Harry Tucker, Executive Vice President and National Property Practice Leader for AmWINS.

Adverse loss development has been a catalyst in this acceleration. Two consecutive years with combined ratios exceeding 100% across the market has heightened the focus of management teams and underwriters to drive rate and reduce aggregate exposure. Increasing rates are creating a deeper and broader change in the market. The obvious tough classes – including frame habitational, recyclers, and open lot – were the first to be affected, but now the trend has crept into broader classes and non-CAT exposed business.

“Along with rate increases, we are seeing more tightened risk selection, reductions in limits, increased deductibles, and close review of policy forms,” says Tucker.

However, the bright spot for clients is that the market is still well capitalized. “Carriers still want to write premium,” says Tucker. “The difference today is that they are applying a level of underwriting discipline we haven’t seen in quite some time.”(3)

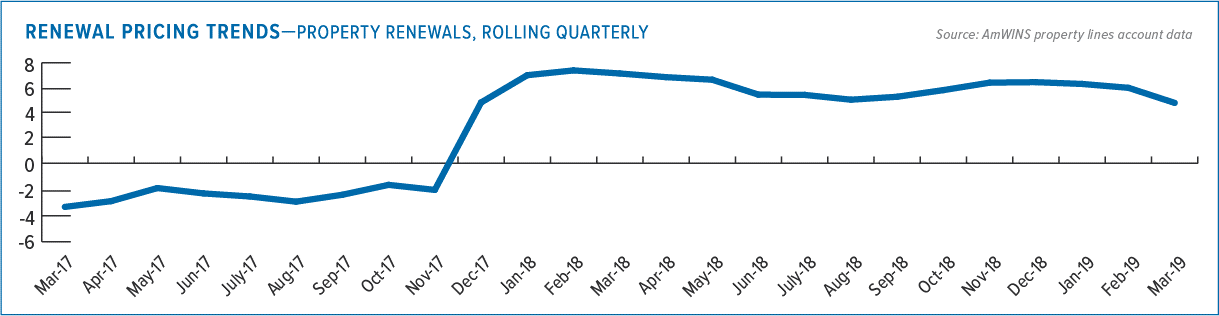

The below graph graphically depicts the pricing trends in property renewals (4):

As property owners and/or tenants, brokers, and property managers, we would encourage you to look at your insurance program against the backdrop of the increase in natural disasters driven by climate change and the changes to occurring as underwriters are dealing with these variables as they develop insurance premiums. You need to understand your exposure, your values, your risk management strategies and your policy wordings. Being forewarned, will assist you exponentially in the event of a loss.