As an essential service supporting insurance, finance, accounting and litigation we have continued to work with our clients to mitigate the risk of COVID 19 for our appraisal and risk management teams in conducting inspections. Ergo, we have been able to advance appraisal and risk management engagements so our client’s applications for insurance, financing, or other purposes can proceed without delay.

As we have been planning our engagements, we are contending with travel restrictions which have forced us to look at travel routes and strategic use of our staffing. As we did this, we started at looking at all the countries we have been pleased to work in the last few years. As the map below depicts, we truly have a global reach and this continues today as we plan current assignments in countries such as Lithuania, Poland, Indonesia, Brazil, Mexico, Australia and all over North America.

Thanks to you, our valued clients, we have been pleased to expand our North American network of offices, while bringing on appraisers based in Europe and South America to better serve your needs. At this time we wanted to thank you for the continued trust in our services and appreciate your patience as we develop processes (such as conducting inspections at maintenance shutdowns or off peak hours) to keep your organization’s and our appraisal teams safe!

“A statement of values (SOV) is a report that an insured submits to an insurer. It details the amount each property that will be covered under a policy is worth. The insurer then bases the insured’s premium on this report.

To avoid underinsurance, the statement of values must be accurate and comprehensive. It must not only provide the amount for each property in every location but it must also list all the insurable items in each property, such as machinery and other equipment.

In order to ensure the accuracy and comprehensiveness of their statement of values, it is advised that the insured get the assistance of a finance professional, such as a property insurance broker, when drafting their SOV.” (1)

When you accept your statement of values, it is your declaration to the insurance brokerage and the insurance company that the composition and valuation of the property contained is accurate. How do you know if the numbers are accurate and what are the consequences if they are not?

First, let us explore where these numbers may have come from. Have you recently had a professional valuation completed by an accredited firm? If so, you can jump to the next paragraph. Did your numbers come from a dated valuation or perhaps original cost and you have applied an inflationary index each year? If so, how did you come up with your index and how long have you been indexing these? Have you accounted for changes to property or machinery and equipment? Have you accounted for freight, installation and any other considerations in the replacement of your property? Without answers to these questions, you may be at risk of insuring your property with inaccurate values.

Next, what is the risk associated with the accuracy of these numbers? The best case scenario is to be accurately insured; you avoid both the over-payment of premium as well as the risk of co-insurance penalties (being under-insured). If you are over-insured, you are paying too much premium. In the event of a loss, you may not receive the excess insurance you placed and those premium dollars are lost. Even worse is the risk of being under-insured and facing a co-insurance penalty.

Co-insurance penalties would apply to policies with a co-insurance clause. A co-insurance clause is written into an insurance policy to spread the risk between parties. The most common co-insurance limit is 90%, which means a client is responsible to insure to 90% of the replacement cost of their property’s value. So for a building that has a replacement cost of $1,000,000 with a 90% co-insurance clause, the client must insure to a minimum of $900,000. The biggest concern to a client failing to meet the minimum co-insurance requirement is the co-insurance penalty.

This example will explain better:

Using the above example, the insured, selects an insurable limit of $750,000 based on historical records in their files (should be $900,000 due to 90% coinsurance clause). Policy has a $1,000 deductible. The building has a fire and there is a $250,000 loss. During the adjusting of the claim, the insurance company will see that the client did not meet the coinsurance requirement and invoke the coinsurance penalty.

The penalty is calculated as follows:

Amount insured to divided by amount should have insured to and multiplied by amount of loss due to claim = amount insurance policy will pay for claim.

$750,000 (insured) / $900,000 (should have insured) X $250,000 (loss) = $208,333 will be paid by insurance company.

The insured will be out of pocket over $40,000 (rather than just the $1000 deductible if they had insured to $900,000).

So what does it imply when you accept your statement of values and send them back to your broker? It means you are confident in the numbers and assume the financial risks of any inaccuracies in a loss scenario. If you are reviewing your statement of values, and do not know if you can trust your numbers, you should consult your broker to look at options to develop the right values.

Call Suncorp Today.

