In contending with COVID 19 and other events such as the West Coast wildfires, or flooding in the Southeast US, many of our clients are examining their fixed assets to develop strategies to maximize value and mitigate risk. In working with them in examining their fixed assets, we always start with “Intended Use”.

Fixed assets represent a significant portion of an enterprises asset base. Most organizations have reasonable estimates of the values or costs of their fixed assets but there are a variety of reasons why an organization may need an external third party valuation by an accredited firm. In this article, we cover seven of the main Intended Uses for fixed asset valuations.

Insurance Placement

Considering the increasing cost of insurance coverage, it is wise to obtain a Cost Estimate Report (insurance appraisal). This will assist with ensuring the coverage is adequate, and that you are not over insured. Whether an organization is renewing their current insurance policy or seeking a new insurance provider, they must provide an accurate statement of their insurable fixed assets. Although trended historical costs, internal estimates and supplier quotations may seem to be adequate, they often are not. A formal valuation of the organization’s insurable fixed assets is generally recommended every three (3) to five (5) years depending on the amount of construction material and labour cost changes over that period. In the interim years, Suncorp has developed a composite index with which we can provide desktop updates.

![]()

Financial Reporting

The need for an accurate statement of fixed asset values in Financial Statements may be driven by a number of circumstances from compliance to accounting standards to business combinations. For example, the Public Sector Accounting Board (PSAB) revised section PS 3150 of the CICA Public Sector Accounting Handbook: “Reporting of Tangible Capital Assets.” As a result, local governments are required to record capital expenditures as capital assets and amortize them over their useful life. The goal of this standard change was to render financial reports that are more current, accurate and comprehensible – hence more useful to legislators, oversight bodies, creditors and the general public. Another change in accounting was when IFRS replaced GAAP for publicly accountable enterprises and government business enterprises. For Property, Plant and Equipment, IAS 16 prescribes accounting treatment for PPE. Relative to business combinations, the recognition and measurement of acquired fixed assets can be challenging. IFRS 3 Business Combinations outlines the accounting when an acquirer obtains control of a business (e.g. an acquisition or merger). Such business combinations are accounted for using the ‘acquisition method’, which generally requires assets acquired and liabilities assumed to be measured at their fair values at the acquisition date.

Asset-Based Financing

Changing economic conditions, uncertain market changes, or shifts in collateral values can cause both lenders and borrowers to reconsider their financial position. In addition, asset-based lending is a key tool for business sustainability and growth when it comes to managing cash and opportunities for expansion. Valuations of the fixed assets are typically required on an Orderly or Forced Liquidation basis depending on the circumstances. Occasionally lenders may accept Fair Market Value-Continued Use as an appropriate premise if an organization’s earnings support the fixed asset valuation.

Asset Control and Management

For organizations both large and small, there is a need to monitor fixed assets in terms of their age, condition and expected dates of replacement. A formal inspection and inventory are typically part of fixed asset valuations. The detailed information provided in valuations can be used to assist internal staff with the development of a formal asset management plan or the need to hire additional consultants to complete formal condition assessment or other studies.

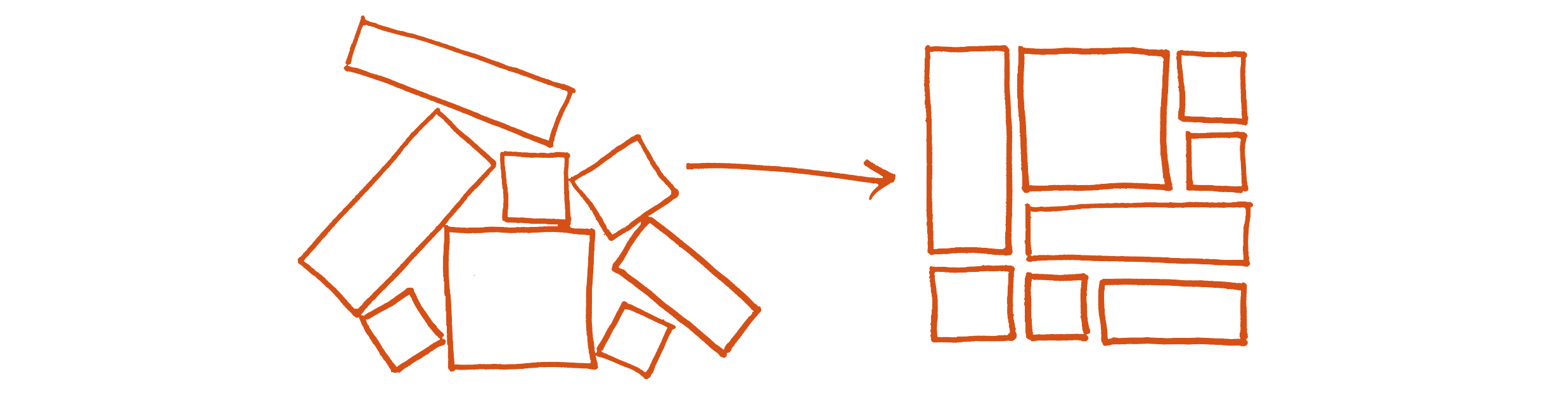

Multi-Use Valuations

Although each of the intended uses above were discussed independently, it is often more cost-effective to complete fixed valuations for multiple uses at the same time. This is because many of the same tasks such as inspections and inventories need to be completed regardless of the reason for the report. Additionally, values that are developed for one purpose (i.e. Reproduction Cost for insurance purposes) may be required to develop values for other purposes (i.e. Fair Market Value for purchase price allocation).

In conclusion, given the wide variety of uses it is important in requesting a fixed asset valuation to clearly communicate what the intended use of the valuation is and to also advise if there are any secondary purposes that may be able to be incorporated into the valuation service provided. This will ensure that you receive the correct valuation for your use and users.

Contact Suncorp today for all your valuations needs.