Picture This Scenario

A fire breaks out at your property and within minutes a major portion of the building and its contents are lost. The fire department responds promptly, but many of the assets not lost to fire are lost to smoke and water damage. Your initial reaction would be to contact your insurance broker. When they report the claim to the insurance company, an adjuster is appointed to handle the claim. The adjuster will ask questions such as; How much is the property worth now in terms of current construction? Without an up-to-date appraisal, you could be scrambling to try to establish replacement costs for your assets and possibly find yourself under insured.

You Are Responsible

In the event of any loss where an insurance claim needs to be processed, the onus is always on you, the insured party, to provide “proof of loss”. An appraisal provides that proof accurately and immediately, when kept up-to-date.

Do You Know The Current Value Of Your Assets?

If you are under-insured and suffer a major loss, this could result in dire consequences. Many property policies contain a co-insurance penalty. Alternatively, if you are over-insured, you are paying for extra insurance you cannot claim. An accredited appraiser can determine the replacement cost of your building and content assets, in accordance with your insurance policy.

Asset values are changing continuously

Inflation can increase the replacement cost of your building;

Certain building systems become obsolete;

Buildings are expanded and renovated;

Imported components (such as HVAC equipment) are subject to foreign exchange fluctuations;

Machinery and other equipment are replaced, sold off, retired, or become obsolete (particularly with Information Technology).

READ: Cost Appraisals vs Value Appraisals – What Are The Main Differences?

What are the Benefits of an Insurance Appraisal Program?

Up-to-date appraisal reports allow for quick loss settlements;

Insurance premiums are based on investigated, not arbitrary, values;

A reputable appraisal company backs what it says with professional liability insurance;

An appraisal avoids any under-insurance penalties.

Did you know?

• Suncorp Valuations has been providing insurance valuations to its clients across the globe since 1960;

• We are the insurance appraisers of choice for some of the largest insurance companies in the world;

• We have expanded our service line to include value added professional services in the areas of loss prevention, including but not limited to playground audits, fleet surveys, custom premises liability and crime surveys.

Imagine you decide to get into the picnic table business as a hobby. You figure you can make a basic picnic table in your garage in about an hour. Using white pine and some tinted exterior sealer would make it look nice. You figure the lumber and material costs from the store are about $50. And with your labor included your total cost is about $75 per table. So then you take your creation to the farmers market to sell. It is springtime, so lots of people are fixing up their yards and you have no problem selling your whole inventory of tables for $150 each. Nice! A couple of months go by and you decide to do it again to make some extra money. However, this time it is late fall and the farmer’s market is quiet. You are only able to sell a couple of tables for only $25 each. What happened? Well, in a way you just learned some of the differences between cost and value. Please read on to better understand what we mean..

“Price is what you pay. Value is what you get.” – Warren Buffet

In our example the cost of the picnic table was constant regardless of the season. However – it’s value fluctuated, mainly due to seasonal changes in demand levels. That is why there are both cost appraisals and there are also value appraisals. They are different. There are also different types of costs and different types of values too.

What kind of appraisal do I need?

To answer that question we need to know what you are using the appraisal for.

Cost Estimate Appraisals

Say you own a commercial building and you want to make sure you have enough building insurance coverage in place. If that building was destroyed somehow, you would hope that the insurance coverage was based on its cost and therefore you need a cost estimate appraisal. A cost estimate appraisal is one of the services that Suncorp specializes in. We do cost estimate appraisals for all building types including multi-family, commercial and industrial structures.

Market Value Appraisals

Say you decide to sell that commercial building, or maybe you are thinking of taking out a mortgage on it. Well in that case you need a value appraisal, specifically a market value appraisal. This is an estimate of what the property will sell for given current market conditions and you want to be sure that you sell it for at least it’s market value. For mortgage purposes, the bank will want to know market value to ensure that the loan-to-value ratio is appropriate. Suncorp has a team of highly qualified appraisers who specialize in this type of work. We do value appraisals for all building types, as well as machinery and equipment too.

Different Types of Cost

There are a variety of different types of cost. Here are 2 common examples;

– Reproduction Cost New (CRN)

An estimate of the cost to construct an exact duplicate of an existing building.

– Replacement Cost New (RCN)

An estimate of the cost to reconstruct a building using modern materials and standards.

Different Types of Value

There are a variety of different types of values too.

– Market Value

As mentioned, market value is an estimate of what a property/asset may sell for.

– Market Rent

An estimate of what a property may rent for.