REFERENCES:

Statement of Value (SOV). Retrieved from https://www.insuranceopedia.com/definition/509/statement-of-values-sov-insurance

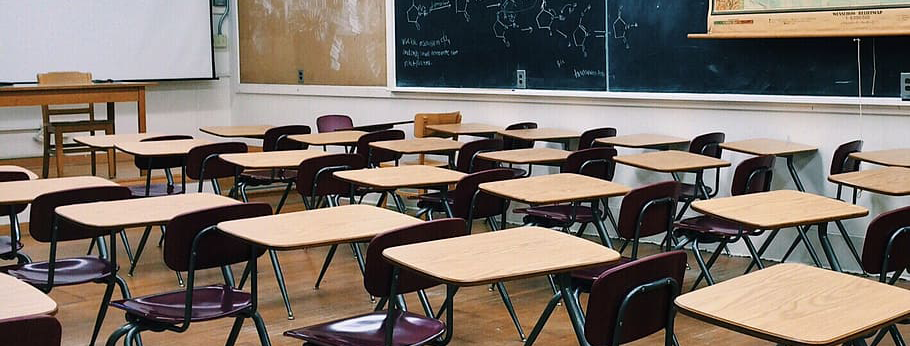

Learning Objective: To provide some suggestions on what to consider as part of your schools re-opening plans during and post the COVID-19 pandemic.

Many School Divisions are meeting to examine how they can safely re-open their schools now that the Governments and Provincial Health Authorities have given their approval. In discussions with many of you and information we’ve gathered from other areas throughout Canada and around the world, we thought it was timely to provide you some of the ideas being considered.

Ultimately, everyone wants to ensure our schools are safe for staff and students while at the same time providing an effective environment for students to learn. As such, balancing this will be the challenge that School Divisions will encounter as they navigate the various requirements.

Things to consider:

- Thorough cleaning of all schools prior to student’s arrival.

- Hand sanitizers located at all key entry points and common areas throughout school.

- Constant promotion of proper hand washing for all staff and students.

- Regular screening of students/staff for temperature, and COVID-19 related symptoms. If symptoms present, Isolate until such time as they can be picked up by a parent/care giver.

- Staggered arrival/departure times. Different grades starting and being dismissed at different times.

- Staff/students splitting their instructional days where a portion will be instructed in classrooms and a portion via home based learning.

- Implementing alternate days/weeks where students will attend school and learn from home.

- Smaller number of students on buses (supports the staggered start time’s scenario).

- Smaller number of students in classrooms to maintain required physical distancing of 2m.

- Process in place within hallways, stairs, and other common areas to ensure proper distancing is maintained, ie. one staircase designated for down only and one designated for students going up.

- More emphasis on distance learning. Some Divisions are considering certain grades will be taught through distance learning programs versus in schools. This will provide some relief on the challenges associated with classroom loads in many schools.

- Re-purposing single use rooms such as libraries, cafeterias, gyms into multi-purpose areas where lessons can take place.

- Using outdoor learning when weather & systems permit. Use of sports field surrounding schools as outdoor classrooms.

- Looking to rent alternate facilities to use for instruction.

- Redrawing of school boundaries to take advantage of underused facilities.

- Availability of applicable PPE for staff and/or student use.

- Removal/decommissioning water fountains.

- Installation of Water Bottle filling stations.

- Restricting visitors to schools – applicable sign in/out sheets should now be mandatory in all schools.

- Parents restricted from entering schools during drop-off and pick-up times.

- Frequent cleaning of all common and high touch areas.

- Look at the merits of installing automated systems such as lights, and doors to limit contamination of high touch areas.

- Policies for to avoid sharing of school supplies, food, etc.

- Meal service – proper Provincial Food Safety training should be mandatory for all staff involved in this area including the use of PPE. How food is provided to students is also being reviewed – delivered to student versus buffet style lines. Ways to continue with meal programs in schools is critical for many of the students well being.

- Removal of microwaves from common areas, and classrooms; used only by Food Safety trained staff.

- Physical activities – sports like basketball, football, volleyball, baseball, etc. pose some unique challenges given the student is required to touch the ball, whereas sports such as soccer, lacrosse, golf, track events (without relay batons, javelin, shot put) and hockey are such where the participant doesn’t touch (skin contact) the ball/puck on a regular basis.

Flexibility:

- The need for flexibility in adapting to the temporary requirements is critical as we make our way through these challenging times.

- Now, more than ever, regular documented inspections should be provided and maintained for all areas within a school including the mandatory sign-in and sign-out logs for all staff and visitors.

Final Thoughts:

Throughout your planning process, there needs to be an ongoing analysis on primarily three areas when reviewing your re-opening plans:

- The physical – actual brick and mortar requirements. Reconfiguration of learning spaces, installation/removal of equipment, safety devices, etc. What are the technology requirements for laptops, internet connections, etc.? What are the transportation needs for our students?

