We are attending the next RIMS Canada Conference, the preeminent convention and trade show for risk insurance managers and Insurance Brokers from Canada.The conference is being held in Edmonton, AB from September 8-11th, 2019.

Event Location & Dates

Address: Shaw Conference Centre – 9797 Jasper Avenue, Edmonton, AB, Canada, T5J 1N9

Dates: Sunday September 8th to Wednesday September 11th, 2019

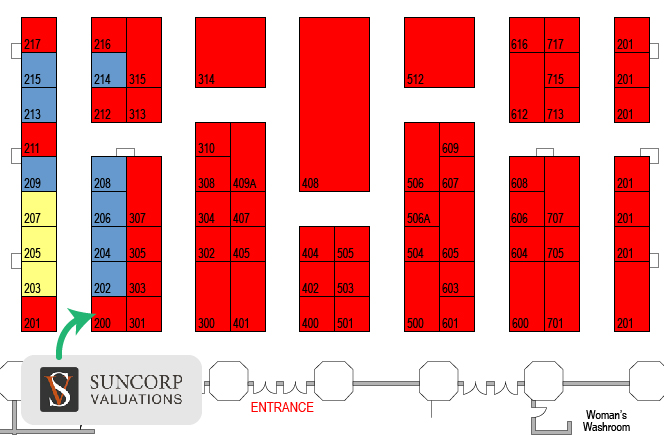

Visit Us At Booth #200

We have a stand booked for booth #200, so come on down to visit us and speak to one of our knowledgeable representatives! Booth #200 is close to the entrances. Just turn left when you walk into the booths area, and you should see our team! See the map below to get a better idea of where you’ll find us.

We Have Prizes!

We are going to do a Plinko style game with prizes! Come have some fun with our reps.

Share On Social

We encourage attendees to share their experience across social media channels! If you do so, feel free to use hashtags like #Appraisers, #ValuationServices, #ExpertTestimony, #FinancialServices, #RiskControl, #LossControl, and #SafetyServices etc. to further your reach to relevant viewers.

Event Organizers Video

Below is a fun video made by the event organizers to give you a better idea of what the conference is all about and why one should attend!

We Hope To See You There!

We hope to see you at the event in September. Remember, come visit us at Booth #200 to speak to any one of our awesome reps. Make sure you participate in our Plinko style game for your chance to win some nice prizes too! We are always here to answer any questions you may have, so feel free to contact us if you need to speak to one of our reps prior to the event.

Contact Suncorp Now

In our last blog post we talked about the importance of understanding your client’s exposure, values, risk management strategies and policy wording – especially when dealing with a hard market in the insurance industry like we are today.

READ: The Property Insurance Market Has Hardened

Challenges Facing Brokers and Clients Is Significant

With Insurance Companies tightening their underwriting requirements, increasing premiums and deductibles, and reducing limits, the challenges facing brokers and their clients is significant. Placing a client’s business – regardless of whether they have had a claim or not – can be a daunting task, and where you might have had 2 or 3 insurance companies on a risk before, today we are seeing upwards of a dozen companies now involved.

Advantages of Comprehensive Risk Assessment Reports

Having a comprehensive Risk Assessment report on your client’s operation is a huge advantage for brokers to successfully market their client’s business to the industry. This third party, arm’s length report provides an objective overview of your client’s operation – the hazards associated in the operation and the controls in place to manage these hazards – so that the underwriter has an excellent picture of the risk, they are preparing to take on.

Understanding Different Types of Clients

While many insurance companies today will categorize clients based on, the type of business they operate, this “broad brush” approach can affect many clients with limited or no loss experience. The residential/condominium market is a good example of an industry that has been hit hard given the high number of losses in this type of occupancy. However, in saying this, not all clients will fall under this category. Understanding what separates these clients from the rest is the message that needs to get across.

Solid Risk Management More Critical Than Ever

The insurance market is still well capitalized, however, insurance companies are becoming more selective to write only good quality risks. Solid risk management strategies are now more than ever a critical component for managing your client’s business. A comprehensive Risk Assessment report will provide you and your client with an invaluable tool to assist in mitigating losses, while at the same time providing you the leverage to differentiate your client’s business from the masses during insurance renewals or placement.

Our Risk Management & Valuation Services

If you have any questions on the various Risk Management and Valuation services we can provide, please contact one of our offices, we would be happy to help.