– Forced Sale Value or Liquidation Value

An estimate of what a property may sell for under distressed conditions such as during a foreclosure or bankruptcy.

There are many factors that affect value that appraisers must consider including competing supply, effective demand levels or trends, exposure and marketing periods, etc. There are many other types of cost and value in addition to these examples. If you are unsure of the type of appraisal service you need, your first call must be to Suncorp Valuations. We have decades of experience with these matters and we are anxious to help you today.

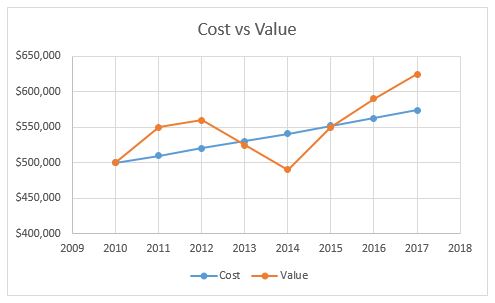

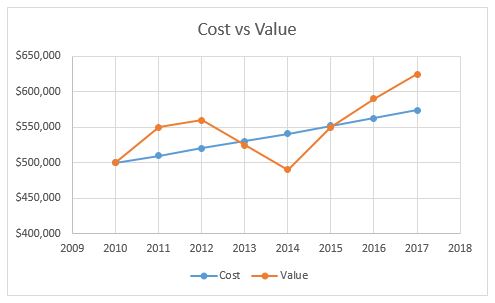

Cost vs. Value Chart

While there may be particular situations where the cost of a particular asset may be equal to its value, this is a rare occurrence. Generally speaking, costs increase steadily over time because of inflation and it is a function of basic material and labor costs. However, although value also tends to increase over time, it is much more volatile and subject to peaks and valleys. This is because value is a function of supply and demand, as well as economic cycles.

About Suncorp Valuations

Suncorp Valuations is a leading provider of independent valuation, appraisal and advisory services. Suncorp’s valuations and appraisals have been relied upon by leading insurance companies, public and private companies, property owners and managers, tax authorities, accounting bodies, courts, municipalities and financial institutions from all over the world.

Our valuation and appraisal staff consist of professionals that are highly accredited in the fields of engineering, real estate and equipment appraisal, business valuation, risk management and loss control. Our multi-disciplinary, multi-regional and multi-lingual staff take an interactive team approach and have been involved in some of the most complex valuation assignments across the globe.

Shops and science labs can be very dangerous places. There are many different dangers such as high heat, dust, machines, flammable liquids/chemicals, excess noise, and more. A high-risk lab could result in an injury or fatality very easily if safety precautions are not taken. The key to reduce risk and liability in such spaces is to be proactive, and a Suncorp Shop & Science Lab Safety Survey is your starting point.

Suncorp Shop & Science Lab Safety Survey Details

A Suncorp Shop and Science Lab Safety Survey touches on many different important points, including the following:

- Analysis of the layout of each Shop and Science Lab to ensure there are adequate clearances around your equipment (delineation lines), and separation of processes involved in these areas.

- An inventory of your major equipment and an analysis of the safety controls in place within each of these facilities.

- A detailed listing and condition assessment of your equipment located in the Shop and Science Labs.

- An inventory with condition notes of all power tools general condition, and notes on any safety concerns/infractions observed.

- An analysis of the general condition of all welders, cutting torches and equipment, grinders, etc.

- An inventory with condition notes of all safety equipment including safety glasses, shields, hearing protection, guards, eye wash stations, etc.

- Analysis of the controls in place within all science labs in the handling and use of chemicals.

- An analysis of chemicals stored and sued within the various Science Labs and controls thereof.

- A review of ventilation, fume hoods and dust control equipment within the various Technology Shops and Science Labs in the schools.

- A review of the safety meetings and instruction to students in place within the School Division or District.

- A general review of the electrical supply and equipment including emergency stop switches, magnetic switches, power cords and outlets (overloading), extension cord use, etc.

- Recommendations regarding how to improve compliance with current codes, provincial standards, CSA standards, NFPA standards, and other relevant regulations.

The Bottom Line on Shops and Science Lab Safety

Shops and science labs are known to be full of danger. It’s important to ensure these areas are as safe as possible. Your Suncorp Shop & Science Lab Safety Survey will provide you with reliable data and recommendations regarding the safety of your operation from our qualified and trained experts. With these tools you can ensure that your shop & science labs will run more efficiently, and will be safer for students and teachers as well. Call Suncorp today to learn more about our Shop & Science Lab Safety survey.