- The Human element – the affects these plans will have on staff and students. Everything from staffing levels, the ability to work remotely to the mental challenges the reopening may have on staff and students will require continual monitoring and support.

- Financial Impact – Some of these changes will require significant capital expenditures. There should be open discussions with all stakeholders (internal and external) in order to the meet the needs.

While this information is specific for school divisions, these considerations could be applied anywhere.

For additional information, contact:

Doug Taylor, CRM, CCPI

Managing Director, Risk Management Group

doug.taylor@suncorpvaluations.com

As we are deemed an essential service in supporting the banking and insurance sectors, we are still progressing with the completion of appraisals and risk management reporting. We have had to alter our inspection protocols to ensure the safety of our clients and staff, inclusive of having all of our appraisal/risk management staff working remotely. One of the questions that our clients have been asking is our thoughts on values post COVID.

There are so many factors in that single question, here are some of the factors we will be examining post COVID:

• Cost of money, with prime interest rates in North America being nearly zero, will banking institutions lower their lending rates, thereby increasing “cheap” capital for investment and recovery activity;

• How long will “cheap” capital be available, if the recovery period is accelerated, cost of funds may go up;

• What types of government stimulus programs will there be, which, in turn, will affect construction activity and potentially impact the cost of construction;

• Changes in demand, will remote working and the prolonged need for physical distancing change the demand for real estate which would impact market values and potentially insurable values;

• Will we continue to focus on climate change initiatives that mean more “Green” buildings, will the potential changes in demand and the drive for innovation make these buildings more affordable;

• Will oil prices and demand continue to sag, which in turn can affect the demand and values of “yellow iron” and other machinery?

In looking at these factors, we will look to examine other Black Swan events. Since 1997, we can look at 9 such events (1):

1997 – Asian Financial Crisis

2000 – The Dot-Com Crash

2001 – 9/11

2008 – Global Financial Meltdown

2009 – European Sovereign Debt Crisis

2011 – Fukushima Nuclear Disaster

2014 – Crude Oil Crisis

2015 – Black Monday China

2016 – Brexit

The current economic malaise is due to a non-economic event such as 9/11, the 2008 Global Financial Meltdown was due an economic event (bad credit, high debt loads). However, events like the 2008 Global Financial Meltdown provide us context for a recovery period. Running up to 2008 we saw a “complacency that emanated from years of stable growth, low inflation & high employment rates in the US which brought financiers to lend recklessly”. (1)

