Suncorp Valuations is excited to be attending the Alberta Municipalities’ 2023 Convention & Trade Show which will take place from September 27 – 29 at the Edmonton Convention Centre.

Come visit our Business Development Manager, Devin Baker, and Manager of Risk Management, Shamair Turner, as they will be there to answer any of your appraisal and risk management questions or discuss the many other services we can provide.

Suncorp Valuations is excited to be an exhibitor at this year’s RIMS Canada Conference 2023 from September 11-14! The RIMS Canada Conference is the second largest annual risk management conference in the world, and we are so honored to be a part of it.

Come visit Devin Baker and Vic Persaud at booth #609. We will have an incredible draw prize – enter to win a $500 Gift Card to Costco!

We very much look forward to seeing you all, in person, at this spectacular event!

In a rapidly evolving industry where growth and success often come hand in hand with unique challenges, Suncorp Valuations has emerged as a leader. With an unwavering commitment to delivering credible, professional, and timely reports the company’s journey has not been without its share of obstacles.

In an exclusive interview with ASA Newsroom, the American Society of Appraisers had the privilege of sitting down with Tom Gardiner, ASA, MRICS, the President & CEO of Suncorp Valuations. Tom shared valuable insights into the company’s continued expansion, its achievements, and the specific challenges encountered in recruiting best in class appraisers and support staff.

Continued Growth Drives New Opportunities for Appraisers

How one firm’s success leads to a recruitment challenge.

ASA: It is great to see your firm experiencing continued growth. Can you tell us more about your success?

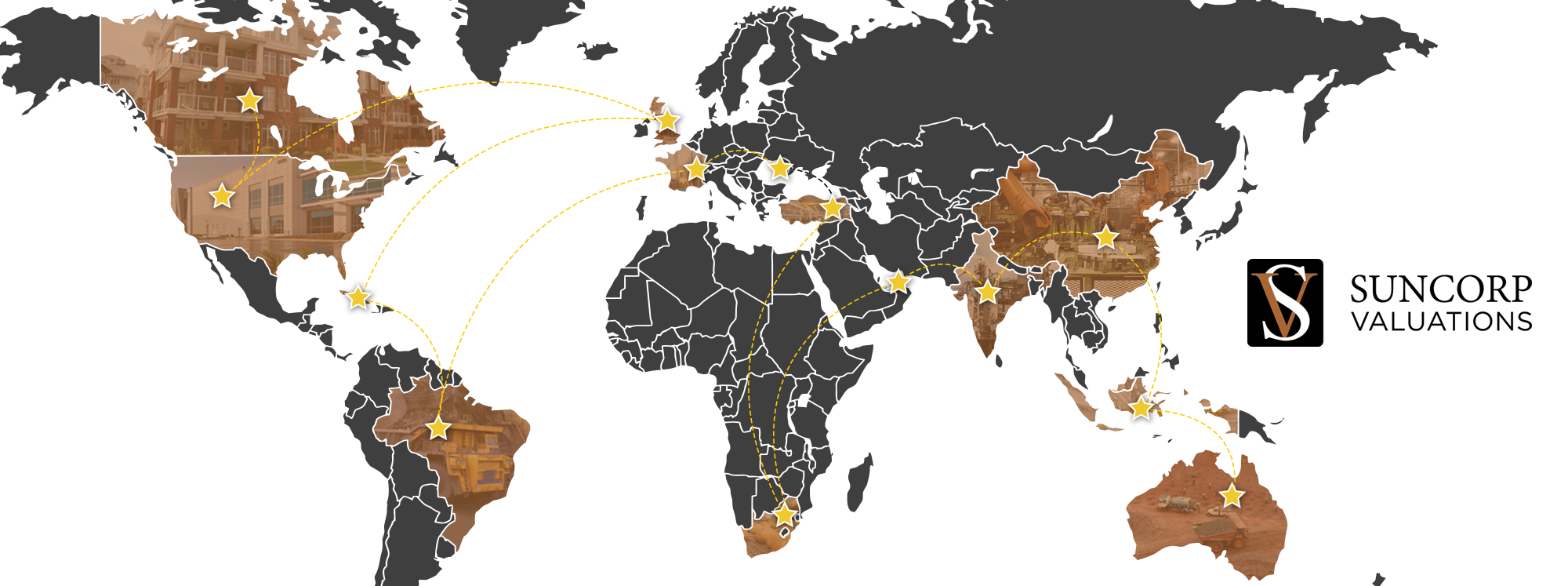

Gardiner: Suncorp Valuations has become one of the largest independent valuation firms in North America since our launch in 1984. Since that time, our firm is often called upon by fortune one hundred companies to perform valuations of complex mining, refining, and chemical processing facilities throughout North America and as far away as Dubai, South Africa, and India. We have grown to set the North American standard in condominium appraisal and are one of the world’s most experienced appraiser of churches and other religious properties. Suncorp Valuations has also diversified its service offerings to include risk management services which provide risk control solutions to our client base in conjunction with our valuation offerings. Our firm routinely values entire municipalities, including their road and sewer infrastructure, water & wastewater treatment facilities, recreation complexes, and we have become one of the largest providers of school safety audits in Canada.

