Many factors influence building costs. These factors fall under the general categories of material costs, services costs, and labour costs.

Looking at material costs, there are many sub-categories such as framing lumber, concrete, steel, gyproc, insulation, etc. Each of these sub-categories are impacted by supply and demand forces in their particular market which ultimately influences the cost for that item.

Looking at framing lumber, these costs have risen significantly during the past year mainly due to a rapid rise in housing starts. On the other hand, labour costs have flattened or in some cases fallen with some sub-trades and in some regions during the past year due to mass layoffs and high unemployment caused by the COVID pandemic.

Although there are innumerable factors that influence building costs, during the last ten years the overall trend has been inflationary.

During the first year of the pandemic, there has been a great deal of volatility, but the overall trend has been inflationary as well.

According to Stats Canada, Canadian residential construction costs increased by 12% between Q1 2020 and Q1 2021.

We have observed in some cases that although building material costs have recently risen significantly, some developers are decreasing profit margins or taking some other steps to lessen the inflationary impact.

As an example, statistical data indicates that overall building costs in the Vancouver region rose 3.7% from Q4-2019 to Q4-2020, and that during the same period the cost of single family housing rose 6.6%.

What is the current outlook for building cost trends for 2021 and 2022?

This short-term rate of building cost inflation is unsustainable. Therefore, at some point in 2021 or 2022 the pace of increase should slow to levels that are more traditional. There may even be a period of deflation to some degree as the markets re-adjust. However, with so many different factors at play it is impossible to predict the nature and timing of this change in trends.

How does this affect Insurance Appraisals?

During normal business cycles, Suncorp’s professional staff monitor a wide variety of data sources to support building cost estimates for a wide variety of building types, and in a wide variety of locations. This includes analysis of statistical data from Stats Canada, RS Means, Marshall & Swift, and many other reliable sources. We also collect and analyze market data in the form of actual costs from current construction projects.

During times of economic instability, such as the COVID pandemic, market forces become volatile. This volatility affects the many factors that influence building costs. As such, it becomes challenging to accurately estimate building costs during these periods. For example, statistical reports often have a 3-6 month lag time. Accordingly, the recommendation by many brokers is to have a professional appraisal done at regular intervals so long term market factors such as economic and even monetary factors (exchange rates) are considered to arrive at an accurate value.

Have you ever considered getting a second opinion on an appraisal, cost estimate report, reserve fund study / depreciation report, or consulting report? Here is an option, the Technical Review. You can even get a Technical Review of a Technical Review.

What is a Technical Review?

A Technical Review is an unbiased and objective formal written critique of a report that was prepared by another firm.

The purpose of a Technical Review is to form an opinion on if a subject report is credible and reliable. The opinion is supported in the Technical Review report by detailed analysis of any errors or deficiencies observed in the subject report.

Technical Reviews are prepared by Suncorp’s Senior Consultants whom have completed additional training and have experience in this specialization. Technical Reviews prepared by Suncorp are prepared in alignment with the Review Standards of either the Uniform Standards of Professional Appraisal Practice (USPAP), or the Canadian Uniform Standards of Professional Appraisal Practice (CUSPAP).

What are Technical Reviews used for?

Technical Reviews are most often prepared for different types of litigation support, and at various stages including pre-claim analysis, or to assist with preparation for cross examination.

Technical Reviews are also often commissioned as part of a due diligence process. For example, a private equity lender may require a Technical Review of an appraisal report to help determine the credibility and reliability of an appraisal submitted as part of a mortgage application.

Scope of a Technical Review

The scope of a Technical Review has a very wide range, from a basic standards compliancy up to a full audit of work-files.

All Technical Reviews include a standards compliancy review against the set of standards under which the subject report was prepared, which could be either USPAP, CUSPAP, RICS Red Book, International Valuation Standards, etc. This stage also includes a review of methodology employed within the subject report.

