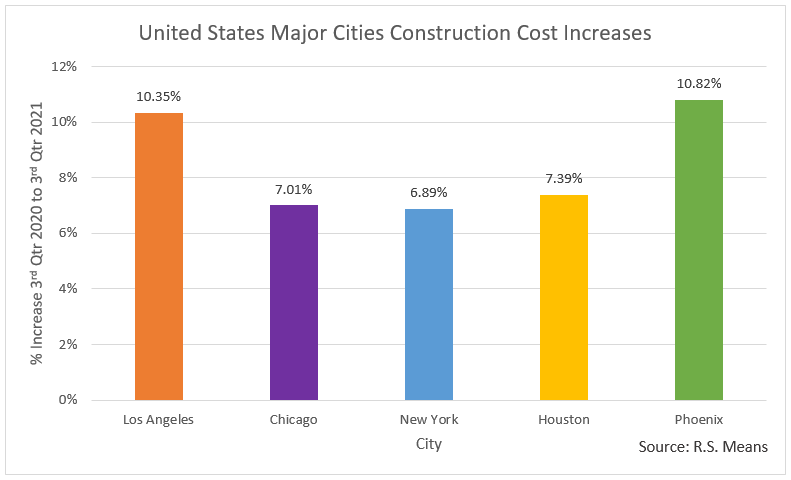

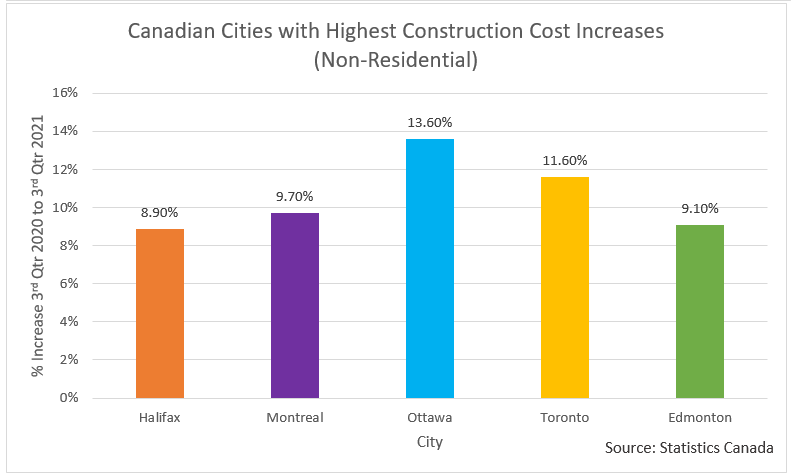

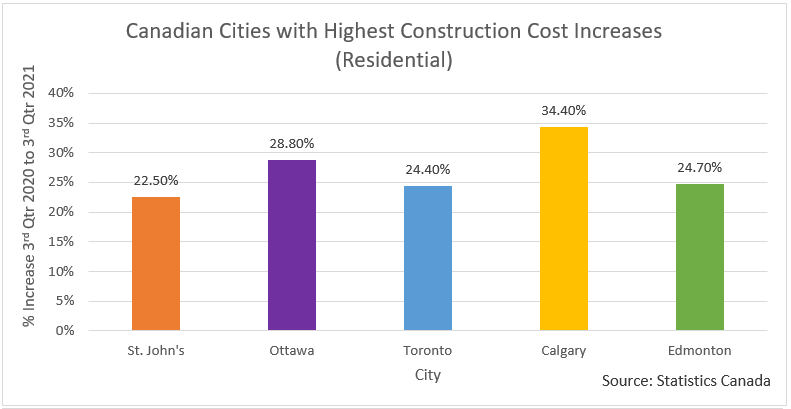

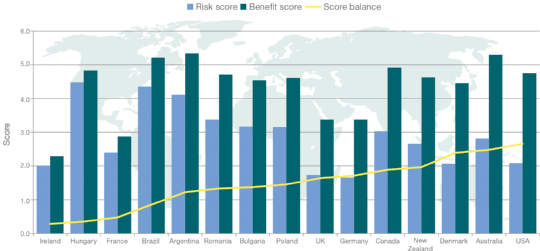

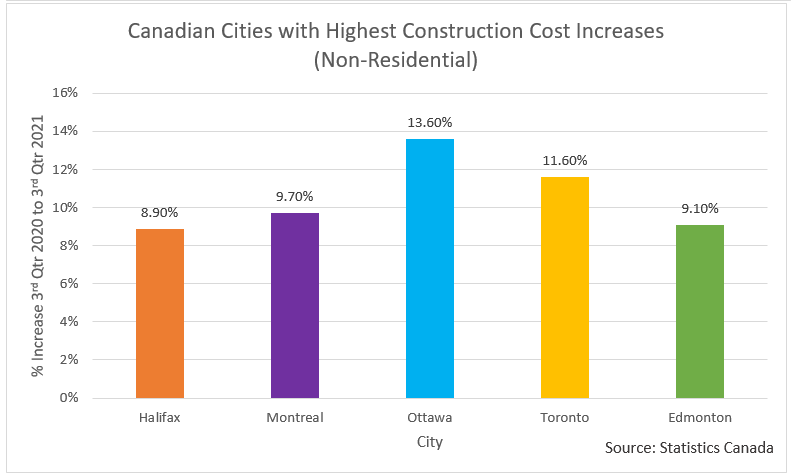

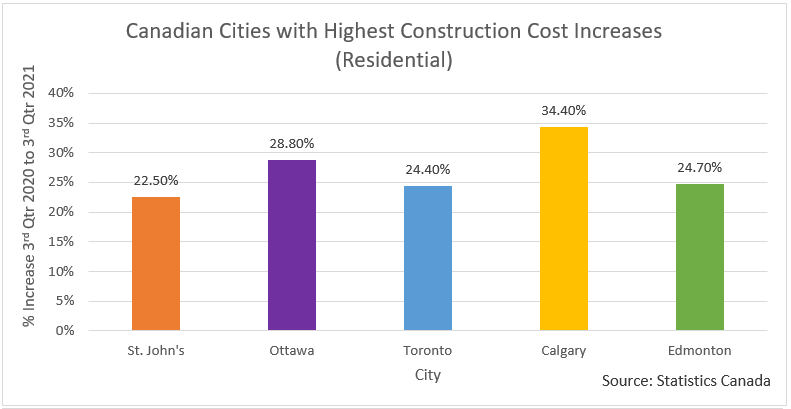

The last few years have been far from normal due to the pandemic. Construction costs have been one item that has seen a dramatic increase. This is a result of a sharp increase in demand for building materials combined with supply chains struggling to keep up. In addition, a booming construction industry has resulted in higher labour costs due to a shortage of skilled workers. Together, these factors have had a significant impact on construction costs as illustrated below.

So what does this mean? The consensus is that costs are up across all industries. The extent of the increases are dependent on:

1) Construction Cost Source (Statistics Canada, R.S. Means, Marshall & Swift, etc.)

2) Industry Sector (Residential, Commercial, Industrial, etc.)

3) Construction Type (Wood Frame, Steel, Concrete, etc.)

4) Geographic Location

5) Asset Type (Buildings, Machinery and Equipment, Mobile Equipment, etc.)

To gain a better understanding of these increases and their impact on your insurable values contact us at https://suncorpvaluations.com/contact-us/

What do you specialize in and what are the best circumstances that clients/prospects should come to you for help?

I have been involved with marketing, project management and completion of engagements for purchase price allocation, asset based lending, insurance placement and proof of loss. Currently, I manage the Business Development activities for our US operations out of our US Head office in Milwaukee. I can be reached for any valuation needs to provide a no obligation proposal for service.

You have appraised buildings all over the North America? What buildings stand out?

I have worked on valuation engagements for 2 of the largest shopping malls in the world in Minnesota, USA and Alberta, Canada. As well as a retail/entertainment complex in New Jersey, USA that features an indoor ski hill. I have also appraised full racetrack/pari-mutuel operations in Ontario, Canada and high profile office towers in New York City, New York, USA. My most marquee assignment was appraisal of a major shipping channel in Central America.

What do you enjoy doing when you’re not working?

Biking, hiking and kayaking.

How many years have you been in the Industry?

22 years

How many years have you been with Suncorp?

13 years!

Agricultural land value trends continue to rise.

