In our July 2019 blog we looked at the advantages of a comprehensive Loss Control Report in a hard market. Given the current market conditions for insurance placement, we thought it would be prudent to offer further considerations that may assist you in placing residential / condominium risk. As we see from the market reaction, losses incurred within this market segment have outpaced many other occupancies; accordingly, we endorse a proactive approach.

Like any other organization, the onus for managing the risk associated with these types of complexes falls on the applicable Boards / Councils and by extension, agents such as property managers and ultimately the unit owners. The steps outlined below should assist in mitigating and alleviating the type and severity of loss:

1. A clearly defined Policies and Procedures document should be drafted and held in place for all unit owners. The document should outline where the responsibilities lie for the Condo Board / Council and owners / tenants. This document is generally outside of the organization’s bylaws, allowing it to be easily amended as needed. The following are our suggested items for this document:

a. All work in any unit or within the building should ONLY be done by a licensed contractor (i.e. certified trades such as plumbers, electricians, carpenters, etc., with proof of insurance provided), as defined by the Board / Council.

b. Procedures should be in place to ensure all units are inspected on a regular basis when a tenant / unit owner will be away for an extended period of time.

c. Dishwashers and washing machines should only be run while the unit is occupied.

d. A clearly defined Emergency Response Plan should be developed and in place for each complex within the property. The Plan should have clear instruction / training provided for on-site residents / staff regarding what to do in the event of an emergency.

e. Insurance requirements with pre-determined coverage limits should be in place for all unit owners / tenants, that clearly define what coverage should be in place.

2. A regular maintenance and inspection program should be implemented and documented throughout all areas of the property. Items to consider are as follows:

a. All gutters should be cleaned on a semi-annual basis (or more frequently if the property is surrounded by trees), to ensure they are flowing as required.

b. All downspouts should have extensions of at least six feet to ensure that water does not pool around the foundation of the building.

c. All mechanical systems (boilers, furnaces, water heaters, make-up air units, air conditioning units, sprinkler systems, etc.) are inspected on an annual basis, with components replaced as required.

d. All walking surfaces should be in good condition and not subject to potential trips and falls. Snow removal, sanding and salting should be done within 24 hours in winter months.

e. Ensure all windows, doors and roofs are in good overall condition, with repairs to flashing, caulking around windows, doors, etc. completed as required and documented.

f. Areas subject to snow load should be cleared as required.

g. All shut-off valves should be exercised (fully closed and reopened) at least once per year, to ensure they function as required.

h. All drains should be inspected, cleaned out and tested on a regular basis, to ensure there are no obstructions and they are draining as required.

i. All rubber water hoses on washing machines / dishwashers should be replaced with a metal braided hose to prevent accidental rupture.

j. All drains from washing machines should be secured in place to the domestic drain to prevent accidental water discharge during the drain cycle.

k. Backflow prevention devices should be installed in all sewer drains.

l. Isolation valves should be provided on each floor for the main water system.

m. Water sensor alarms should be provided in all areas where water leaks could occur.

n. Water heaters should be replaced at a minimum every ten (10) years.

Having a comprehensive Risk Assessment Report on your facility is a huge advantage for brokers to successfully market their client’s business to the industry. A third party, arm’s length report provides an objective overview of the insured premises: the hazards associated in the operation and the controls in place to manage these hazards, so that the underwriter has a clear picture of the risk they are preparing to take on.

If you have any questions on the various Risk Management and Valuation services we can provide, please contact one of our offices and we would be happy to help.

As the Insurance Market Tightens, Professional Appraisal Standards Matter.

Like many other professions, the appraisal profession has developed minimal practice standards. These standards describe the minimal and mandatory scope of work and report content required to provide clients and the public with credible and competent valuation services.

In the US the predominate appraisal standards are known as the Uniform Standards of Professional Appraisal Practice (USPAP). USPAP is maintained by the Appraisal Standards Board which was established by the US Congress in 1989. USPAP is updated every two years, and sets mandatory standards for ethics, competency, appraisals of real property, personal property and business interests, and conducting technical reviews.

Canadian appraisers followed USPAP until 2001 when the Canadian Uniform Standards of Professional Appraisal Practice (CUSPAP) were introduced. CUSPAP is maintained by the Appraisal Institute of Canada and is also updated every two years. CUSPAP is similar to USPAP, however it also sets mandatory standards for reserve fund studies, and appraisals of machinery and equipment.

The “RICS Valuation Global Standards,” which is published by the Royal Institution of Chartered Surveyors (RICS), is widely viewed as mandatory appraisal and consulting standards outside of North America.

USPAP, CUSPAP, and RICS are each recognized globally as premier top tier valuation standards. These standards are accepted and, in many cases, required by all levels of government, lenders, investors and the courts.

