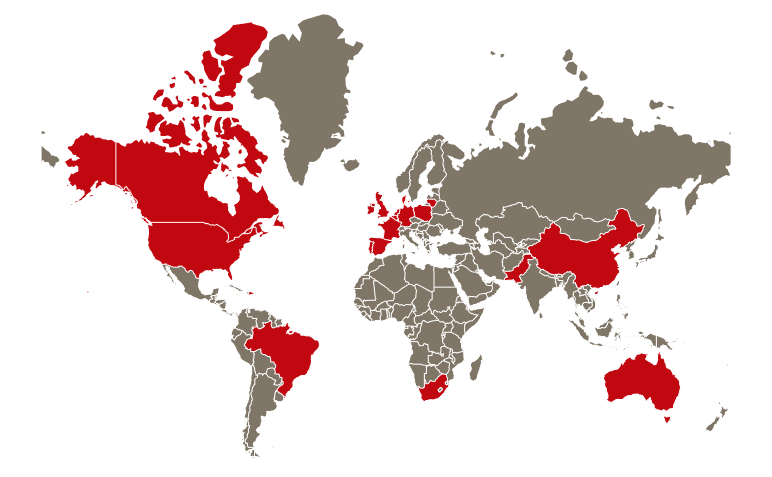

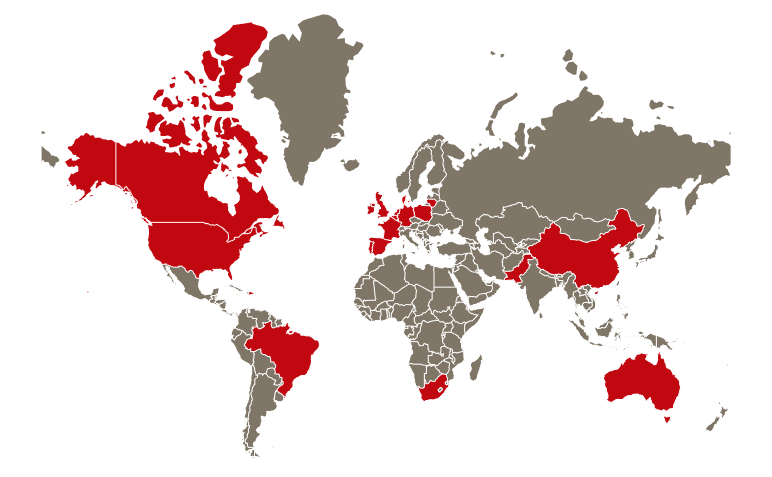

The top 10 losses in 2022, on average, were in excess of $3 billion which far exceeded the average of $1.5 billion in 2021. These losses are based on the financial impact of these natural disasters – not the impact in terms of loss of lives.

Top 10 Natural Disasters in 2022

10. Flooding in South Africa – More than $3 billion

Excessive rain in April caused flooding and landslides in the provinces of KwaZulu-Natal and Eastern Cape. Several thousand homes were damaged or destroyed, as well as much of the major infrastructure.

9. Hurricane Fiona in the Caribbean and Canada – More than $3 billion

Over multiple weeks in September, Hurricane Fiona travelled through the Caribbean, western Atlantic and eastern Canada, reaching Category 4 status. Fiona is the strongest storm to ever impact Canada.

8. Drought in Brazil – More than $4 billion.

An unprecedented drought since 2021 has caused prolonged damages to Brazil’s agricultural, hydropower, shipping and freshwater industries. The Paraná River has reached a record low in its water level; the river that provides freshwater for millions of people in Brazil, Argentina and Paraguay.

7. Storm Eunice in Europe and UK – More than $4.3 billion

In February, a National Severe Weather Warning Service was issued due to this extratropical cyclone. The storm caused a huge amount of damage in parts of Western, Central and Northern Europe.

6. Flooding in Pakistan – More than $5.6 billion

From June to October, Pakistan experienced intense flooding due to a major heat wave that caused both monsoon rainstorms and glacial melting.

5. Flooding in East Australia – More than $7.5 billion

The floods in East Australia from February to April were one of the nation’s worst recorded flood disasters. Almost one thousand schools were closed in response to the flooding and many evacuations took place.

4. Drought in China – More than $8.4 billion

China experienced a record-breaking heatwave for more than 70 days in the summer (reaching over 70 degrees Celsius), causing a major drought that affected about half of China, mostly in the south.

3. Flooding in China – More than $12.3 billion

During the drought in the Southern regions of China, multiple flash floods in August caused much damage in the North.

2. European drought – More than $20 billion

Caused by a similar heat-wave as China, many parts of Europe experienced drought conditions that the Global Drought Observatory confirmed as the worst drought in 500 years.