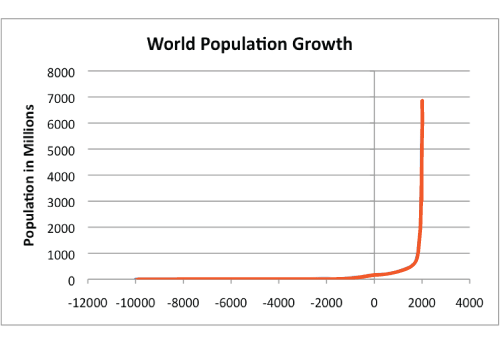

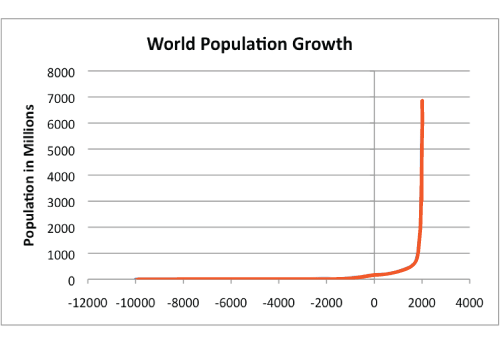

We last provided a blog on agricultural land values in March 2019, and are pleased to provide an up-date to that blog. As the graph below illustrates the world population has increased dramatically since the Industrial Revolution, circa 1800. (1) The world population growth coincides with access to energy, which led to innovation in creating and managing food supply.

The world population growth coincides with access to energy, which led to innovation in creating and managing food supply.