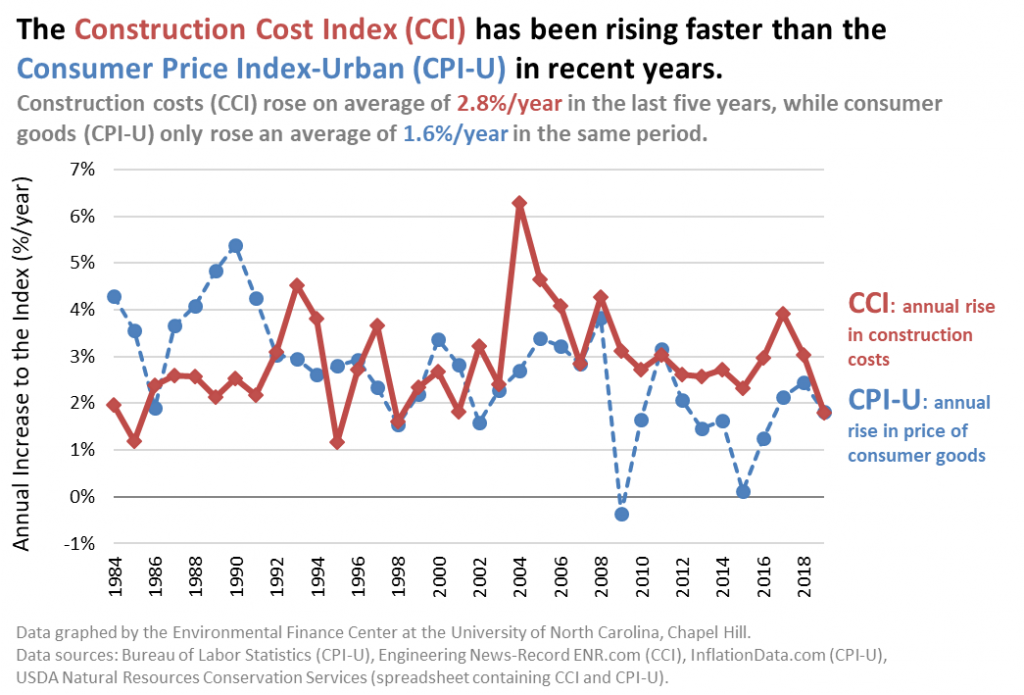

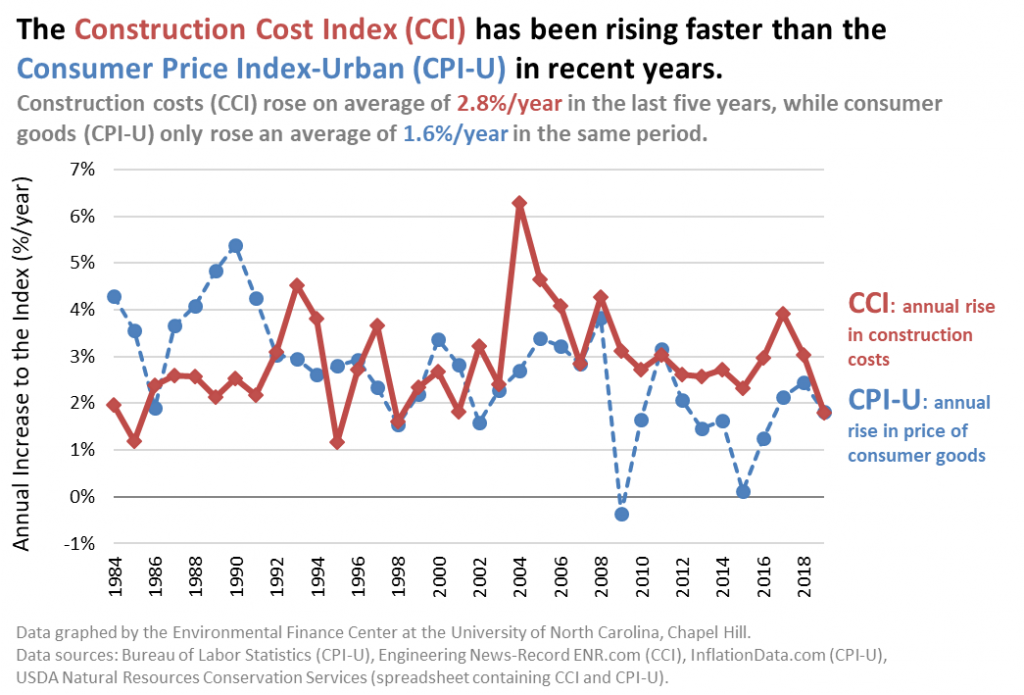

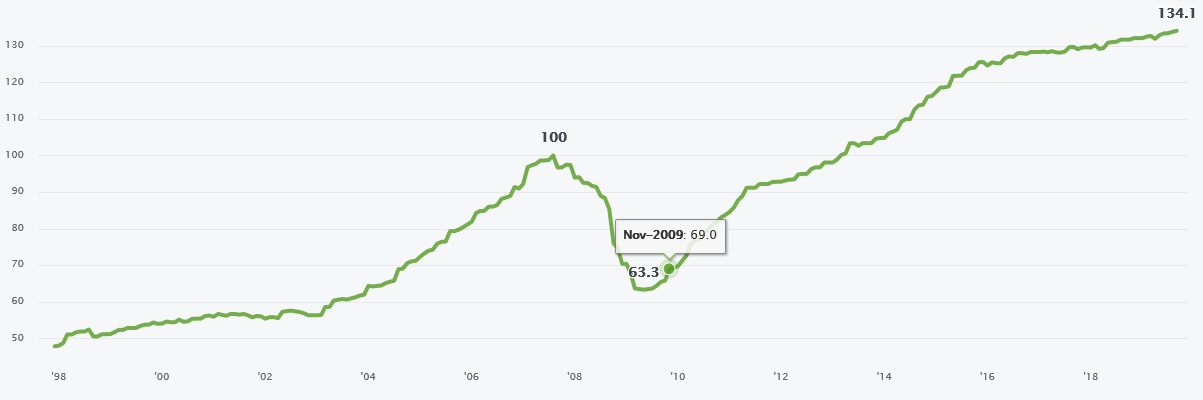

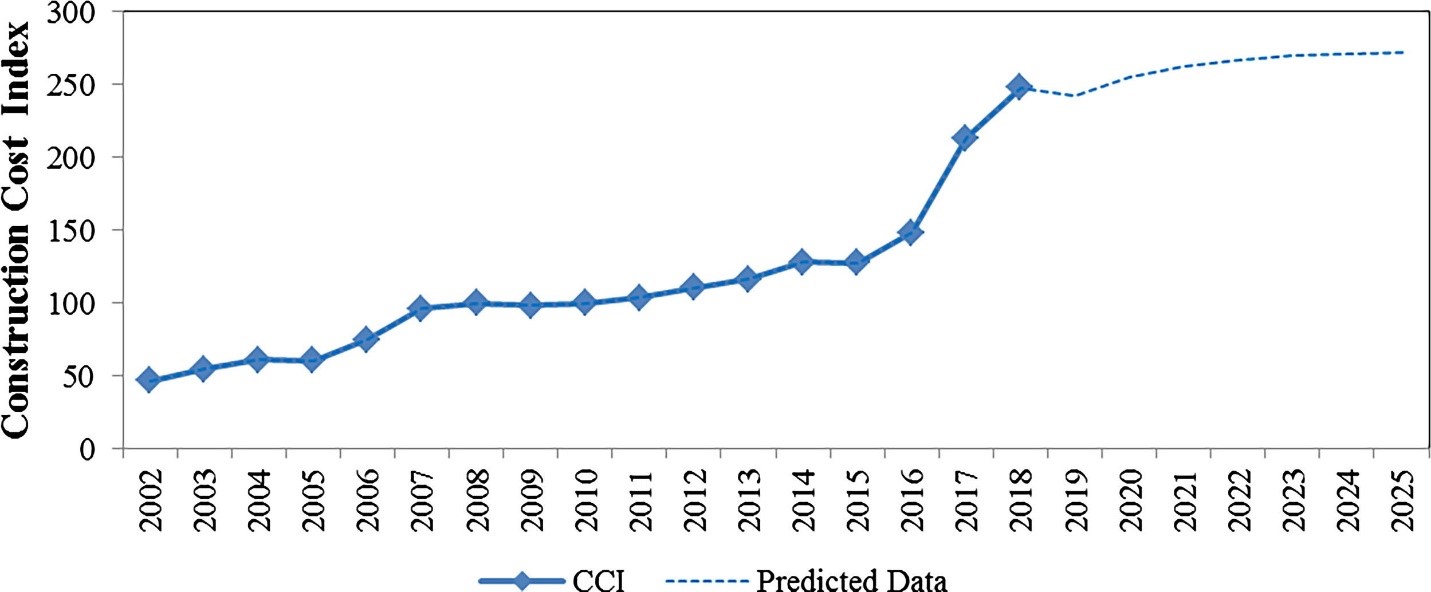

In 2020, we had a similar scenario, stability of growth, lower inflation and high rates of employment in the United States. We were seeing the impact in our appraisals as best illustrated by the following graphs:

