With our continued growth, Suncorp Valuations has been very fortunate to have some of the brightest minds in appraisal and valuation join our team. We are pleased to announce that recently Bharat Kanodia has joined us as Senior Managing Director. Bharat holds a Bachelor of Science in Mechanical Engineering, a Master of Business Administration in International Finance, and the ASA and CVA designations. Bharat has appraised unique assets including the Golden Gate Bridge, Atlanta Airport, Uber, Airbnb, the Brooklyn Bridge, Las Vegas casinos, the ‘I Love New York’ campaign, US national forests, and gold mines.

Bharat was interviewed by the New York Business Journal this past January, where he talked about the values of NYC Landmarks, and how these values are being presented to the public. We are pleased to share that interview to further introduce Bharat to our clients and business partners.

What the Brooklyn Bridge and other NYC Landmarks are Valued at Today.

New York City’s skyline is filled with city-defining landmarks. But with many having been built decades ago, their modern-day valuations are often hidden from the public even though their upkeep is publicly funded.

Bharat Kanodia

Bharat Kanodia

Bharat Kanodia, a valuation expert who has appraised everything from industrial plants to airports to major companies, believes its vital to estimate valuations of such assets in the case of their unexpected destruction by natural disasters or potential for privatization by the entities that own them.

“We know what Tesla’s one share is worth on a second-by-second basis because it’s freely traded in the open market. How come we don’t know what the Brooklyn Bridge is worth second by second in the open market?” Kanodia said. “As taxpayers, we built to create it and we’re paying taxes as we speak to keep it up. Do we not deserve to know?”

Kanodia estimates landmarks’ valuations by comparing them to other similar properties and determining how much it would cost to build the asset from the ground up. He does not account for its historic aspects, rather assessing the cost of replacement not replication.

The Brooklyn Bridge, for example, which opened in 1883 after 14 years of construction that cost $15 million, would be worth an estimated $13 billion to $15 billion today, according to Kanodia.

That includes $200-$300 million for design and planning, $2-$3 billion for site and foundation work, $3-$4 billion for labor, $2 billion for equipment and transportation, $1-$1.5 billion for insurance and administration, and $500 million for other miscellaneous costs and incidentals.

For other properties, he’s estimated the value by determining the cost of the equivalent amount of square footage today. The terminal of Grand Central alone cost $43 million to build in 1913. The entire project cost about $80 million. Today, Kanodia estimates it would cost $10 billion at $5,000 a square foot for 2 million square feet.

Similarly, the approximately 800,000-square-foot 42 Street subway station would cost $2-$2.5 billion. Other New York-owned non real estate assets can also be valued. The “I Love New York” campaign’s valuation can be estimated by calculating its total sales and royalty percentage paid to the state.

“The assets owned by the MTA are two AT&T’s combined and we don’t know what that is worth and that is paid by taxpayers’ money,” Kanodia said. “Do you think there’s a disconnect here?”

