Using Standard Unit Bylaws as a Risk Management Strategy for Buildings

What is a Standard Unit Definition?

A Standard Unit Definition is a list of what parts of a typical condominium complex could be maintained and insured by the condominium board. The Standard Unit Definition for your development will detail exactly what the Condominium board is responsible for, and not responsible for.

For example, a typical Standard Unit Definition for a residential development could indicate that the condominium corporation is responsible to maintain and insure the structure: electrical, plumbing, and HVAC systems; wall and ceiling finish such as drywall and paint; floor finish such as carpet or tile; interior doors; interior electrical, plumbing, and HVAC fixtures; interior doors, casing, and baseboards; and built-in appliances, etc.

In this example, the condominium corporation is responsible to have adequate insurance in place for those items.

The preceding is not an exhaustive list, and in fact, a particular Standard Unit Definition could include more or less components. For example, the Standard Unit Definition may include the drywall for the walls and ceiling, but not the paint that is on the walls and ceilings.

This is especially the case with Standard Unit Definitions for non-residential units. Quite often, a non-residential Standard Unit Definition includes the shell only, with the unit owners being responsible for all other components.

Do we really need Standard Unit Definitions in the Bylaws?

Our recommendation is YES, for a number of reasons.

Mostly it is about insurance. The condominium corporation is responsible to acquire and maintain adequate insurance coverage for all common elements, including the items in the Standard Unit Definition. Insurance for all other components are the responsibility of the unit owner.

Without a Standard Unit Definition, both the condominium board and unit owners would be uncertain about what they need to insure. This could result in overlaps in coverage, resulting in insurance levies being too high. Worse, a gap in insurance coverage, which is a significant increase in risk.

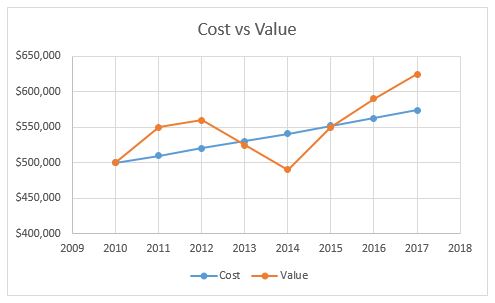

Another reason to have Standard Unit Definitions is that they set minimum quality and décor standards for all units. This is important to ensure that the entire development maintains its overall level of quality and consistent esthetics. Otherwise, individual unit Market Values could suffer.

Finally, some condominium corporations have used Standard Unit Bylaws as a strategy to limit corporation claims, which can affect their premiums significantly. This strategy can put more onus on unit owners to pay particular attention to their personal coverage and how that fits into the corporation’s coverage.

What are Betterments and Improvements?

It is important to note that Standard Unit Definitions do not include Betterments and Improvements.

Betterments is a term to describe when an owner has upgraded a component that is part of the Standard Unit Definition. For example, consider a residential condominium development where the Standard Unit Definition includes carpet floor covering, and a particular owner has replaced the carpet with hardwood. In a case such as this, the hardwood is the “Betterment”. The condominium corporation would be responsible to carry sufficient insurance to replace the flooring with carpet only, and the unit owner would be responsible to carry insurance to pay for the upgrade to hardwood.

Improvements are those components that are installed in addition to the Standard Unit Definition. This is quite common with non-residential units. For example, a Standard Unit Definition in a commercial office condominium unit might include only “shell space”. The unit owner would be responsible for the costs to install the interior development, and to insure the improvements.

Speak to us about our Standard Unit Definition services today!