ASA: What core firm values have been key factors in meeting your clients’ needs?

Gardiner: Our business is value. We make it a point to fully understand the needs of our clients, and because of our experience we know what can go wrong and therefore we help them manage their risks and avoid future losses, as a result. We are experts at helping them manage and determine ongoing value. Simply put, we provide our clients with appraisal and valuation services that determine their assets worth and risk management services that help them mitigate potential future losses and keep track of everything that they own, along with its value over time.

ASA: How is your success leading to a recruitment challenge?

Gardiner: Demand for qualified appraisers has never been greater. The ability to work at a high-level, deliver on-time, credible, professionally presented reports for clients, help write legislation, sit on advisory councils, and testify as certified expert witnesses are critical skills needed today. Finding and/or developing such professionals is difficult, especially now due to the retirement of experienced senior appraisers and a growing gap in new candidates entering the profession.

ASA: What solutions are you employing to address recruitment/development?

Gardiner: We have taken deliberate steps to recruit and develop valuers, the principle of which has been partnering with leading valuation professional organizations like ASA. This past year we participated as a Gold Sponsor at the Society’s 85th Annual International Conference in Tampa, which included our team members being onsite delivering a technical presentation and meeting with attendees at our booth. We have recently contracted with ASA to repeat the Gold Level sponsorship at the annual International Valuation Conference along with a Presenting Sponsor at the annual ASA Equipment Valuation conference over the course of the next five years, commencing this year. Additionally, we are running a recruitment themed banner advertisement in ASA’s Machinery and Technical Specialties monthly e-newsletter. Partnering with ASA is important to us due to our shared values and commitment to professionalism and the profession. ASA’s long-standing reputation and international recognition helps to better position us in front of the profession’s best and brightest.

ASA: How can appraisers pursue new opportunities at Suncorp Valuations?

Gardiner: Individuals are welcomed to visit the careers page on our website at https://can63.dayforcehcm.com/CandidatePortal/en-US/suncorpvaluations, call us at 1-800-764-4454 or email me directly at tom.a.gardiner@suncorpvaluations.com, as I would be pleased to meet with them to discuss our firm’s goals and objectives and outline how those goals and objectives can help them meet their professional growth plans within the valuation profession. New recruits can also view our recruitment video “Why Choose Suncorp“.

You can view the original article and more by the ASA Newsroom here: https://www.appraisersnewsroom.org

With our continued growth, Suncorp Valuations has been very fortunate to have some of the brightest minds in appraisal and valuation join our team. We are pleased to announce that recently Bharat Kanodia has joined us as Senior Managing Director. Bharat holds a Bachelor of Science in Mechanical Engineering, a Master of Business Administration in International Finance, and the ASA and CVA designations. Bharat has appraised unique assets including the Golden Gate Bridge, Atlanta Airport, Uber, Airbnb, the Brooklyn Bridge, Las Vegas casinos, the ‘I Love New York’ campaign, US national forests, and gold mines.

Bharat was interviewed by the New York Business Journal this past January, where he talked about the values of NYC Landmarks, and how these values are being presented to the public. We are pleased to share that interview to further introduce Bharat to our clients and business partners.

What the Brooklyn Bridge and other NYC Landmarks are Valued at Today.

New York City’s skyline is filled with city-defining landmarks. But with many having been built decades ago, their modern-day valuations are often hidden from the public even though their upkeep is publicly funded.

Bharat Kanodia

Bharat Kanodia

Bharat Kanodia, a valuation expert who has appraised everything from industrial plants to airports to major companies, believes its vital to estimate valuations of such assets in the case of their unexpected destruction by natural disasters or potential for privatization by the entities that own them.

“We know what Tesla’s one share is worth on a second-by-second basis because it’s freely traded in the open market. How come we don’t know what the Brooklyn Bridge is worth second by second in the open market?” Kanodia said. “As taxpayers, we built to create it and we’re paying taxes as we speak to keep it up. Do we not deserve to know?”

Kanodia estimates landmarks’ valuations by comparing them to other similar properties and determining how much it would cost to build the asset from the ground up. He does not account for its historic aspects, rather assessing the cost of replacement not replication.

The Brooklyn Bridge, for example, which opened in 1883 after 14 years of construction that cost $15 million, would be worth an estimated $13 billion to $15 billion today, according to Kanodia.