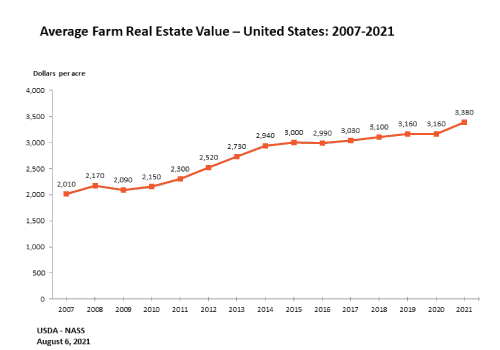

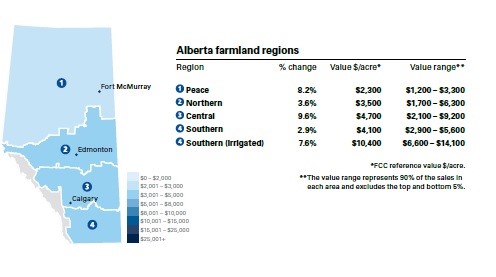

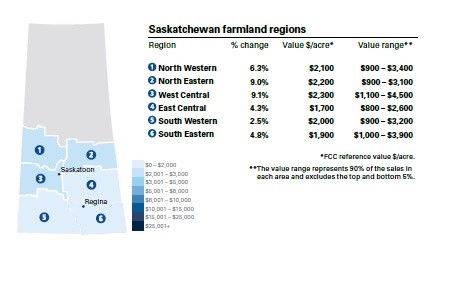

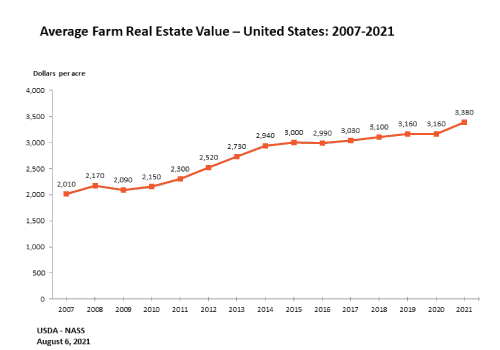

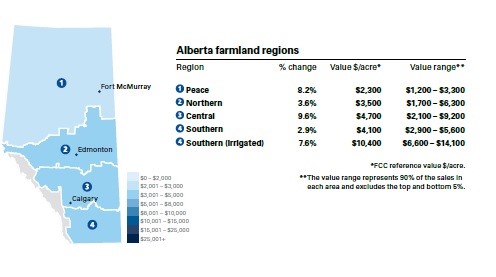

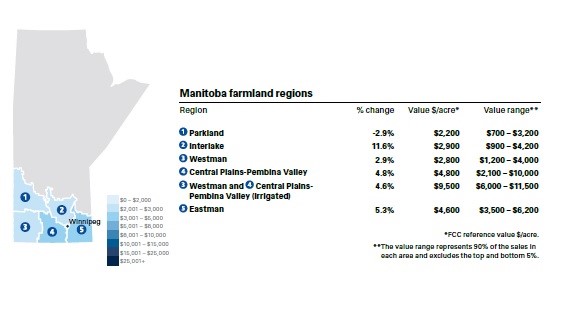

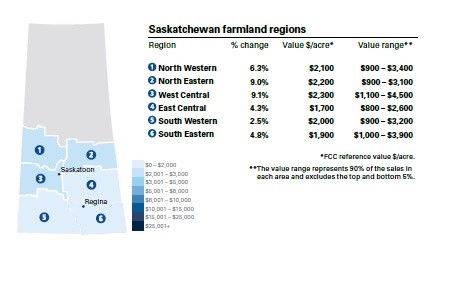

As a full service appraisal firm with offices across North America and completing engagements worldwide, we are often called to assist firms with the valuation of facilities involved in food processing. As many of our clients have grown their facility footprint, we have seen dramatic jumps in the value of agricultural land that provide the inputs for their processing. As the graph below depicts, agricultural land is at premium in certain regions. (2)

Combine the population growth with the effects of climate change and it is easy to see the trend for agricultural land values across the globe has risen and we assert will continue to rise.

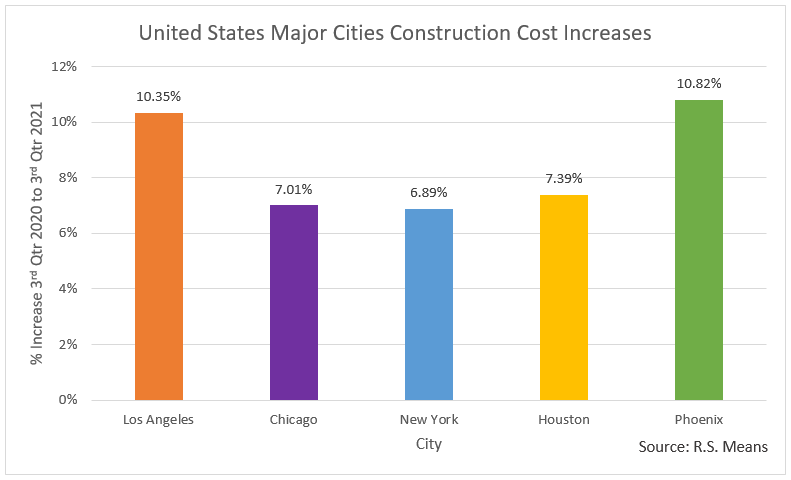

Europe continues to lead the pace of growth in agricultural land values.

The Netherlands is the country with the highest agricultural land prices in Europe, with an average price of €69,632/ha in 2019. Prices in Eastern European countries are lower: €3,395/ha in Croatia, €3,361/ha in Estonia, €3,922/ha in Latvia. Conversely, land is expensive in Italy, at an average of €34 156/ha, and in Ireland, at €28 068/ha. (3)

In 2019, the exchange rate for Euros to US Dollars was 1 to 1.12; accordingly, 70,000 Euros (the benchmark price per hectare in the Netherlands) converted to $78,400 US Dollars. Converting hectares to acres at 1 to 2.5 meant that the land agricultural land value in the Netherlands was $31,360 US Dollars per acre.