Contact Suncorp Now

In our February 2019 Industry Insight article, we looked at the insurance industry focusing on building resilience with those insured to be prepared for natural disasters. The underlying premise being that natural disasters will occur; it is no longer an “if”, it is about the when.

In that article, we pointed to the insurance markets hardening to face the pressure of mounting losses. We are now in the midst of a hard property market and the impact on renewals and premiums is certainly felt.

“Characteristics of Soft and Hard Markets.

A strong economic climate, a favorable legal environment and/or few catastrophic events can increase insurers’ capacity, creating a soft insurance market. When the market is soft many insurers are competing for business and premiums are generally low. Insurers relax their underwriting standards and coverage is widely available. Underwriters are generally flexible and willing to negotiate coverage terms. Broad coverage is available with some extensions available for free.

A series of catastrophic events, a litigious legal environment and/or a poor economy can reduce insurers’ capacity to write new policies. The result can be a hard insurance market. A hard insurance market is the opposite of a soft one. When the market hardens, insurers tighten their underwriting standards. Some coverages may be difficult to secure as fewer insurers are competing to write policies. Premiums are relatively high and insurers are disinclined to negotiate terms. Broad coverage may be costly or unavailable but some coverage extensions may be available for an additional premium.” (1)

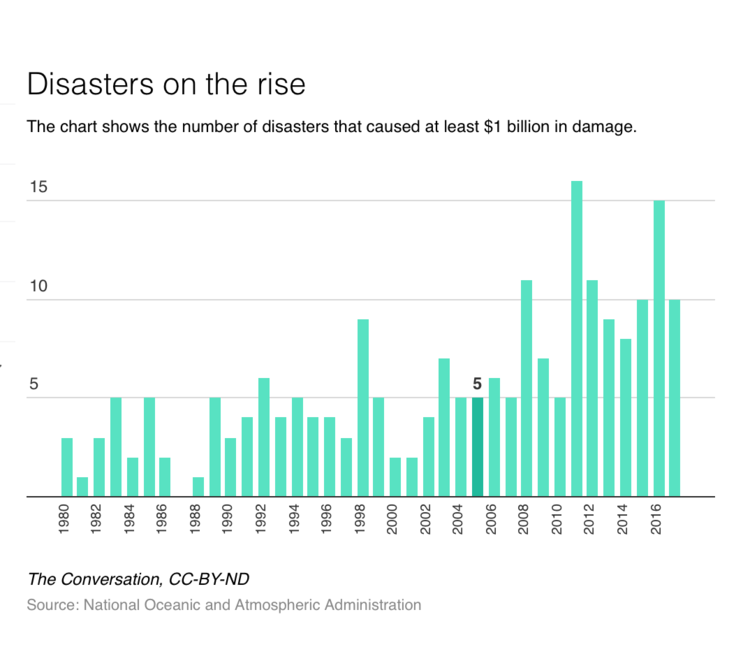

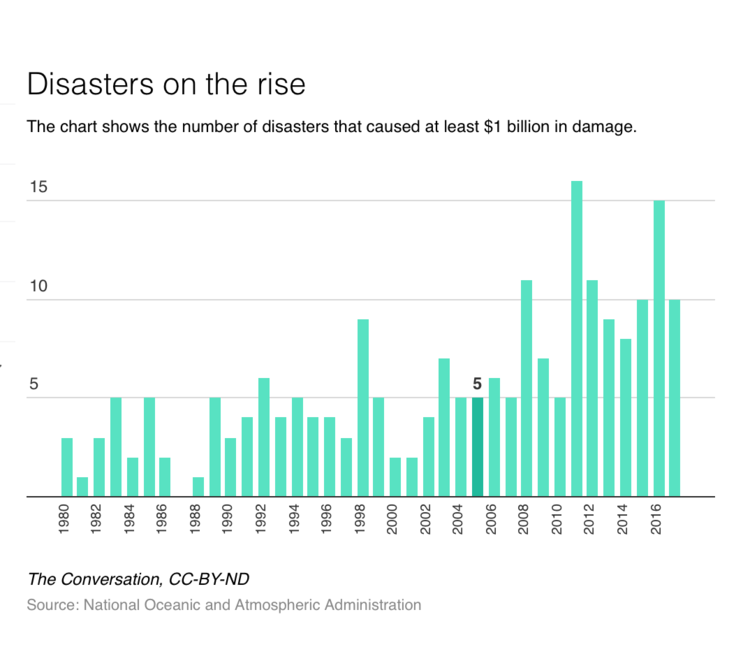

As the chart below depicts, we do have catastrophic events and their costs rising, which are having a direct impact on the insurance market hardening (2).