Technical Reviews may also include additional steps depending on our clients need. These can include verification of factual data reported within the Subject Report, re-inspection of the subject property, additional market research, or even a full audit of the entire process and work-file. Often our clients may have specific questions or issues they may want us to investigate.

It is important to note that a Technical Review does not provide an alternate opinion. For example if the subject report is an appraisal report, the Technical Review does not include an alternate opinion of value. However if the client also needs that alternate opinion of value, Suncorp is available to provide that service under separate cover.

Geographical Considerations

Depending on the scope, Technical Reviews may be conducted on reports developed on properties located virtually anywhere.

For example if the subject report is a Reserve Fund Study on a property located in, say Texas, and the scope of review is limited to a standards and methodology review, then the location of Suncorp’s reviewer is not an issue.

Suncorp’s Technical Reviews Services

Suncorp Valuations can provide Technical Review services on a wide variety of report types including Real Property Appraisals, Machinery & Equipment Appraisals, Insurance Appraisals, Reserve Fund Studies and Depreciation Reports, and related Consulting Reports.

For a Second Opinion, Call Suncorp Today.

Learning Objective: To discuss the recommended inspection practices for Playgrounds after winter conditions.

The requirements/recommended practices for inspections of playgrounds follows CSA Z614 “Children’s Playspaces and Equipment Standards”. Compliance with this CSA standard will help to reduce injuries on playground equipment. This document will discuss the recommended practices for Playground Inspections before opening in the spring.

Design & Operation

Design & Operation

- All Playgrounds should be installed according to the most current CSA standard.

- A “third party” detailed Playground Safety Audit should be in place on all equipment.

- Standard impact protection, sand, pea gravel, wood chips, rubber, etc. should be maintained at all times.

- Damaged equipment should be repaired or removed from play immediately to help prevent injury.

Spring Time Inspection

Spring Time Inspection

- Have any changes taken place to the equipment over winter that could affect the integrity of the playground structures.

- Is all playground equipment in good condition with no damage or missing pieces?

- Is all impact protection materials maintained to appropriate depths to help minimize exposure to injury (Tilling or top up may be required after winter snow pack)?

- Check to make sure all standing water is drained as quickly as possible or device cordoned off until such time as this water can be drained.

- If needed, Cordon off equipment from use should repairs, standing water, or other damage be evident.

- Is appropriate signage provided and visible alerting patrons to current conditions?

Regular Inspection/Maintenance Schedule

- Daily/weekly: Visual inspection for broken glass, vandalism, animal droppings, damaged equipment, etc. Replenish or rake ground cover. This inspection should be conducted before students arrive in the morning (if a school) and can be performed by any staff member or a custodian. The inspection and any corrective action should be logged in a daily journal. (Appropriate maintenance department staff should be notified immediately if any concerns are noted. Have process in place, work order or communications system, documented inspections and follow up.)

- Monthly:This is a more detailed inspection and must be recorded on an appropriate equipment checklist form. This inspection should be conducted by a certified inspector. Any maintenance or repairs noted on the checklist should be acted upon immediately, and recorded when completed.

- Annually:This is a comprehensive audit of the playground site that should be conducted by a certified playground inspector. Contact your applicable department office or ourselves if needed. Annual Audits should be provided as per current CSA standards.

For additional information, contact:

Doug Taylor, CRM, CCPI

Managing Director, Risk Management Group

doug.taylor@suncorpvaluations.com

Recently, we have been conferring with many clients and their accounting counsel on the potential for economic impairment and subsequent potential for write-downs as they wrestle with the day-to-day impacts of COVID-19. This is relevant to financial statements for the periods ending after December 31, 2019.

The implications for financial statements include not only the measurement of assets and liabilities but also disclosure and possibly an entity’s ability to continue as a going concern. The implications, including the indirect effects from lower economic activity, should be considered by all entities, not just those in the territories most significantly affected. (1)

Here are some bullet points to consider:

- Asset write-downs and impairments are a big focus. Impairments really put pressure on companies’ balance sheets. They occur in an environment in which the company is distressed, assets are being written down, and at a time when companies really need capital to sustain their operations. (2)

- Whether you are operating under International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP), the relevant accounting associations are providing guidance that businesses should examine.