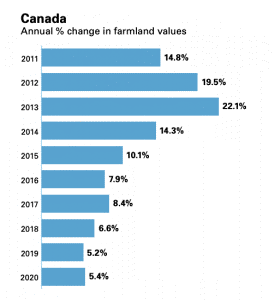

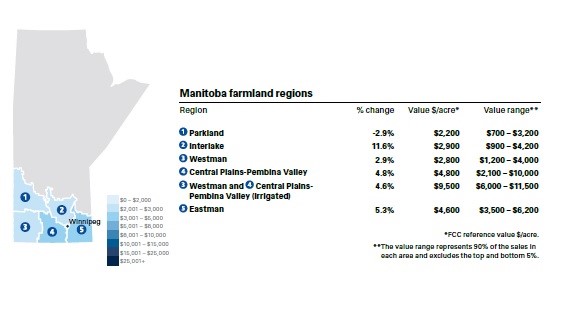

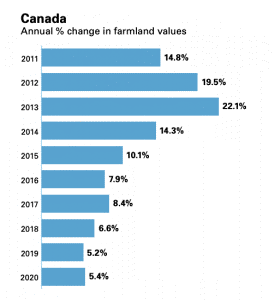

In the United States and Canada, we see the escalation in agricultural land values as well. For 2021, the United States Department of Agriculture shows the benchmark value across the country at $3,380 per acre, up from $3,160 per acre in 2020. (4) In Canada, percentage growth rates for agricultural land continues to grow. The Prairie Provinces have exhibited rise in benchmark values for the last several years. (5)

In Canada, percentage growth rates for agricultural land continues to grow. The Prairie Provinces have exhibited rise in benchmark values for the last several years. (5)

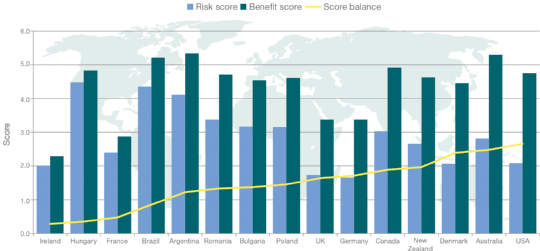

Given the trend of rising agricultural values, it is interesting to measure the risk of land ownership; this graph illustrates the security of owning land in various countries as developed by Savills Research. They leveraged various reports and data sources to the lay the foundations of the matrix. Savills Research from 2002 to 2016 highlighted the strong and steady rise in the value of farmland globally. (6)

We assert that world agricultural land values will continue to rise in the next 3 to 5 years, in particular in those countries where an adequate risk/benefit score can be achieved, such as shown by the above graph.

REFERENCES:

What do you specialize in and what are the best circumstances that clients/prospects should come to you for help?

I specialize in insurance appraisals for private sector building construction including multifamily residential, commercial, industrial and bare land/ common element properties. Clients should come to me if they need to know how much it would cost to replace their building if anything was to happen to it in order to make sure they have adequate insurance coverage.

Please describe an interesting project you worked on recently.

I recently completed an insurance appraisal for a 1.2 million square foot shopping mall with 200 retailers and an 1100 seat food court in Tsawwassen.

You have appraised buildings all over the North America? What buildings stand out?

A marquee New York office tower, a brand name hotel in Las Vegas Nevada, and a marquee office building in midtown Montreal, QC.

What do you enjoy doing when you’re not working?

I enjoy gardening, paddle boarding, hiking and going out quadding and snowmobiling with my family; really anything outdoors, and I love travelling.

What’s your guilty pleasure?

Shoe Shopping

How many years have you been in the Industry?

I started with Suncorp in 2002, took a break at home to raise my kids while they were small and have been back for 7 years.

The real estate business, by its nature, is complex and therefore ripe for misunderstanding and disagreement. When there is a dispute, the parties have a choice. They can go through the public courts which are expensive, time consuming, rigid, and offers no privacy. Or they can engage the services of a qualified and skilled Real Estate Arbitrator.

POP QUIZ: You are a busy business owner. You are ten years into a 20 year lease for the building that your business operates out of. The lease has a clause that the rental rate renews at “Market Rent” every five years. It is renewal time. Your landlords’ appraiser says that your rent is to go from $15,000/month, to $21,000/month plus all occupancy and common area costs, for the next five years. But your appraiser says that Current Market Rent is actually only $17,000/month plus utilities. What do you do?

WHAT ARE THE BENEFITS OF ARBITRATION?

Arbitration is a private dispute resolution service. Compared to the public courts, arbitration has five significant advantages including speed, cost, privacy, flexibility, and expertise.

- Faster: Disputes going through the public court system can often take many years. The courts are a public institution that typically has a backlog of cases with long wait times. An arbitration on the other hand is much faster, often completed within a few months. That is important, because time is money.

- Cheaper: Arbitrations are very cost effective as compared to the expense of a public trial which may often cost in the tens to hundreds of thousands of dollars. The cost of a particular arbitration depends on the scope and complexity of the issues, however it is often a fraction of the cost of a court action.