1. Hurricane Ian in the U.S. and Cuba – More than $100 billion

Hurricane Ian was the third-costliest weather disaster in the world on record, causing damage in western Cuba and the southeast United States.

As losses increased worldwide in 2022 it continues to put pressure on insurance markets and results in increased scrutiny when underwriting risks. It’s prudent therefore for property owners to be proactive in ensuring that their assets are insured to value with accurate valuations.

*Data Source: Christian Aid

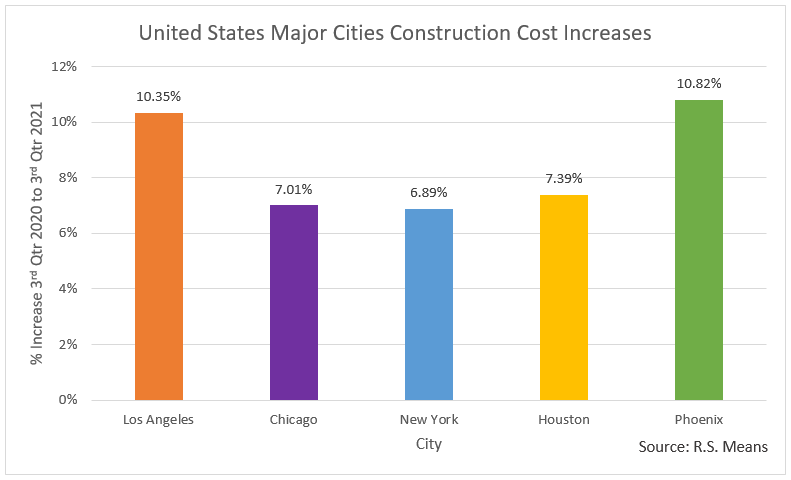

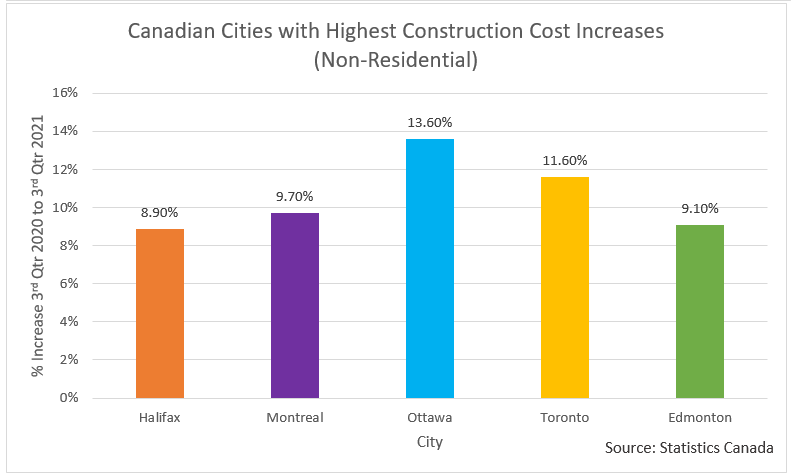

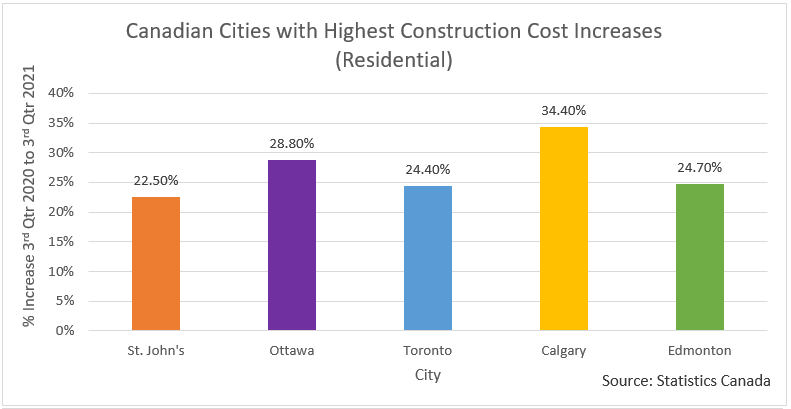

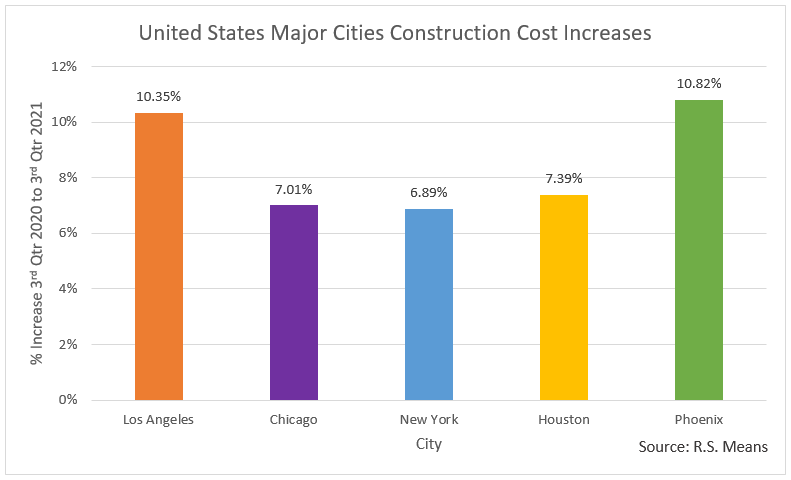

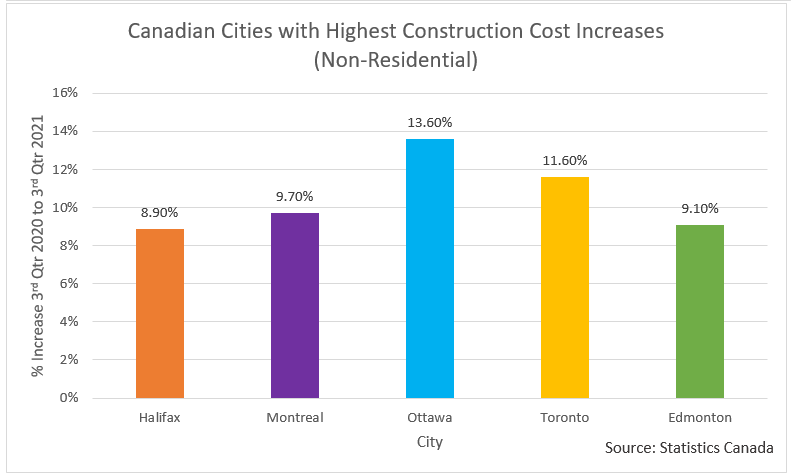

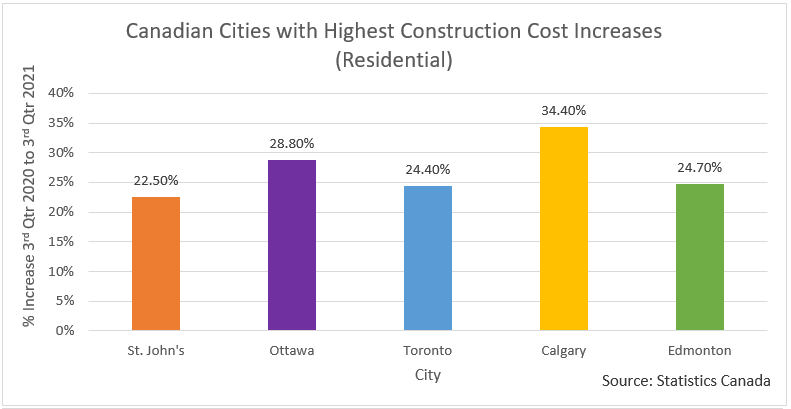

The last few years have been far from normal due to the pandemic. Construction costs have been one item that has seen a dramatic increase. This is a result of a sharp increase in demand for building materials combined with supply chains struggling to keep up. In addition, a booming construction industry has resulted in higher labour costs due to a shortage of skilled workers. Together, these factors have had a significant impact on construction costs as illustrated below.

So what does this mean? The consensus is that costs are up across all industries. The extent of the increases are dependent on:

1) Construction Cost Source (Statistics Canada, R.S. Means, Marshall & Swift, etc.)

2) Industry Sector (Residential, Commercial, Industrial, etc.)

3) Construction Type (Wood Frame, Steel, Concrete, etc.)

4) Geographic Location

5) Asset Type (Buildings, Machinery and Equipment, Mobile Equipment, etc.)

To gain a better understanding of these increases and their impact on your insurable values contact us at https://suncorpvaluations.com/contact-us/

Recent trends have shown that construction costs throughout the United States and Canada have escalated at an accelerated rate, particularly in specific metropolitan regions. This is due to a combination of factors, including price increases for building materials and rising labour costs due to a rebound in construction activity since the recession of 2009. Areas such as Seattle, Los Angeles, Vancouver and Toronto are emblematic of the rise in construction cost, as market values have rebounded.

Source: Pixabay

As a result of these cost increases, many commercial and residential properties are at risk of being under-insured. This is especially so for Condominiums that are situated in many of these city centres. It is therefore prudent to assess if the source and accuracy of your Condominium’s Insurable Value are reliable.