How do you know if your appraisal report complies with these standards? A starting point is to ensure that the signing appraiser holds one of the following professional appraisal designations:

ASA – American Society of Appraisers

AACI – Appraisal Institute of Canada

MRICS – Royal Institute of Chartered Surveyors

MAI – Appraisal Institute

In addition to ensuring quality and credibility, adherence to professional standards is also important for errors and omissions insurance coverage. If a party suffers a loss as a result of a faulty appraisal, and the E&O insurance carrier determines there is willful non-compliance then coverage may be denied. Willful non-compliance may occur if an appraisal does not meet professional standards, or if the signing appraiser does not have a professional appraisal designation (ASA, AACI, MRICS, or MAI).

It is recommended that when one engages an appraiser that the service contract stipulates that the services to be provided must be in full compliance with either USPAP, CUSPAP or RICS; and that the report must be signed by a fully qualified appraiser that holds a recognized appraisal designation.

At Suncorp, all appraisal services we provide are fully compliant with either USPAP, CUSPAP, or RICS, and in many cases exceed the minimal standards. All Suncorp Valuation Consultants have either earned or are working towards a professional appraisal qualification. Furthermore, all Suncorp appraisal reports go through a rigorous quality control procedure and are then signed by a Senior Valuation Consultant (ASA or AACI) prior to being published to our client.

Contact Suncorp today for all your valuations needs.

The One Asset Class that keeps growing in value…but real estate is still a great hold!

As a full service appraisal company completing engagements around the world, we often get involved in unique valuations. Recently, we have been involved with or proposed on the valuation of facilities for sports franchises. Taking out the political issues around funding of these facilities and whether or not the investment on the tangible asset side is worthwhile, we definitely see that the value of the franchises themselves appear to be have some immunity from economic cycles and downward pressure on values.

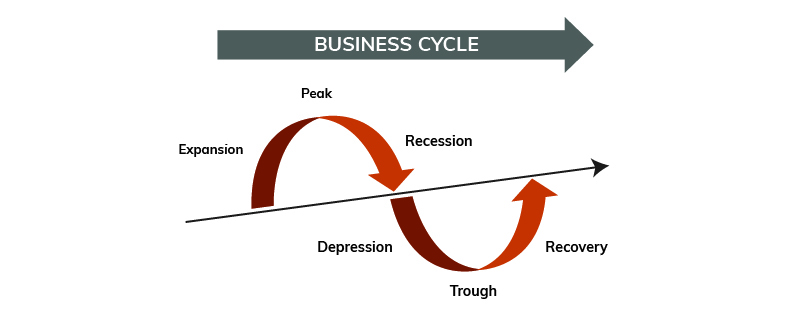

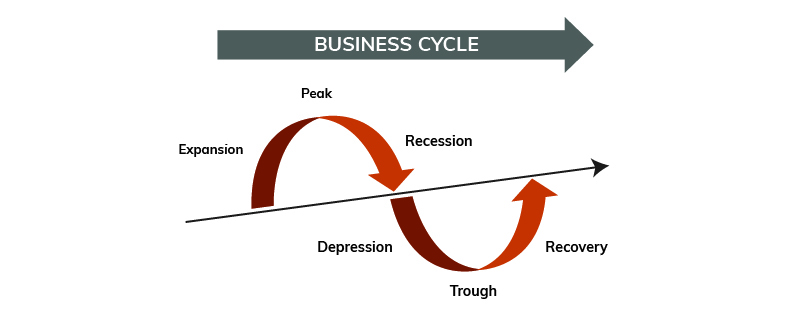

Traditionally, we see economic cycles having 5 distinct phases (1):

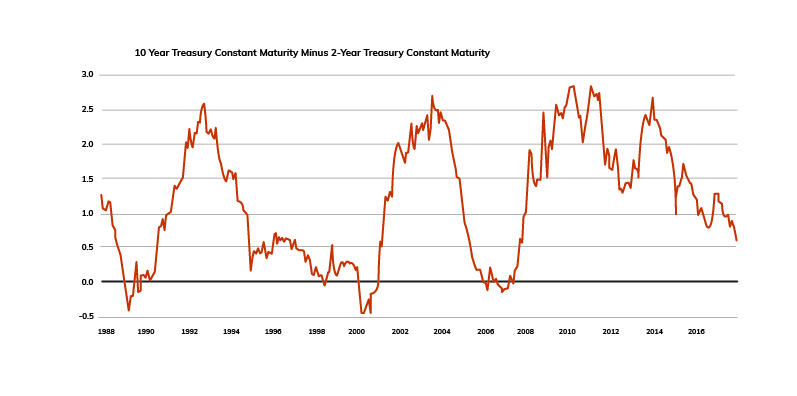

During these cycles we see fluctuations in market value and insurable values, often in recessions we see market values dive while insurable values can stay the same or increase due to pressures as we are experiencing right now with shrinking capacity in the insurance market(s).