Written by Sarah Jones – Reporter for New York Business Journal

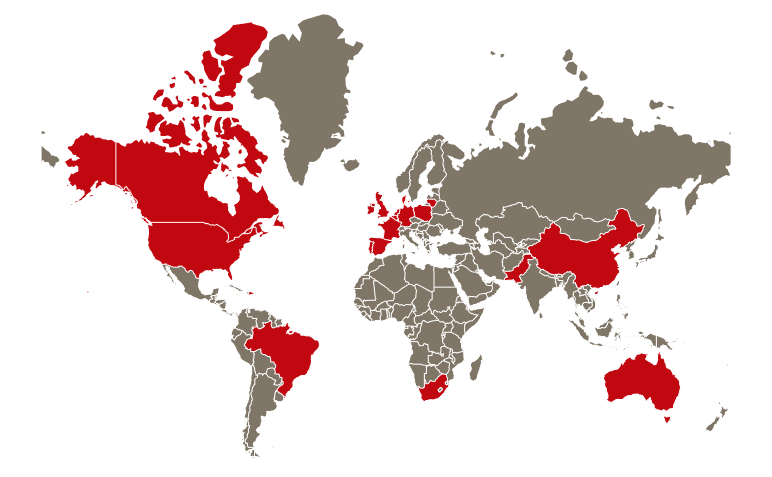

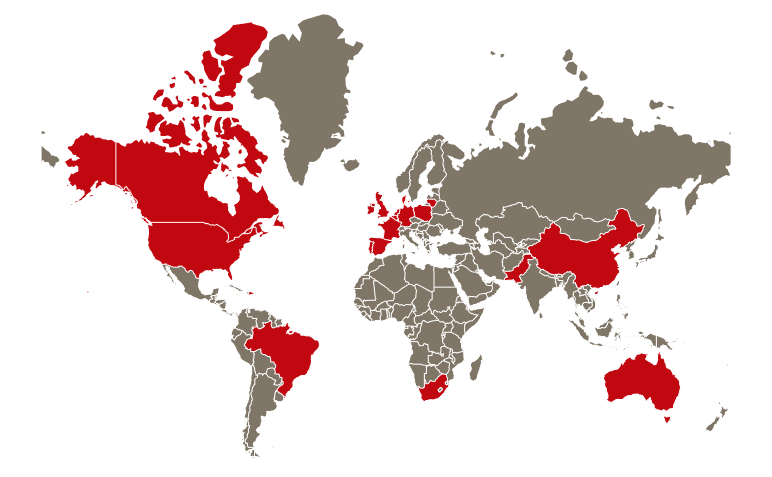

The top 10 losses in 2022, on average, were in excess of $3 billion which far exceeded the average of $1.5 billion in 2021. These losses are based on the financial impact of these natural disasters – not the impact in terms of loss of lives.

Top 10 Natural Disasters in 2022

10. Flooding in South Africa – More than $3 billion

Excessive rain in April caused flooding and landslides in the provinces of KwaZulu-Natal and Eastern Cape. Several thousand homes were damaged or destroyed, as well as much of the major infrastructure.

9. Hurricane Fiona in the Caribbean and Canada – More than $3 billion

Over multiple weeks in September, Hurricane Fiona travelled through the Caribbean, western Atlantic and eastern Canada, reaching Category 4 status. Fiona is the strongest storm to ever impact Canada.

8. Drought in Brazil – More than $4 billion.

An unprecedented drought since 2021 has caused prolonged damages to Brazil’s agricultural, hydropower, shipping and freshwater industries. The Paraná River has reached a record low in its water level; the river that provides freshwater for millions of people in Brazil, Argentina and Paraguay.

7. Storm Eunice in Europe and UK – More than $4.3 billion

In February, a National Severe Weather Warning Service was issued due to this extratropical cyclone. The storm caused a huge amount of damage in parts of Western, Central and Northern Europe.

6. Flooding in Pakistan – More than $5.6 billion

From June to October, Pakistan experienced intense flooding due to a major heat wave that caused both monsoon rainstorms and glacial melting.

5. Flooding in East Australia – More than $7.5 billion

The floods in East Australia from February to April were one of the nation’s worst recorded flood disasters. Almost one thousand schools were closed in response to the flooding and many evacuations took place.

4. Drought in China – More than $8.4 billion

China experienced a record-breaking heatwave for more than 70 days in the summer (reaching over 70 degrees Celsius), causing a major drought that affected about half of China, mostly in the south.

3. Flooding in China – More than $12.3 billion

During the drought in the Southern regions of China, multiple flash floods in August caused much damage in the North.

2. European drought – More than $20 billion

Caused by a similar heat-wave as China, many parts of Europe experienced drought conditions that the Global Drought Observatory confirmed as the worst drought in 500 years.

1. Hurricane Ian in the U.S. and Cuba – More than $100 billion

Hurricane Ian was the third-costliest weather disaster in the world on record, causing damage in western Cuba and the southeast United States.

As losses increased worldwide in 2022 it continues to put pressure on insurance markets and results in increased scrutiny when underwriting risks. It’s prudent therefore for property owners to be proactive in ensuring that their assets are insured to value with accurate valuations.

*Data Source: Christian Aid

Suncorp Valuations is excited to be attending Alberta Municipalities’ 2022 Convention & Trade Show September 21-23.

Come visit Devin Baker at booth #55 – this is a great opportunity to ask about your Municipality’s insurance or asset management!

He is very much looking forward to seeing everyone, in person, at this incredible event!

Suncorp Valuations is delighted to be attending this year’s The Alberta Condominium & Real Estate Conference in Calgary, AB from September 16-17.

Come visit Trystan Hill at booth #110 – this is a great opportunity to ask about your Insurance Appraisal and Reserve Fund Studies.

She is looking forward to seeing everyone, in person, at this amazing event!

Suncorp Valuations is delighted to be attending this year’s International ASA Conference in Tampa, FL! We are a proud Gold Sponsor of this event.

Our President and CEO, Tom Gardiner, will be attending along with some of our senior appraisal staff: Andrea Grant; Chris Parr; Joshua Abbey; Asher Cohen; and Priya Rajkondawar.

Asher Cohen and Joshua Abbey will also delivering a presentation about MTS Appraiser’s Role in completing a Purchase Price Allocation(PPA) Appraisal.

They are all looking forward to seeing everyone, in person, at this fantastic event!

Suncorp Valuations is delighted to be an exhibitor at this year’s Golden Horseshoe Annual Conference on September 16th!

This is a great opportunity to ask us about your condo insurance appraisal and learn more about what we do.

Come visit Vic Persaud and Shilpa Thakur at booth #502. They are looking forward to seeing everyone, in person, at this incredible event!