Common Pitfalls

It is not uncommon for Directors and Property Managers of Condominiums to be so heavily involved in other issues that they often forget the importance of having an accurate determination of the Replacement Cost of the standard unit and common elements of their Condominium. As a result, the Insurable Value they report may have come from a variety of less-than-reliable sources including:

1) Use of Developer’s Construction Costs

In many cases, the Insurable Value may have been based on the Developer’s construction cost. This amount may not include “soft costs” such as Architect Fees, Development Fees and General Contractor Fees. These are significant costs that should be included in the Insurable Value of the Condominium. In addition, a Developer who is building multiple condominiums can also achieve efficiencies in regards to material and labour costs. The reduction in these costs may result in a lower construction cost for the Condominium, which may not be achieved in the event of a loss and reconstruction of a single building. In most instances, the Developer’s construction cost can be approximately 20 to 40% less than the Replacement Cost of the Condominium.

2) Extended Indexing of Insurable Value

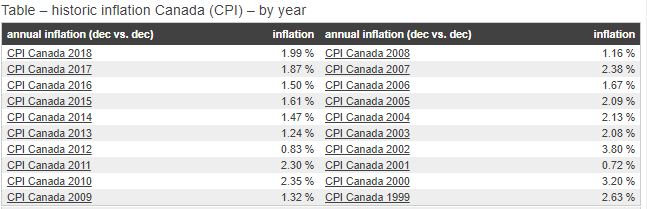

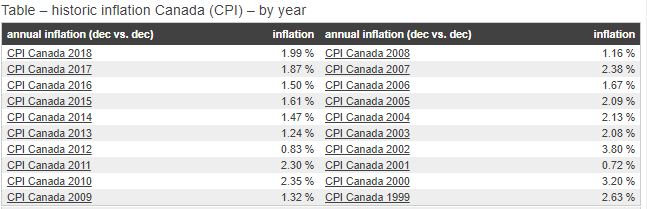

Once an Insurable Value exists, many Insurers/Insurance Brokers may use the annual Consumer Price Index (CPI) to update the Insurable Value of the condominium for an extended period of time. The annual CPI has been reported in the 1-2% range in recent years. In contrast, construction costs in some locales has been have been averaging double this amount. In addition, if the original construction cost that is being indexed is incorrect it can compound the error substantially over the years. Lastly, even with a correct original construction cost and accurate Inflation Index Factors, an Insurable Value should not be indexed up for more that three consecutive years.

3) Estimates from Unqualified Parties

In an attempt to save costs, some firms who lack architectural costing experience may develop a Replacement Cost estimate on a cost per square foot basis only. This methodology is not reliable since it may not consider location, construction quality and many of the important specialty features of the Condominium’s construction and services. Many of the construction details of a Condominium can only be verified by a physical inspection and comprehensive review of the architectural and site plans. In addition, the firm that completes the estimate should have specific architectural costing experience versus market value appraisal experience. Market value appraisals consider many other factors that are not relevant to the Insurable Value.

Insurance Appraisals By Qualified Professionals – The Most Accurate Source for Determining Insurable Values

An Insurance Appraisal is a formal estimate or opinion of value on a property as of a specified date. The premise of value developed should be the Replacement Cost New (RCN) of the standard unit and common elements of the Condominium. This value is based on a physical inspection, review of the building plans (architectural and site) and the development of current construction costs. Appraisal Firms use various construction costs from published sources including Marshall & Swift/Boeck, R.S. Means Construction Cost Data and Handscombe’s Yardstick for Costing. A reputable Appraisal Firm will also cross-reference this data with actual construction costs (including soft costs) reported by Contractors and Developers. Finally, construction costs of similar condominiums appraised should be used as a benchmark test to ensure the Insurable Value is correct. It is important that the Insurance Appraisal Firm you engage use as many of the above resources to develop an accurate Insurable Value.

Qualifications of Reputable Appraisal Firms

To select a reputable Appraisal Firm, it is recommended that they meet the following qualifications:

- The Firm carries Errors and Omissions Insurance;

- The Appraiser(s) have an educational background in Architectural Costing or Engineering;

- The Appraiser(s) are experienced at completing Insurance Appraisals for Condominiums;

- The Appraisal Service includes both Above Grade and Below Grade Assets;

- The Appraisal Service is performed in compliance with the Uniform Standards of Professional Appraisal Practice (USPAP); and

- The Appraiser(s) reviews Architectural Plans, Site Plans and Standard Unit-By Law (if applicable).

In conclusion, it is prudent for the Directors and Property Managers to engage a Professional Appraisal Firm to complete an Insurance Appraisal of their Condominium. Furthermore, many of the Declarations and By-Laws of Condominiums specify the frequency that Insurance Appraisals should be completed (e.g. every three years). Lastly, the Condominium Acts of many of the jurisdictions have sections requiring the Condominium be insured for its Replacement Cost. Compliance with these guidelines can be best achieved by having a reputable firm complete an independent Insurance Appraisal.