That includes $200-$300 million for design and planning, $2-$3 billion for site and foundation work, $3-$4 billion for labor, $2 billion for equipment and transportation, $1-$1.5 billion for insurance and administration, and $500 million for other miscellaneous costs and incidentals.

For other properties, he’s estimated the value by determining the cost of the equivalent amount of square footage today. The terminal of Grand Central alone cost $43 million to build in 1913. The entire project cost about $80 million. Today, Kanodia estimates it would cost $10 billion at $5,000 a square foot for 2 million square feet.

Similarly, the approximately 800,000-square-foot 42 Street subway station would cost $2-$2.5 billion. Other New York-owned non real estate assets can also be valued. The “I Love New York” campaign’s valuation can be estimated by calculating its total sales and royalty percentage paid to the state.

“The assets owned by the MTA are two AT&T’s combined and we don’t know what that is worth and that is paid by taxpayers’ money,” Kanodia said. “Do you think there’s a disconnect here?”

Written by Sarah Jones – Reporter for New York Business Journal

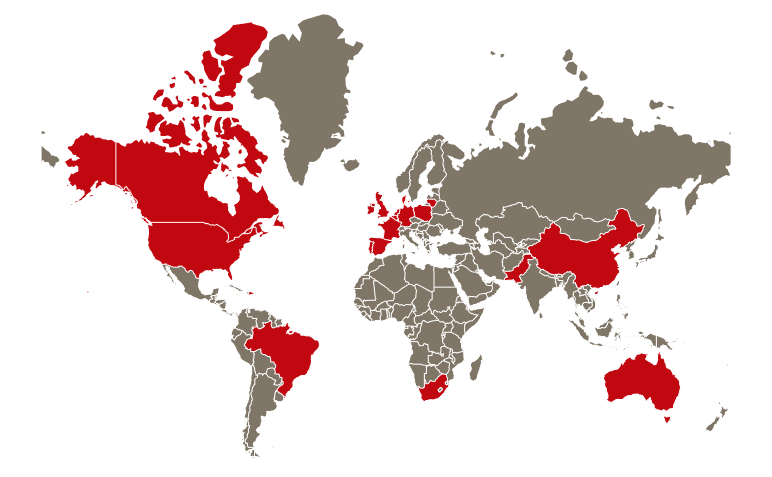

The top 10 losses in 2022, on average, were in excess of $3 billion which far exceeded the average of $1.5 billion in 2021. These losses are based on the financial impact of these natural disasters – not the impact in terms of loss of lives.

Top 10 Natural Disasters in 2022

10. Flooding in South Africa – More than $3 billion

Excessive rain in April caused flooding and landslides in the provinces of KwaZulu-Natal and Eastern Cape. Several thousand homes were damaged or destroyed, as well as much of the major infrastructure.

9. Hurricane Fiona in the Caribbean and Canada – More than $3 billion

Over multiple weeks in September, Hurricane Fiona travelled through the Caribbean, western Atlantic and eastern Canada, reaching Category 4 status. Fiona is the strongest storm to ever impact Canada.

8. Drought in Brazil – More than $4 billion.

An unprecedented drought since 2021 has caused prolonged damages to Brazil’s agricultural, hydropower, shipping and freshwater industries. The Paraná River has reached a record low in its water level; the river that provides freshwater for millions of people in Brazil, Argentina and Paraguay.

7. Storm Eunice in Europe and UK – More than $4.3 billion

In February, a National Severe Weather Warning Service was issued due to this extratropical cyclone. The storm caused a huge amount of damage in parts of Western, Central and Northern Europe.

6. Flooding in Pakistan – More than $5.6 billion

From June to October, Pakistan experienced intense flooding due to a major heat wave that caused both monsoon rainstorms and glacial melting.

5. Flooding in East Australia – More than $7.5 billion

The floods in East Australia from February to April were one of the nation’s worst recorded flood disasters. Almost one thousand schools were closed in response to the flooding and many evacuations took place.

4. Drought in China – More than $8.4 billion

China experienced a record-breaking heatwave for more than 70 days in the summer (reaching over 70 degrees Celsius), causing a major drought that affected about half of China, mostly in the south.

3. Flooding in China – More than $12.3 billion

During the drought in the Southern regions of China, multiple flash floods in August caused much damage in the North.

2. European drought – More than $20 billion

Caused by a similar heat-wave as China, many parts of Europe experienced drought conditions that the Global Drought Observatory confirmed as the worst drought in 500 years.

1. Hurricane Ian in the U.S. and Cuba – More than $100 billion

Hurricane Ian was the third-costliest weather disaster in the world on record, causing damage in western Cuba and the southeast United States.

As losses increased worldwide in 2022 it continues to put pressure on insurance markets and results in increased scrutiny when underwriting risks. It’s prudent therefore for property owners to be proactive in ensuring that their assets are insured to value with accurate valuations.

*Data Source: Christian Aid