- Private: The privacy advantage of an arbitration is often very attractive to many parties especially when the nature of the dispute is sensitive, or some evidence is confidential or proprietary. The arbitrator is bound by confidentiality and ethics rules to not disclose any details of the dispute, or even that there is a dispute.

- Flexible: The public courts have rigid procedures including the rules of court and the rules of evidence. The procedures for an arbitration however can be custom designed for the particular nature of each dispute. For example, for some disputes a fast track “documents only” arbitration may be appropriate.

- Expertise: In the public court system judges are assigned at random. However, with an arbitration the parties choose the decision maker. Parties often engage a qualified arbitrator (Q.Arb or C.Arb) that also has additional specialized qualifications, such as an professional appraiser (AACI or CRA) to arbitrate real estate disputes.

ENFORCEABILITY

Arbitration awards are enforceable. Provided that all procedures were correctly followed by the arbitrator an arbitration award is often legally enforceable by the courts, very much like a judgement.

POP QUIZ: You are an investor and you have hired a general contractor to build an apartment building for you. Your payments to the general contractor are due at certain stages of completion. The contract says that “a payment of $175,000 is due once the project reaches 25% complete.” The general contractor says they are at 26% and they want their money now. You say no, it is at 15% because it isn’t correct to include the delivered but uninstalled material in the percent complete calculation. Construction has stopped until this dispute is settled. What do you do?

WHAT KIND OF REAL ESTATE DISPUTES CAN BE ARBITRATED?

A Real Estate Arbitrator can help with just about any type of real estate dispute, such as:

- Lease disputes including interpretation of clauses, rental rate renewals and terms, common area expense allocations, etc.

- Disputes regarding the interpretation and enforcement of condo/strata rules and regulations.

- Disputes involving market value, market rent, or other types of value or cost estimates.

- Issues relating to the allocation of value or cost, such as during creation or dissolution of partnership agreements or other types or shared equity arrangements.

- Disputes relating to tangible or intangible real estate or property damages and claims.

- Family disputes over the shared ownership of assets such as cottages, farmland, or revenue properties.

HOW DO I GET STARTED?

If all parties to the dispute are open to arbitration then the first step is to engage a qualified and skilled Real Estate Arbitrator. A professional with the Q.Arb or C.Arb designation is trained and qualified in all aspects of arbitration services.

It is recommended that your Real Estate Arbitrator also has expertise in the real estate industry. For example, a qualified real estate appraiser (AACI or CRA) has in-depth training and years of experience in all types of real property valuation issues, as well as expertise in a wide variety of real estate consulting and advisory services. AACI’s and CRA’s are bound by very strict ethical standards which ensure objectivity and confidentiality.

Once you have engaged a qualified and skilled Real Estate Arbitrator the next step is for the parties and the arbitrator to develop an Arbitration Agreement which establishes the scope, jurisdiction, and procedures for the arbitration.

POP QUIZ: You are a tenant in a condo/strata strip mall. Your unit is open storage space only, and all the other units are fully developed offices. The leases say each tenant must pay “…a proportionate share of the total property tax…” You think “proportionate” means that the tax bill is divided up based on the assessed value of each unit, and on that basis your share of the tax bill is $3,500/year. However your landlord and all the other tenants say no, the total tax bill is divided up equally based on occupied square feet, and on that basis your share of the tax bill is $7,500/year. What do you do?

About Suncorp Valuations

Real estate disputes are often very complex and can involve a lot of money. Do you have the time and patience to wind your way through the public courts for all to see? Or would you be better served to engage the services of an objective, qualified and skilled Real Estate Arbitrator from Suncorp Valuations that has expertise in the real estate industry and speaks your language?

Suncorp Valuations is a leading provider of independent valuation, appraisal, and advisory services. Suncorp’s valuations and appraisals have been relied upon by leading insurance companies, public and private companies, property owners and managers, tax authorities, accounting bodies, courts, municipalities and financial institutions from all over the world.

Our valuation and appraisal staff consist of professionals that are highly accredited in the fields of engineering, real estate and equipment appraisal, business valuation, risk management and loss control. Our multi-disciplinary, multi-regional and multilingual staff take an interactive team approach and have been involved in some of the most complex valuation assignments across the globe.

For questions or comments, or to be added or removed from this distribution list please Contact Us.