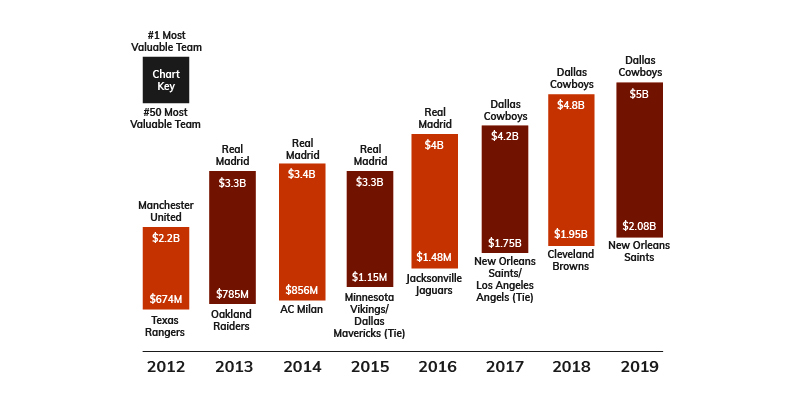

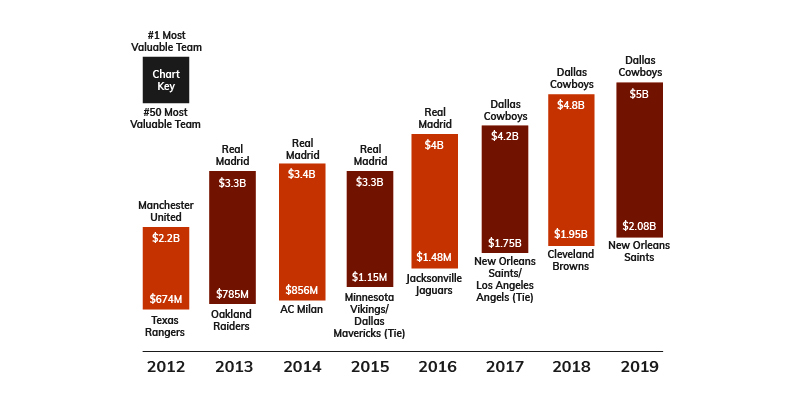

Interestingly, sports franchises seem to have immunity from these cycle forces, even if the team(s) are not successful in the field of play. Underlying the immunity is the strength of earnings for these franchises, no matter the general economic circumstance these franchises have expanded their earnings which in turn drives up values.“The discount bin is empty when shopping for teams in the major sports leagues. Every NFL, NBA and MLB franchise is now worth at least $1 billion.”(2)