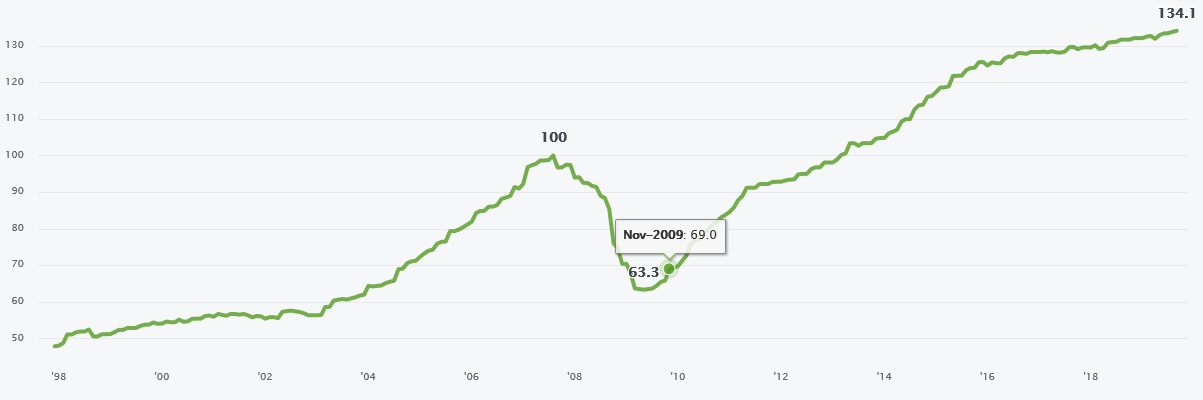

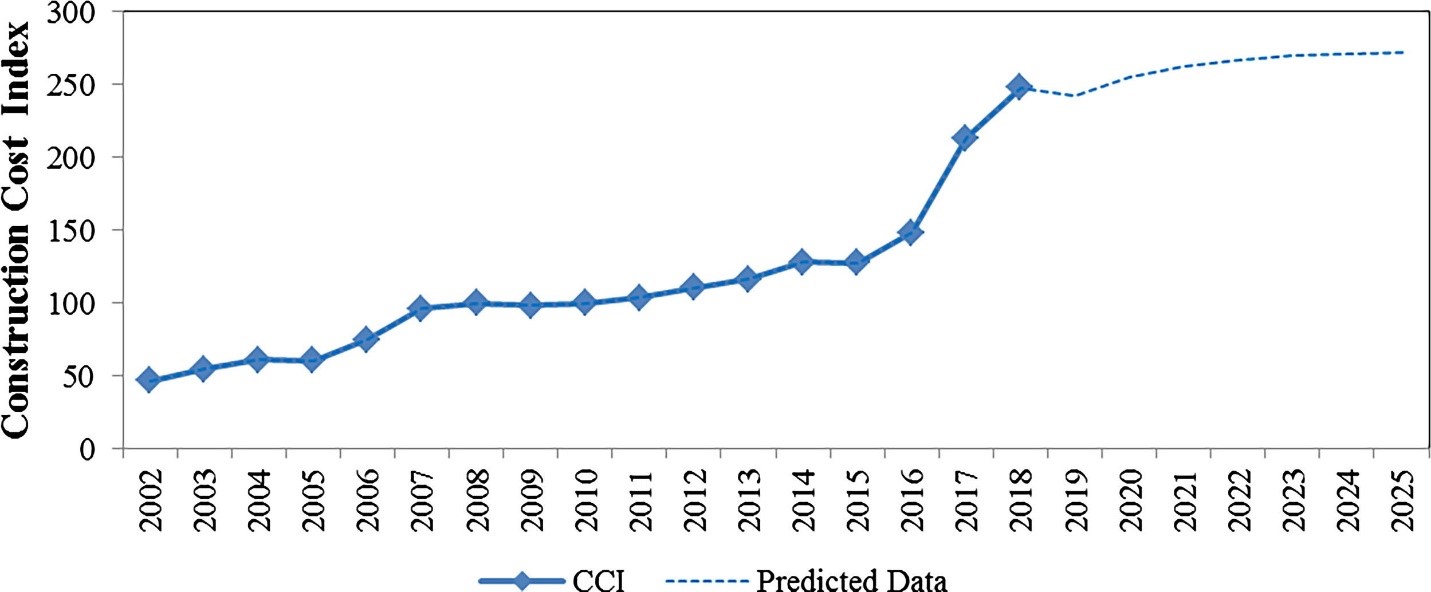

Relative to insurable cost values on a generic basis:

Relative to market values for commercial real estate on a generic basis:

Green Street Commercial Property Price Index

Indexed to 100 in August 2007

All Property CPPI weights: retail (20%), office (17.5%), apartment (15%), health care (15%), industrial (10%), lodging (7.5%), net lease (5%), self storage (5%), manufactured home park (2.5%), and student housing (2.5%). Retail is mall (50%) and strip retail (50%). Core Sector CPPI weights: apartment (25%), industrial (25%), office (25%), and retail (25%). (2)

So what does this all mean for impact on values? It is important to note the distinction between insurable cost values and market values (we have posted to our web-site a previous blog on the distinctions between these two premies of value).

Prior to COVID 19 and the oil price crisis, we would look at some predictive models (as below from Science Direct) that provided trends for construction costs (3):

However given the unprecedented nature of the current Black Swan event no one can reasonably predict what the new trends will be, perhaps we will see no change, an increase or sharp drop for both construction costs and market values. However, government intervention may stave off sharp drops or at least shorten the effects of the Black Swan event. Again it is important to note the distinction between insurable cost values and market values, the trends for both are somewhat correlated over time (not perfectly), however in the current environment they could de-couple as governments look to financially support infrastructure projects as economy starters. Furthermore, we could see future insurable cost values and market value trends differ for component type, property type and regions.