The insurance industry is well known for its cyclical nature of “soft” and “hard” markets. Anyone in the industry, including brokers and insurers are very familiar with the “soft” and “hard” market terminology and the very different business environments they create. They experience “firsthand” the daily impact of these market cycles on all their lines of business and service offerings. In contrast, few people outside the industry are familiar with these terms, although most individuals as well as commercial and public entities are long-time consumers of many insurance services and are financially impacted by these insurance market cycles. It is therefore important to have a clear understanding of these concepts and how it impacts individuals or business entities, so they can better navigate through the challenging times of a “hard market”, minimizing its financial impact.

Soft Market versus Hard Market

Insurance markets are impacted by national and international financial conditions, and other global events. These include the general state of the economy, interest rates, stock market performance, natural catastrophic events, conflicts between countries, terrorists’ events, evolving cyber risks, and claim activity resulting from these events.

More precisely, a “soft market” is usually a result of:

- Stable, positive economic conditions;

- High interest rates;

- Less property claims activity;

- Insurers having the adequate capital to insure.

Stable economic conditions, translates into more potential clients for insurers, since most businesses, and individuals are doing well and have the financial ability to pay for appropriate insurance coverages. When interest rates are high, the insurers’ investments are also doing well. Lastly, if claim activity is as expected or lower, and the average claim costs are lower, this also has a positive impact on their financial position. Simply put, the culmination of these factors, results in insurers being well capitalized, giving them the capacity to underwrite a larger amount of insurance throughout most of their business lines. This also means there is greater competition among insurers for business, translating into lower premiums rates and more favourable terms for the insureds.

In contrast, a “hard market” is typically a result of:

- Unstable economic conditions;

- Low interest rates;

- Catastrophic events and high property claims;

- Negative global events (i.e., climate change, pandemics, trade wars, civil unrest, etc.).

During poor economic times, businesses and individuals are not doing as well, diminishing their ability to pay for various insurance coverages. Lower interest rates also mean insurers are making less money on investments. This unfavourable financial performance is compounded if they are experiencing high property claims, especially if the average claim amounts are larger than expected. These negative factors result in the insurers having a lower capacity to underwrite insurance in most of their business lines. Since they do not want to take on any high-risk coverages during these times, they become very selective on what risks they insure, charge higher rates, and impose much stricter terms and reduced coverages. They are also much less inclined to negotiate the terms of the policy.

The Current Hard Market and How We Got Here

The state of the insurance market had been “soft” for 15 years, until Q3 of 2020. We then had a convergence of events and factors that rapidly changed the landscape of the insurance market. There has been an increase in the severity of losses, further evidence of accelerated climate change and the impact of Covid on the global economy. Because of these events and the resulting costly claims, we are now well entrenched in a “hard insurance” market, with insurers having little appetite to take on risky policies. North American commercial insurance prices are experiencing significant premium increases for most lines of business.

What Can Businesses do to Mitigate the Impact of a Hard Insurance Market

There are several things that businesses can do to lessen the financial impact of placing insurance, in a hard market:

- Review your Policy

Consult with your broker(s) to review and understand coverages. Property inclusions and exclusions should be carefully considered, along with the premises of the insured values. Redundancies should be eliminated, and any inadvertent property omissions added to the policy.

- Implement Best Risk Management Practices

Implementation of a comprehensive risk management policy is a prudent step in decreasing the chance of a loss. This will also put a business or public entity in a much better position to be viewed as a “better risk” by insurers, making it easier to place a policy at better premium rates and more flexible terms. Two components of a sound risk management strategy include having your property appraised by a qualified appraiser and developing and implementing a loss control program that can include risk inspections with recommendations and follow-up (to ensure recommendations are being executed).

- Assist your Broker(s) in Making a Better Submission

Currently, insurers are being inundated with submissions from potential clients having a difficult time placing a policy. Naturally, underwriters will select submissions that have the most complete information and tell a positive story about the client seeking coverages. It is important these submissions from the brokers highlight the risk-mitigating practices that have been adopted by their client and the positive loss history that has ensued. A current insurance appraisal and loss control report will significantly augment the submission and assist in differentiating the client from others in their industry.