The Chartered Professional Accountants Canada has provided a valuable alert relative to Accounting Standards for Private Enterprises (ASPE), see https://www.iasplus.com/en-ca/publications/cpa-canada/assessing-potential-covid-19-impacts-on-financial-statements-questions-to-ask-under-aspe/at_download/file/02449-RG-ASPE-Alert-Assessing-COVID-19-Impact-Questions-June-2020.pdf.

The Chartered Professional Accountants Canada has provided a valuable alert relative to Accounting Standards for Private Enterprises (ASPE), see https://www.iasplus.com/en-ca/publications/cpa-canada/assessing-potential-covid-19-impacts-on-financial-statements-questions-to-ask-under-aspe/at_download/file/02449-RG-ASPE-Alert-Assessing-COVID-19-Impact-Questions-June-2020.pdf.

The ASPE bulletin provides guidance relative to Property, Plant and Equipment.

Impairment of Assets Other than Financial Instruments

The financial performance of entities may be significantly affected by COVID-19 and related government measures. This may raise impairment concerns for various assets held by an entity including property, plant and equipment, intangible assets, goodwill, investments in other entities, inventories and other assets.

These assets are tested for recoverability whenever events or changes in circumstances indicate that their carrying amount may not be recoverable. COVID-19 may raise questions, such as:

• Are some items of property, plant or equipment no longer in use due to COVID-19?

• Have certain operations of the business closed down, either temporarily or permanently?

• Is the useful life of any asset likely to be shortened as a result of COVID-19?

The above are examples of indicators of impairment and are not meant to be an exhaustive list. Advice from qualified professionals is essential in assessing the expected significance and duration of COVID-19 impacts and related government measures on the business unit, and when evaluating how quickly that business unit is expected to recover. A short-term reduction in cash flows followed by a rapid return might not be significant enough to be considered an indicator of impairment for some entities. For others, even a relatively short disruption due to COVID-19 may affect recoverability of carrying amounts of certain assets. An impairment loss might not be reversed if the fair value of the asset or group of assets subsequently increases in a future period. (3)

- Under GAAP there is the use of a “triggering event” for restatement purposes. From a financial reporting perspective, the fair value of assets could come under pressure as the economic impact becomes more visible. Impairment testing is required whether in the case of a “triggering event”, as defined in ASC 350 – Intangibles –Goodwill and Other, and in ASC 360 – Plant, Property and Equipment. Triggering event-based impairment testing is an issue even for those who have made accounting elections whereby assets are being amortized rather than tested annually for impairment. (4)

As professional appraisers we are being asked to assist in the quantification of impairment for facilities all over the world. The American Society of Appraisers has offered previous guidance to allocating impairment losses to the value of assets.

If value in use for a single cash generating unit (CGU) is less than the sum of Depreciated Replacement Cost (based on physical and functional depreciation) of the assets comprising the CGU and the difference is recognized as asset impairment (economic obsolescence), the question then arises as to how to allocate these impairment losses among the assets comprising the CGU. IFRS does not include a directive concerning how impairment losses are to be allocated; it is an accounting policy decision taken by a company in consultation with its auditors working with the appraisers. Two opinions are prevalent: (1) losses can be allocated according to the relative value of each asset based on the sum of DRC value for all assets in the CGU: e.g. a single asset representing 15% of total DRC asset value would be allocated 15% of the total impairment loss, or (2) Identify the assets that are the main cause of the economic obsolescence and allocate losses mostly to those assets: e.g. if a certain piece of equipment has a capacity to operate at 100 hours per week but is only used 50 hours per week and all other assets are utilized at capacity, then the underutilized asset be allocated most of the loss. (5)

We would urge our clients to continue to confer with their accounting and appraisal counsel on the potential impairment and impact on their financial statements. This could have a cascade effect on your tax and equity positions.