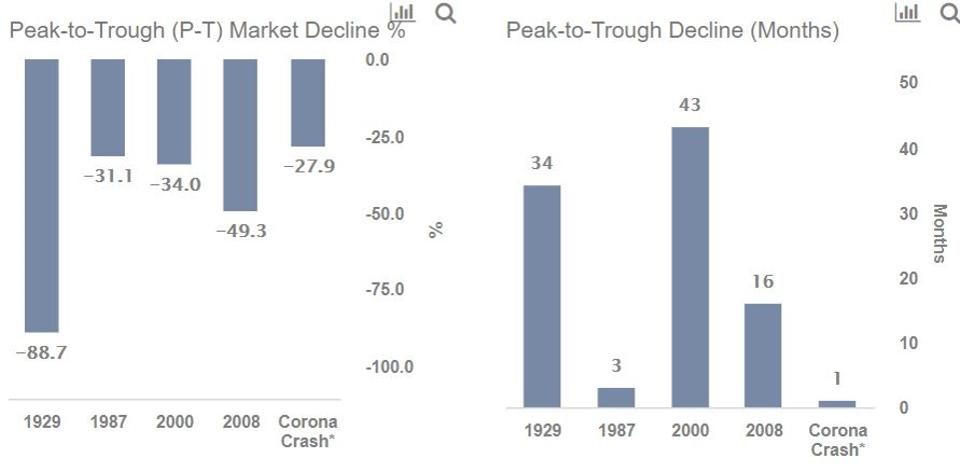

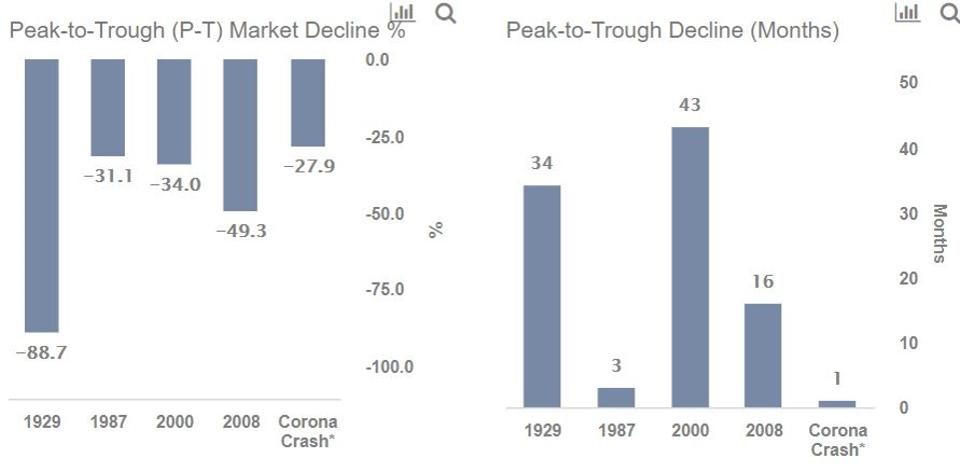

Ultimately, we know we are in for periods of volatility (and that the volatility maybe based on geography), particularly until we have a vaccine for COVID 19. Accordingly, the only impact we can predict with some certainty is that we are going to have some volatility, and that we will need to build in some contingencies for this event and for future Black Swan events, time tells us they will occur and this latest event takes us to the extreme in terms of magnitude of impact. As below, some timelines that demonstrate potential impact due to COVID 19.

Timelines of Past Crises in the Stock Markets (4):

| Crisis |

Pre-Crisis Peak |

Market Bottom |

| Great Depression |

August 1929 |

June 1932 |

| Black Monday |

August 1987 |

November 1987 |

| 2000’s Recession |

December 1999 |

September 2002 |

| Great Recession |

October 2007 |

February 2009 |

REFERENCES:

Faisal Khan (January 18, 2019). 9 Black Swan Events that changed the Financial World. Retrieved from https://www.datadriveninvestor.com/2019/01/18/9-black-swan-events-that-changed-the-financial-world/

Commercial Property Index. Retrieved from https://www.greenstreetadvisors.com/insights/CPPI.

Construction cost index prediction using neural networks. Retrieved from https://www.sciencedirect.com/science/article/pii/S1110016819300316#f0025

Trefis Team (March 13, 2020). Market Crashes Compared:-28% Coronavirus Crash Vs. 3 Historic Market Crashes. Retrieved from https://www.forbes.com/sites/greatspeculations/2020/03/13/market-crashes-compared28-coronavirus-crash-vs-4-historic-market-crashes/#5112cdd14ee8

During times of crisis, emergencies, or other types of disruption, authorities often order closures of non-essential businesses and services.

During these times, essential services are permitted to continue operations. In fact, they are expected to remain in operation. Why? Because, among other reasons, essential services are necessary to preserve basic societal and economic functions.

The Appraisal industry is recognized as an Essential Service in most jurisdictions.