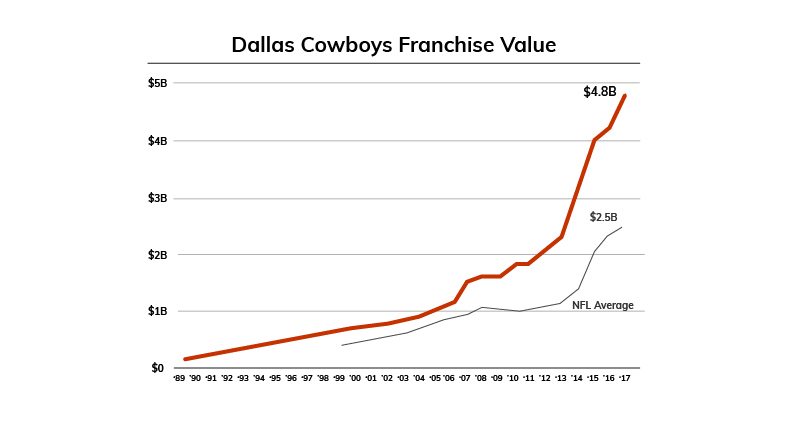

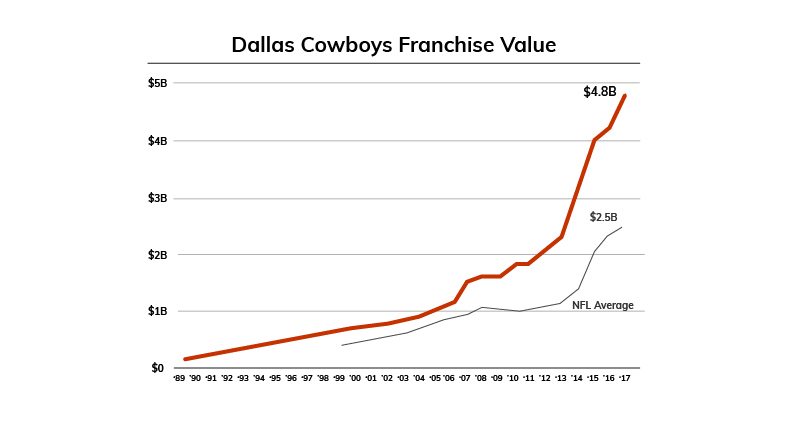

Consider that Jerry Jones (Owner of the Dallas Cowboys) paid $140 million USD for the franchise in 1989. That converts to around $300 million USD in today’s dollars, annual inflation was around 2.5% over that timeframe. “In the last decade the Dallas Cowboys franchise value has increased by 220% (see below graph), even the lesser known NFL franchises have grown significantly. “(3) As the graph illustrates the value trend has stayed upward trending.

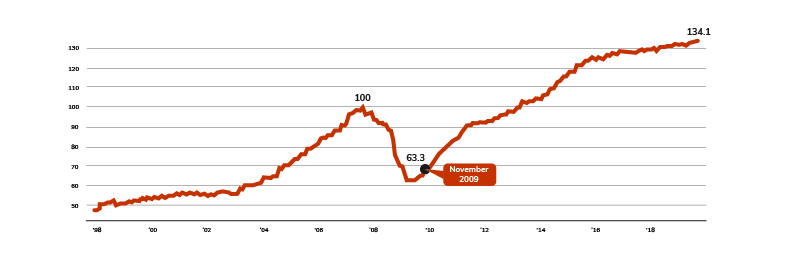

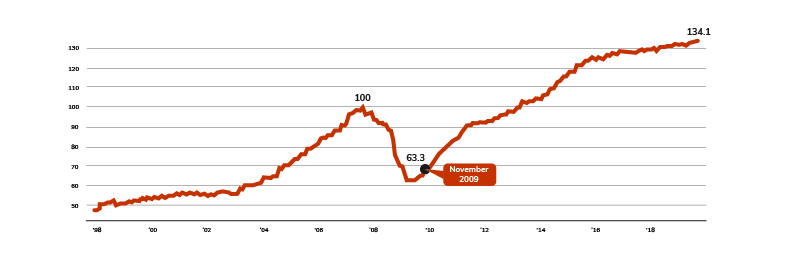

As comparative, let us look at an index of US Real Estate market values since 1998.

All Property CPPI weights: retail (20%), office (17.5%), apartment (15%), health care (15%), industrial (10%), lodging (7.5%), net lease (5%), self storage (5%), manufactured home park (2.5%), and student housing (2.5%). Retail is mall (50%) and strip retail (50%).

Core Sector CPPI weights: apartment (25%), industrial (25%), office (25%), and retail (25%). (4)

As you can see Commercial Real Estate in the US over time has increased but is subject to fluctuations based on economic cycles.

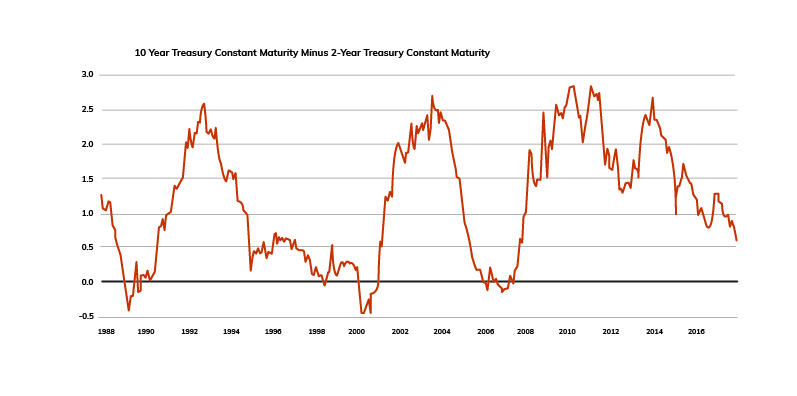

In looking at the volatility in general economic cycles, recessionary times can mean opportunities in real estate. Correlating the below graph on recessionary periods to the Green Street Commercial Property Price Index, we see a similar dip in real estate market values but values have had a general increasing trend. (5)

If you cannot own a sports franchise, commercial real estate is still a great hold!

REFERENCES:

5 Phases of Business Cycle

Kurt Badenhausen (July 22,2019). The World’s 50 Most Valuable Sports Teams 2019.

Cork Gaines (September 26, 2017). Jerry Jones paid a record $140 million for the Dallas Cowboys — the team is now worth $4.8 billion.

Commercial Property Index.

Jason Kirby (December 5, 2017). The 91 most important economic charts to watch in 2018.