REFERENCES:

2020 PwC.. In Depth. A look at current financial reporting issues

Clare Beckker (2020). COVID-19 and Financial Reporting: 5 Things to Know.

2020 Chartered Professional Accountants of Canada. Financial Reporting Alert, May 2020, Accounting Standards for Private Enterprise (ASPE). ]

Ludmila Simonova (Unknown). Applying Business Valuation Techniques to Determine Economic Obsolescence of Real Property and Personal Property Assets for the Purpose of Financial Reporting in Europe

In the world of professional valuation services we often hear the idiom that “you get what you pay for”. Usually the context behind this is “we offer three types of service”, namely:

- Credible and Reliable;

- Cheap; or

- Fast.

But you can only pick two:

- Credible and reliable and cheap will not be fast;

- Credible and reliable and fast will not be cheap; or

- Cheap and fast will not be credible and reliable.

At Suncorp Valuations we emphasize credible and reliable reporting that is completed on time and at a fair price, in accordance with our brand promise!

Those of you who use our services know that Suncorp always prepares and delivers a proposal which details our current understanding of the services to be conducted. We do this in order to establish the appraisal’s intended use, scope of service, our professional fee, and the required timing of our deliverables.

Recently, a new client to Suncorp advised us that they had obtained three independent proposals from suppliers who they thought were credible and reliable. In vetting these proposals, our client asked if we could help them better understand the variances between them and explain why our professional fee was the highest.

The first variance we identified was related to the “credible and reliable” premise:

Clearly two of the firms were proposing to utilize staff who had not obtained a designation from a recognized and regulated Appraisal Society. Each and every report that Suncorp Valuations prepares is reviewed and signed off on by one of our permanent, full-time appraisers, who have obtained an Accredited Senior Appraiser designation from one of the following recognized Appraisal Societies:

These designations have rigorous requirements with respect to formalized training and articling experience which must be adhered to before a Senior designation within each Society is granted.

The second variance we identified was related to the “on time” premise:

Our proposal was the only one that addressed the timing of the deliverables to align with the intended use of the report (i.e. to assist the insurance broker with the placement of property insurance). At Suncorp we want to be timely in our reporting to meet our client’s requirements; not fast, but appropriately timed!

The third variance we identified related to disclaimers within our competitor’s proposals:

These disclaimers limited the competitor’s liability in the event that their final cost estimates were not adequate to replace the property in the event of a significant loss.

Suncorp Valuations believes that by combining appropriate liability insurance along with proper appraisal accreditation, this affords our firm the ability to withstand scrutiny of our value conclusions. As a prudent company, having been in business for over 60 years , our professional fees need to reflect the cost of being able to provide both services. Accordingly, our professional fees are not always “the cheapest” option. We are happy to provide clients with a copy of our “Certificate of Insurance” which outlines the coverage we have in place to protect them, in the unlikely event that there is an error in our final cost estimate.

In selecting your valuation services provider, we encourage you to conduct an “apples to apples” comparison to ensure your interests are represented appropriately.

Be wary of companies that limit their liability to a multiple of the fees paid for the service, along with those who do not utilize staff members with Senior Appraiser designations from one of the above-noted recognized Appraisal Societies.

To sum things up, “cheap and fast” is not always the correct answer, and to quote a man who has a proven record of accomplishment in measuring risk:

“Price is what you pay; value is what you get.”

— Warren Buffett

In contending with COVID 19 and other events such as the West Coast wildfires, or flooding in the Southeast US, many of our clients are examining their fixed assets to develop strategies to maximize value and mitigate risk. In working with them in examining their fixed assets, we always start with “Intended Use”.

Fixed assets represent a significant portion of an enterprises asset base. Most organizations have reasonable estimates of the values or costs of their fixed assets but there are a variety of reasons why an organization may need an external third party valuation by an accredited firm. In this article, we cover seven of the main Intended Uses for fixed asset valuations.