What makes appraisals an Essential Service? The banking, finance and insurance industries are Essential Services as they provide basic economic functions. The appraisal industry is part of the supply chain to the banking, finance and insurance industry, thus appraisals are an Essential Service.

Being recognized as an Essential Service is an important responsibility placed on the shoulders of the appraisal industry. We do not take this lightly. We understand that it is our duty to continue providing high quality professional services while doing our best to protect the health and safety of the public and the appraiser(s).

The COVID-19 crisis affects appraiser’s ability to do property inspections. Travel and inspection safety are not new territory to a professional appraiser. We routinely encounter all kinds of risks while in the field, and managing inspection risk is part of our training. At Suncorp Valuations, we added pre-inspection procedures and questions to identify potential COVID-19 issues as much as reasonably possible. When we do identify a risk, we communicate with our client immediately to identify ways to mitigate the risk.

At Suncorp Valuations, we have also developed alternatives to full inspections such as desktop analysis or exterior only inspections with preliminary reports, to be followed by a final report once we are able to complete a full inspection. This is a good example of how we continue to serve the public and support a functioning economy, while minimizing risk to all parties.

Here at Suncorp we are committed to remain in full operation during the COVID-19 crisis, however keeping governmental guidelines and protocols in place to limit exposure for our clients and staff.

Learning Objective: To discuss the dangers of mixing bleach with other cleaners.

The danger of making your own sanitizer can be significant and we thought it timely to send out an Inspection Tip to make sure everyone stays safe. As we navigate our way through the COVID-19 virus, we all understand the importance of maintaining a clean environment around us. Unfortunately, when a shortage of product occurs, people may resort to making their own sanitizing products that may result in dangers they never knew existed. In this document, we will discuss some of the dangers of attempting to mix bleach with various cleaners found around the home.

Chlorine Bleach

Sodium Hypochlorite is the active ingredient in chlorine bleach, it is found in household bleach and many other disinfectants. Sodium hypochlorite reacts with ammonia, drain cleaners, and other acids. Many household products state that they contain bleach on the label.

Mixing Bleach with Acids

When chlorine bleach is mixed with an acid, chlorine gas is given off. Chlorine gas and water combine to make hydrochloric acid.

Chlorine gas exposure, even at low levels and for short periods, usually irritates the mucous membranes (eyes, throat, and nose). This can cause coughing and breathing problems, burning and watery eyes, and a runny nose. Higher levels of exposure can cause chest pain, more severe breathing difficulties, vomiting, pneumonia, and fluid in the lungs. Very high levels can cause death.

Acid Products

Products containing acids include vinegar and some glass and window cleaners, automatic dishwasher detergents and rinses, toilet bowl cleaners, drain cleaners, rust removal products, and brick and concrete cleaners.

Mixing Bleach with Ammonia

When bleach is is mixed with ammonia, toxic gases called chloramines are produced. Exposure to chloramine gases can cause the following symptoms:

- Coughing

- Nausea

- Shortness of breath

- Watery eyes

- Chest pain

- Irritation to the throat, nose, and eyes

- Wheezing

- Pneumonia and fluid in the lungs

Ammonia Products

In addition to using ammonia as a cleaning product, ammonia can be found in some glass and window cleaners, interior and exterior paints, and in urine (use caution when cleaning litter boxes, diaper pails, or toilet bowls).

Mixing Bleach with Other Cleaning Products

Bleach also reacts with some oven cleaners, hydrogen peroxide, and some insecticides. Pool chemicals frequently contain calcium hypochlorite or sodium hypochlorite and should not be mixed with other cleaning products.

Some Common Household Products to avoid mixing

1. Bleach + vinegar = chlorine gas.

This can lead to coughing, breathing problems, burning and watery eyes.

Chlorine gas and water also combine to make hydrochloric acid.

2. Bleach + ammonia = chloramine.

This can cause shortness of breath and chest pain.

3. Bleach + rubbing alcohol = chloroform.

This is highly toxic.

4. Hydrogen peroxide + vinegar = per acetic/peroxyacetic acid.

This can be highly corrosive.

More Resources

- Product labels usually have a toll-free telephone number that you can call to learn more about the product you have purchased. Most manufacturers also have web sites with product information

- If you or someone you know has been exposed to a chemical mixture and is experiencing symptoms of illness, contact a health care provider or emergency response service (911).

For additional information, contact:

Doug Taylor, CRM, CCPI

Managing Director, Risk Management Group

doug.taylor@suncorpvaluations.com