Why Has the Insured Value of my Building Increased While its Market Value Declined

In a past newsletter we have examined the correlation between commodity prices and construction costs that during periods of escalating commodity prices property owners can find themselves underinsured as the cost to replace certain types of assets escalate. In periods such as these many property owners question why they should be insuring their buildings or equipment for a higher value when they are aware that the market value of their property may not have appreciated to the same degree or in some cases may have even declined.

While this is counter-intuitive, property owners need to be cognizant of the difference between market value and replacement or insurable value. Market value, as determined by an accredited appraiser, represents the probable price that would be realized for a specified property at a specific point in time, if offered for sale on the open market. Generally speaking, market value is arrived at through an analysis and reconciliation of the market environment, the investment characteristics of the property, and its depreciated replacement value of the improvements. Reconstruction costs are the basis for determining replacement or insurable values and include an analysis of the labor, materials, equipment and other costs required to reproduce a property (or piece of equipment) of like kind and quality in the same location.

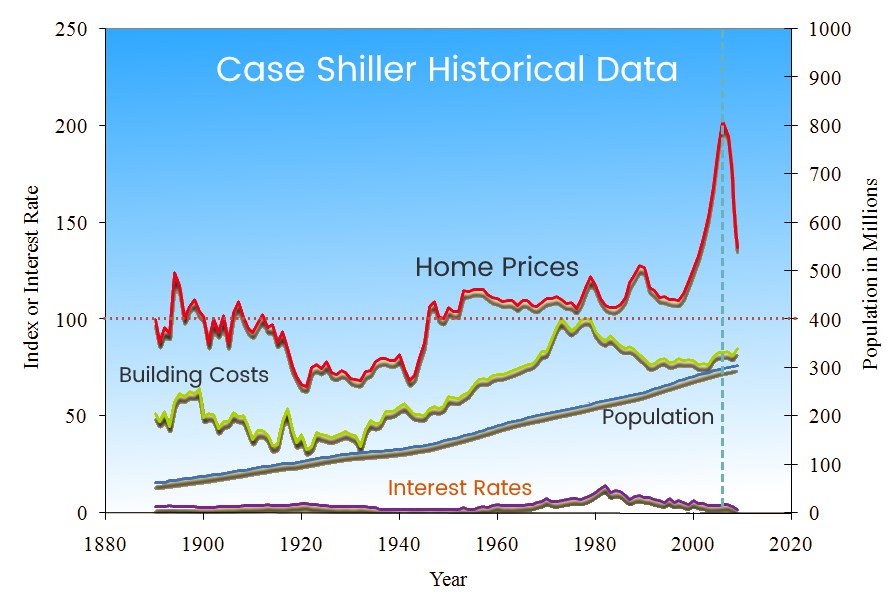

While there has been little research on the relationship between market and replacement values, the graph below produced by Robert Shiller of Yale University charts U.S. home prices against construction costs, population growth and interest rates since 1880. What is evident from this research is that there is little relationship between building costs and housing prices and there have even been periods where the two are negatively correlated. In fact, despite the decline in U.S. housing prices over the past couple of years there continues to be a general escalation in building construction costs across the country.

With respect to other types of occupancies (commercial, industrial, multi-family) our experience suggests that there can be a minimal correlation between changes in the market value of a property and the costs associated with constructing that same property. The relationship between market and replacement or insurance value is even less evident when one considers that costs associated with reconstruction can be significantly higher than new (Greenfield) construction for a number of reasons which include:

- Demolition and Debris Removal – In the case of a total loss the remaining structure needs to be demolished and removed from the site which can be costly.

- Changes to Building Codes for Fire Protection, Handicap Access, and Parking – Changes to building codes may require costly upgrades to comply with current building codes.

- Regional Economic Factors –A variety of regional economic factors in an area can increase the demand for labor and building materials which can lead to an escalation in the costs associated with both new and reconstruction.

- Inefficiencies– When a new building is constructed materials can often be purchased in bulk while in a reconstruction materials must be purchased on a piecemeal basis which can be more expensive.

About Suncorp Valuations

Suncorp Valuations is a leading provider of independent valuation, appraisal, and advisory services. Suncorp’s valuations and appraisals have been relied upon by leading insurance companies, public and private companies, property owners and managers, tax authorities, accounting bodies, courts, municipalities and financial institutions from all over the world.

Our valuation and appraisal staff consist of professionals that are highly accredited in the fields of engineering, real estate and equipment appraisal, business valuation, risk management and loss control. Our multi-disciplinary, multi-regional and multilingual staff take an interactive team approach and have been involved in some of the most complex valuation assignments across the globe.

For questions or comments, or to be added or removed from this distribution list please Contact Us.