Insurance Placement

Considering the increasing cost of insurance coverage, it is wise to obtain a Cost Estimate Report (insurance appraisal). This will assist with ensuring the coverage is adequate, and that you are not over insured. Whether an organization is renewing their current insurance policy or seeking a new insurance provider, they must provide an accurate statement of their insurable fixed assets. Although trended historical costs, internal estimates and supplier quotations may seem to be adequate, they often are not. A formal valuation of the organization’s insurable fixed assets is generally recommended every three (3) to five (5) years depending on the amount of construction material and labour cost changes over that period. In the interim years, Suncorp has developed a composite index with which we can provide desktop updates.

Financial Reporting

The need for an accurate statement of fixed asset values in Financial Statements may be driven by a number of circumstances from compliance to accounting standards to business combinations. For example, the Public Sector Accounting Board (PSAB) revised section PS 3150 of the CICA Public Sector Accounting Handbook: “Reporting of Tangible Capital Assets.” As a result, local governments are required to record capital expenditures as capital assets and amortize them over their useful life. The goal of this standard change was to render financial reports that are more current, accurate and comprehensible – hence more useful to legislators, oversight bodies, creditors and the general public. Another change in accounting was when IFRS replaced GAAP for publicly accountable enterprises and government business enterprises. For Property, Plant and Equipment, IAS 16 prescribes accounting treatment for PPE. Relative to business combinations, the recognition and measurement of acquired fixed assets can be challenging. IFRS 3 Business Combinations outlines the accounting when an acquirer obtains control of a business (e.g. an acquisition or merger). Such business combinations are accounted for using the ‘acquisition method’, which generally requires assets acquired and liabilities assumed to be measured at their fair values at the acquisition date.

Asset-Based Financing

Changing economic conditions, uncertain market changes, or shifts in collateral values can cause both lenders and borrowers to reconsider their financial position. In addition, asset-based lending is a key tool for business sustainability and growth when it comes to managing cash and opportunities for expansion. Valuations of the fixed assets are typically required on an Orderly or Forced Liquidation basis depending on the circumstances. Occasionally lenders may accept Fair Market Value-Continued Use as an appropriate premise if an organization’s earnings support the fixed asset valuation.

Asset Control and Management

For organizations both large and small, there is a need to monitor fixed assets in terms of their age, condition and expected dates of replacement. A formal inspection and inventory are typically part of fixed asset valuations. The detailed information provided in valuations can be used to assist internal staff with the development of a formal asset management plan or the need to hire additional consultants to complete formal condition assessment or other studies.

Multi-Use Valuations

Although each of the intended uses above were discussed independently, it is often more cost-effective to complete fixed valuations for multiple uses at the same time. This is because many of the same tasks such as inspections and inventories need to be completed regardless of the reason for the report. Additionally, values that are developed for one purpose (i.e. Reproduction Cost for insurance purposes) may be required to develop values for other purposes (i.e. Fair Market Value for purchase price allocation).