We are seeing the insurance market acknowledge the hardening of the property market and what that means for insureds, brokers, and property managers in property markets.

“At the end of 2018, the property market had begun to see some firming, and that continued into Q1 of 2019. As we move into Q2, this trend has not just continued; it has accelerated.”

“The message for retailers is that things are changing in property more quickly than expected, and the changes are deeper than anticipated,” says Harry Tucker, Executive Vice President and National Property Practice Leader for AmWINS.

Adverse loss development has been a catalyst in this acceleration. Two consecutive years with combined ratios exceeding 100% across the market has heightened the focus of management teams and underwriters to drive rate and reduce aggregate exposure. Increasing rates are creating a deeper and broader change in the market. The obvious tough classes – including frame habitational, recyclers, and open lot – were the first to be affected, but now the trend has crept into broader classes and non-CAT exposed business.

“Along with rate increases, we are seeing more tightened risk selection, reductions in limits, increased deductibles, and close review of policy forms,” says Tucker.

However, the bright spot for clients is that the market is still well capitalized. “Carriers still want to write premium,” says Tucker. “The difference today is that they are applying a level of underwriting discipline we haven’t seen in quite some time.”(3)

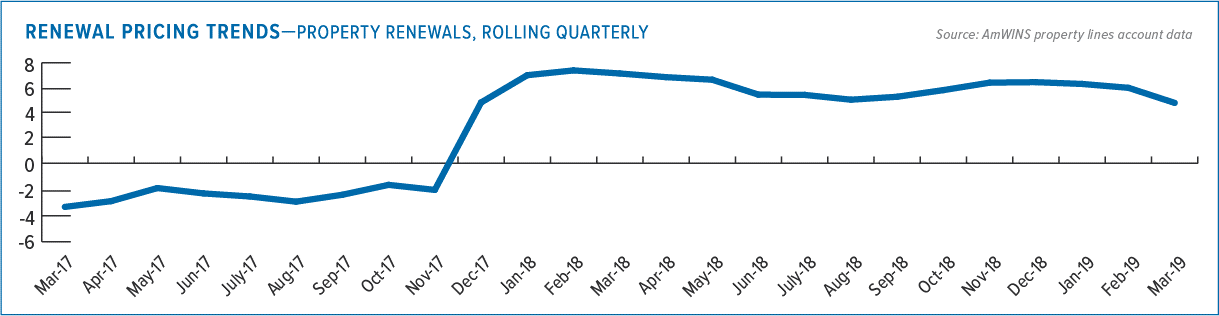

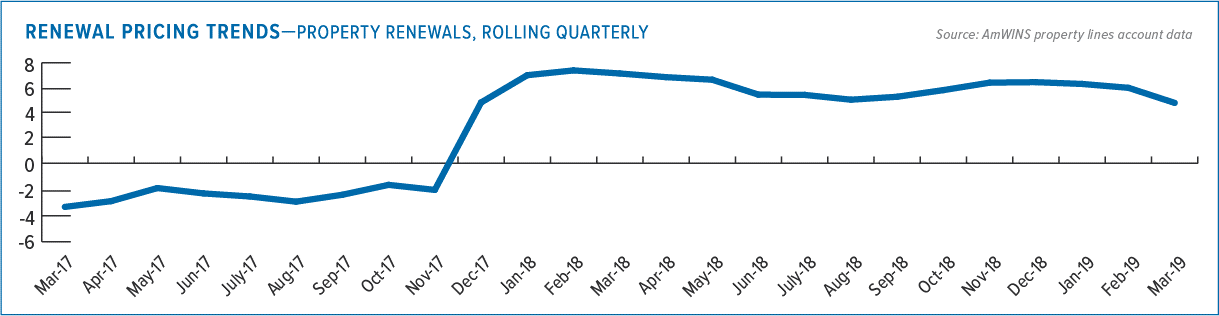

The below graph graphically depicts the pricing trends in property renewals (4):

As property owners and/or tenants, brokers, and property managers, we would encourage you to look at your insurance program against the backdrop of the increase in natural disasters driven by climate change and the changes to occurring as underwriters are dealing with these variables as they develop insurance premiums. You need to understand your exposure, your values, your risk management strategies and your policy wordings. Being forewarned, will assist you exponentially in the event of a loss.

Discuss Property Appraisal w/ one of our Pros!