- Practice More Frequent and Better Communication with your Broker

The renewal frequency may be annual; however, property and economic changes are always ongoing. So, it is useful to have periodic communication with your broker(s), especially when circumstances have significantly changed since the renewal date. These changes need to be communicated so the broker(s) and insurers have up to date information. For clients that had insurance appraisals completed, property changes are best captured in an insurance appraisal update, that can be provided to your brokers.

Why are Insurance Appraisals and Loss Control Reporting of Property Viewed so Favourably by Underwriters?

We have discussed the importance of providing brokers and insurers current insurance appraisals and loss control reports. Why are these reports (appraisal and loss control) viewed as a very important part of the submission? As a background, post-loss analysis of recent years indicates that over 60% of commercial businesses’ property are under-insured. An accurate insurance appraisal and loss control reporting completed by qualified/experienced personnel, will eliminate this risk of under-insurance, and assist to mitigate a loss before it happens. To understand the benefits to insurers, it is helpful to look at the appraisal and loss control process and the information provided within the reports. As part of the appraisal process, the property is inspected, photos are taken, and principal assets are detailed in the appraisal report, providing underwriters granular documentation of the insured property. For loss control reporting, the property is also inspected for hazards and risks that pose potential losses. Once these are identified, recommendations are made to reduce the risks, keeping with applicable standards (ex. National Fire Protection Association. This level of detail is very helpful in quantifying not only a total loss, but also a partial loss. Combining appraisal and loss control service such as Construction, Occupancy, Property Exposure (COPE) reporting can be very useful to brokers and insurers for insurance placement, however, can also be very beneficial in the unfortunate scenario of a loss.

Finding the Right Firm for your Insurance Appraisal and Loss Control Needs

As a commercial business or a public entity in this “hard market” you should discuss with your broker(s) and jointly decide whether a current insurance appraisal and or loss control reporting for your property will be useful to assist with placement of the policy with potential underwriters. If you decide to proceed with these services, how do you go about selecting a service provider that is best for your needs? Many initial considerations must be made, including the type of property to be insured and the skill sets that will be required. Specific industries such as power generation, forestry, mining, high-tech manufacturing, metal working facilities, food, and beverages, require intimate knowledge of the assets of these industries to complete an accurate appraisal and/or perform loss control inspection and reporting.

A good place to start your service provider selection process is to consult with your broker. Since they have many clients, it is likely they are very familiar with appraisal and loss control firms that perform services similar to your requirements. Secondly, contacts in companies that are engaged in similar services to your business may be able to provide referrals to reputable appraisal and loss control firms. Once you identify the firm(s) that may be able to assist, you should make the following assessment:

- Does the firm have a good market reputation? Can they provide a list of previous clients served in your industry, including recent references?

- Does the firm carry Errors and Omissions insurance for the clients’ additional protection?

- Does the firm have appropriate credentials in cost estimating and/or loss control, providing assurance of the technical knowledge required to complete the service accurately. For example, relevant accreditations include Accredited Senior Appraiser (“ASA”) designation from the American Society of Appraisers; Accredited Appraiser Canadian institute (“AACI”) from the Appraisal Institute of Canada; Canadian Certified Playground Inspector (“CCPI”) from the Canadian Playground Safety Institute; Associate in Risk Management (“ARM”) from the Risk Management Society.

- Who would be the personnel assigned to the project? Do they have the relevant educational background and technical skill sets in appraising or completing loss control inspections for the buildings and machinery and equipment?

- Will the appraisal include a site inspection, and documentation of the insurable assets to enable a current cost estimate, versus relying on indexing of historical costs from property records?

- Will the loss control report include a site inspection, documentation of observed risks and hazards with appropriate recommendations to mitigate loss?

- What type of report(s) will be provided? (It is not unreasonable to request a sample report of the deliverables and share it with your broker to ensure it meets their requirements).

Conclusion

Insurance appraisals and loss control reporting are always a key component of an entity’s risk management strategy. This is especially so in this current hard market, as insurers are much more selective as to which properties they underwrite. Further, with the current higher insurance rates, reporting of overstated values will translate into even larger premium overpayments. An accurate insurance appraisal and loss control report completed by an accredited, experienced, reputable firm, is your best option to assist with placement of insurance in this hard market.

For Assistance in this Hard Market, Call Suncorp Today.