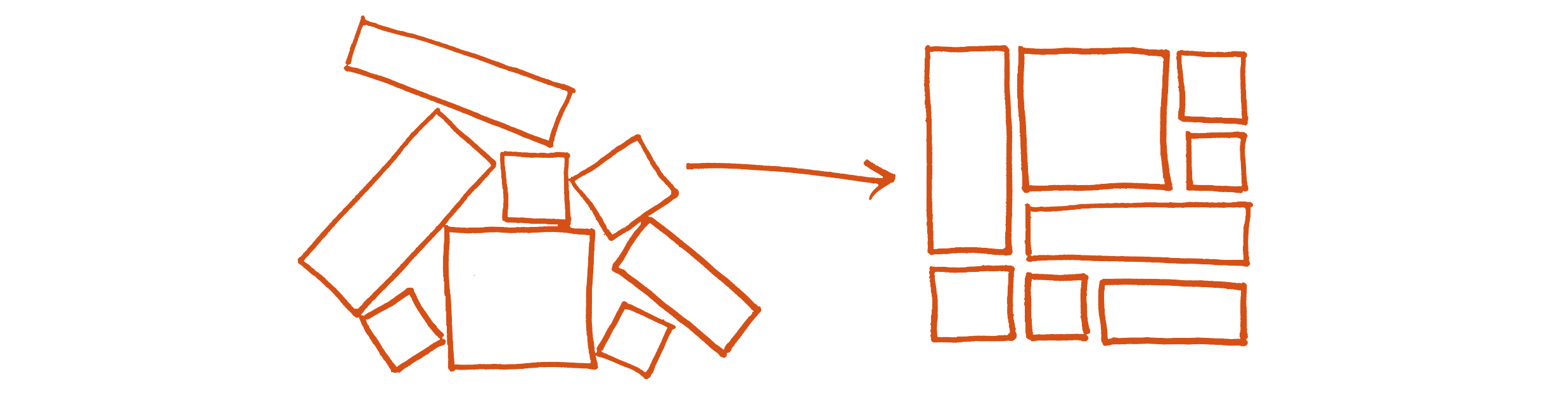

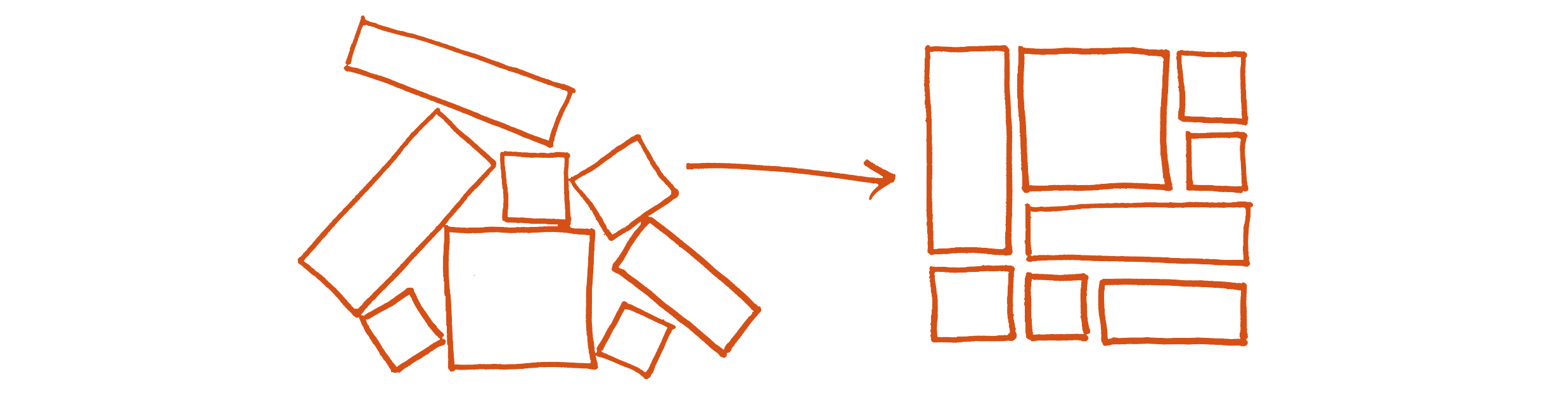

In conclusion, given the wide variety of uses it is important in requesting a fixed asset valuation to clearly communicate what the intended use of the valuation is and to also advise if there are any secondary purposes that may be able to be incorporated into the valuation service provided. This will ensure that you receive the correct valuation for your use and users.

Contact Suncorp today for all your valuations needs.

Design & Operation

Design & Operation Spring Time Inspection

Spring Time Inspection

The Chartered Professional Accountants Canada has provided a valuable alert relative to Accounting Standards for Private Enterprises (ASPE), see

The Chartered Professional Accountants Canada has provided a valuable alert relative to Accounting Standards for Private Enterprises (ASPE), see